Crypto exchanges on Zent: OKX

The OKX exchange boasts 50 million registered users and a wide portfolio of user-friendly services. Its institutional suite features maker fees close to 0%, deep liquidity opportunities, maximized uptime, smart margin tools, and more. Here's what corporate traders should know.

OKX overview

The OKX cryptocurrency exchange was launched in 2017 under the leadership of Mingxing Xu, aka Star X, who remains its CEO as of April 2024. Based in Seychelles with offices worldwide, it is the fourth exchange by trading volume, according to CoinMarketCap.

The owner, OK Group, also owns another Star X's brainchild and crypto exchange, Okcoin. The OKX platform is regulated in the Bahamas and has recently obtained Dubai's VASP (Virtual Asset Service Provider) license. Due to regulatory issues, OKX does not accept users from the United States.

In addition to spot trading, OKX users can access an NFT marketplace, a DEX, Dapps, and a multi-chain wallet. The celebrity endorsements include Coach Pep Guardiola (the manager of Premier League club Manchester City), F1 driver Daniel Ricciardo, and Snowboarder Scotty James.

Countries of operation

OKX services are available in over 100 countries but not in the US. The Terms of Service specify compliance with "any trade or economic sanctions lists of any Competent Authority," including the United Nations Security Council, the European Union, the Monetary Authority of Singapore, the Hong Kong Monetary Authority, the Hong Kong Customs and Excise Department, or the Office of Foreign Asset Control.

Cryptocurrencies available

As of April 2024, CoinGecko lists 322 coins in 506 pairs on OKX. It provides spot trading and derivatives, including margin, futures, perpetual swaps, and options. According to Investopedia reviewers, some digital assets are traded at low liquidity.

Products and services for institutions

OKX's crypto trading solutions cater to trading firms, asset managers, family offices, and brokers. The website mentions 99.9% uptime with a zero-breach security record and a highly performant API, among other benefits.

- Exchange order book. OKX Institutional offers 350+ tokens in 730 spot trading pairs, 280 derivatives, and 1,000 options.

- Yield and structured products. Organizations can earn yield by providing liquidity or staking with tailored strategies and access to top-tier DeFi protocols.

- Liquid marketplace. OKX's on-demand liquidity network with multiple brokers facilitates the trading of spot OTC, futures spreads, and options at the desired prices.

- Advanced execution algorithms. OKX has time-weighted average price (TWAP) and Iceberg execution algorithms.

- VIP Loan pool. The platform features dedicated low-interest-rate lending pools.

- ETH 2.0 Staking. Institutions stake ether to receive BETH for extra liquidity at a 1:1 ratio and daily rewards.

- Market maker program. OKX provides competitive rebates on its order books and Liquid Marketplace.

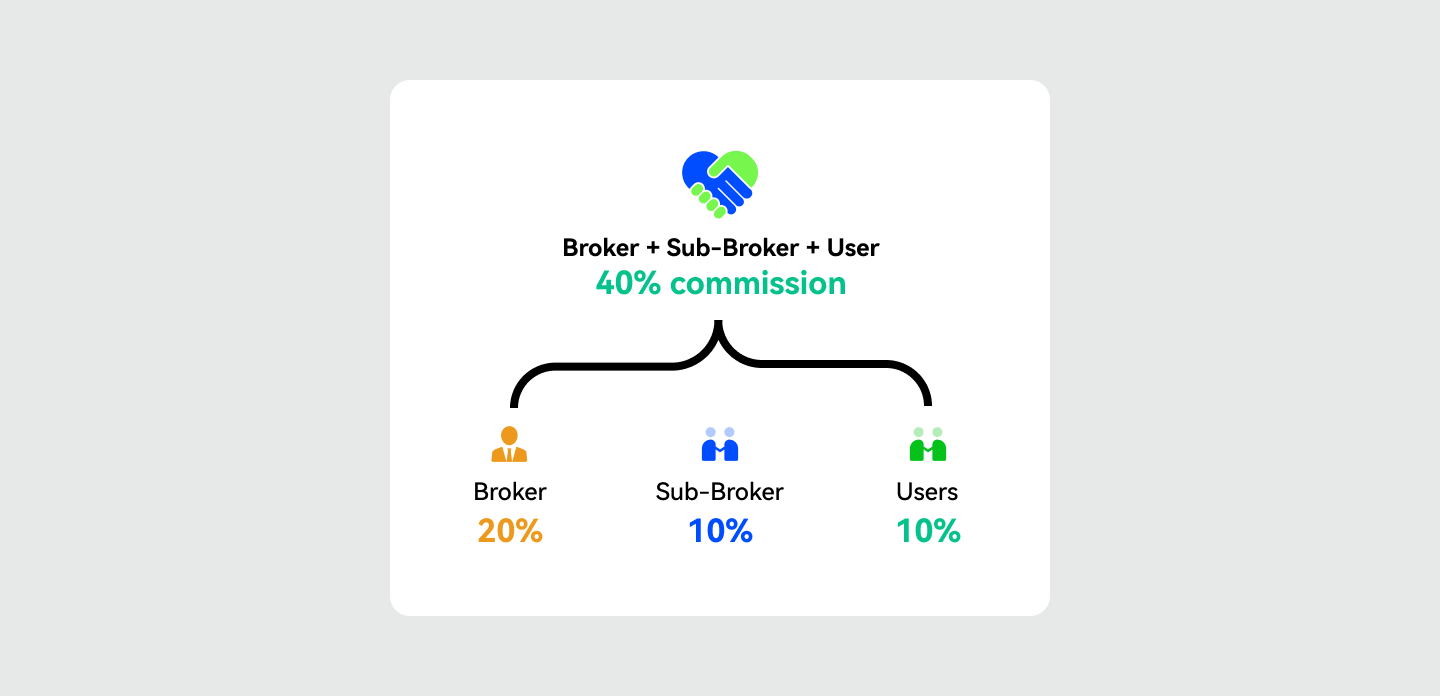

- Broker program. Customizable solutions with competitive commissions provide API, OAuth, and ND broker integrations with top-tier liquidity and market depth.

Trading fees

OKX divides users into five regular and eight VIP levels, determining the trading fees for the next trading day. The tiers are based on OKB holdings or the asset amount/30-day trading volume.

Regular users pay between 0.080% and 0.060% as makers and 0.100% and 0.060% as takers. The VIP maker fees range from 0.045% to -0.005%, while VIP takers pay between 0.050% and 0.015%.

The highest VIP level (8) requires a 30-day trading volume of at least $5B.

Security measures

OKX offers standard security precautions for users, secure online and offline storage systems reinforced with multi-sig protection, and multiple backups. Furthermore, it has a dedicated asset risk reserve fund — OKX Risk Shield — to protect against crypto security risks. A portion of its earnings is continually allocated to the fund.

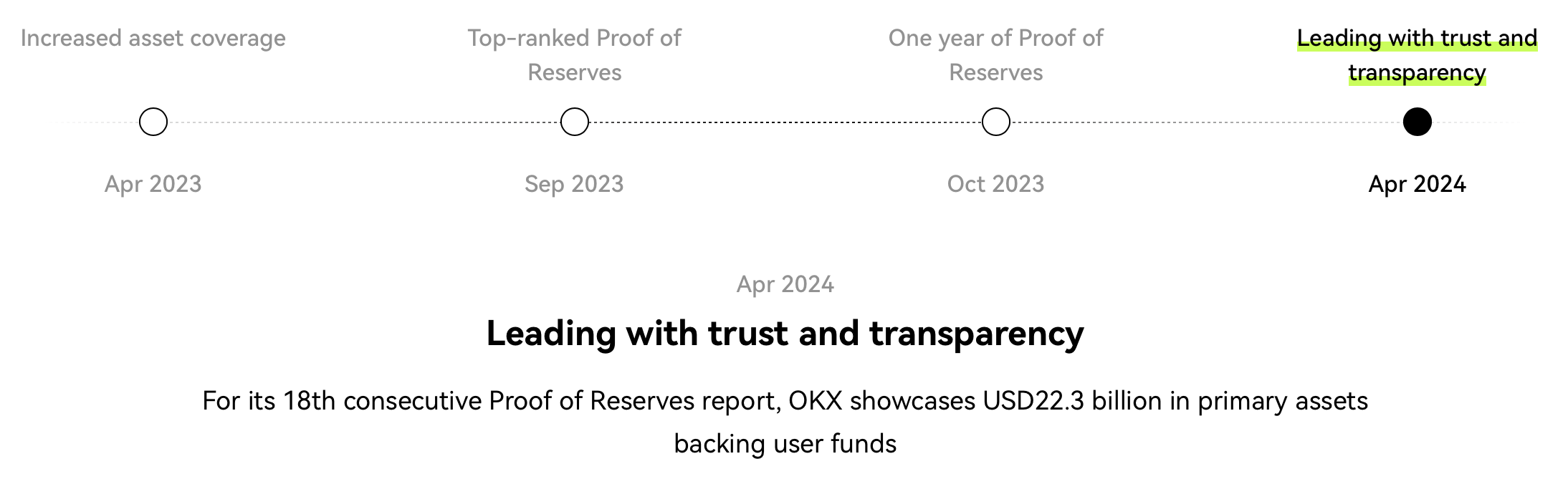

The OKX security "encompasses all aspects: platform, assets, data, and access security." Its proof of reserves includes a 1:1 reserve of all users' funds and periodic reports published on its website. However, user safeguards are fairly standard:

- Email verification

- Google Authenticator

- Mobile verification

- Mandatory 2FA

- Anti-phishing code

Opening an account

Users can create a personal account with their email address, Google account, Apple ID, Telegram, or OKX Wallet. Signing up for institutional services requires the following.

- Click "Get started" on the institutional page.

- Complete the provided form, entering your full name, email address, and job title, as well as the company's name, type of business, location, countries of operation, and other details.

- Agree to communications and storing and processing of personal data.

- Wait for a response from OKX's dedicated team.

The institutional form specifies if the entity is a P2P merchant or is currently trading on OKX, its anticipated monthly trading volume, and interest in OKX products and services. No standard response time is specified.

Customer service

P2P users may contact the exchange via a dedicated email address — [email protected]. For other matters, the company offers:

- Email support at [email protected]

- How do I raise a dispute section on the OKX platform and app

- Live chat on the official website

Key takeaways

OKX is a popular crypto exchange with diverse institutional offerings, from derivatives to loans to broker rewards. The company publishes regular proof-of-reserves reports and offers deep liquidity for many asset pairs. Like many other top exchanges, OKX is unavailable in the USA, but it has a global reach and a broad spectrum of services for asset managers, funds, and other big players.