Despite ETF success: Why financial advisors are wary of Bitcoin

Upon launch, US spot Bitcoin ETFs triggered a crypto market surge in early 2024. Yet their success failed to dispel skeptics' doubts. Financial advisors remain cautious about discussing digital assets with clients due to several concerns, from regulatory gaps to volatility. Here's what needs to change.

Crypto ETF Success and Advisor Reluctance

Since their introduction in January, spot Bitcoin exchange-traded funds (ETFs) have attracted over $14.6 billion in inflows, significantly boosting the price of the tracked coin (BTC). Despite this success, as noted by Investopedia, the majority of financial advisors refrain from advising clients on digital asset strategies.

A study by Cerulli Associates revealed that a mere 2.6% of advisors have recommended crypto opportunities to their clientele. Furthermore, just 12.1% are open to discussing crypto if their clients bring it up. Hence, investors are left to navigate these investments independently.

BlackRock's data backs this observation. As noted by Samara Cohen, chief investment officer of ETF and Index Investments, around 80% of inflows into crypto ETPs have come from self-directed investors through online brokerages.

Regulatory Hurdles and Institutional Hesitancy

Financial advisors are most concerned about regulatory uncertainty around crypto. The SEC's recent approval of spot ether ETFs highlights the need for comprehensive regulatory frameworks.

The green light came unexpectedly — approval was deemed unlikely until shortly before the deadline. The regulator's decision was largely interpreted as political ahead of the US presidential elections, following Biden's anti-crypto moves like vetoing the repeal of SAB 121.

Although the SEC has officially ended its investigation into Ethereum 2.0., it has not explicitly confirmed that the coin has commodity status. Consensys, however, believes that "this means that the SEC will not bring charges alleging that sales of ETH are securities transactions."

The passage of the Financial Innovation and Technology for the 21st Century Act (FIT21), which has cleared the House of Representatives but awaits Senate and presidential approval, could provide some clarity. However, more is required to address advisors' concerns fully.

James Seyffart, an analyst at Bloomberg Intelligence, pointed out that many major wealth platforms, wirehouses, and advisor networks have not yet approved Bitcoin ETFs. Currently, advisors can only purchase a Bitcoin ETF for their clients if specifically requested by them.

Seyffart anticipates that the regulations surrounding advisors' ability to offer spot bitcoin ETFs will evolve by the end of 2024, although the process may take months to conclude.

Navigating Crypto Volatility in Client Portfolios

Bitcoin and altcoins still see dramatic fluctuations, as reflected by the Crypto Volatility Index. For instance, at press time (July 5, 2024), BTC has dipped by 11.3% over seven days on concerns about the US presidential election, the Fed's policy, and Mt. Gox redemptions.

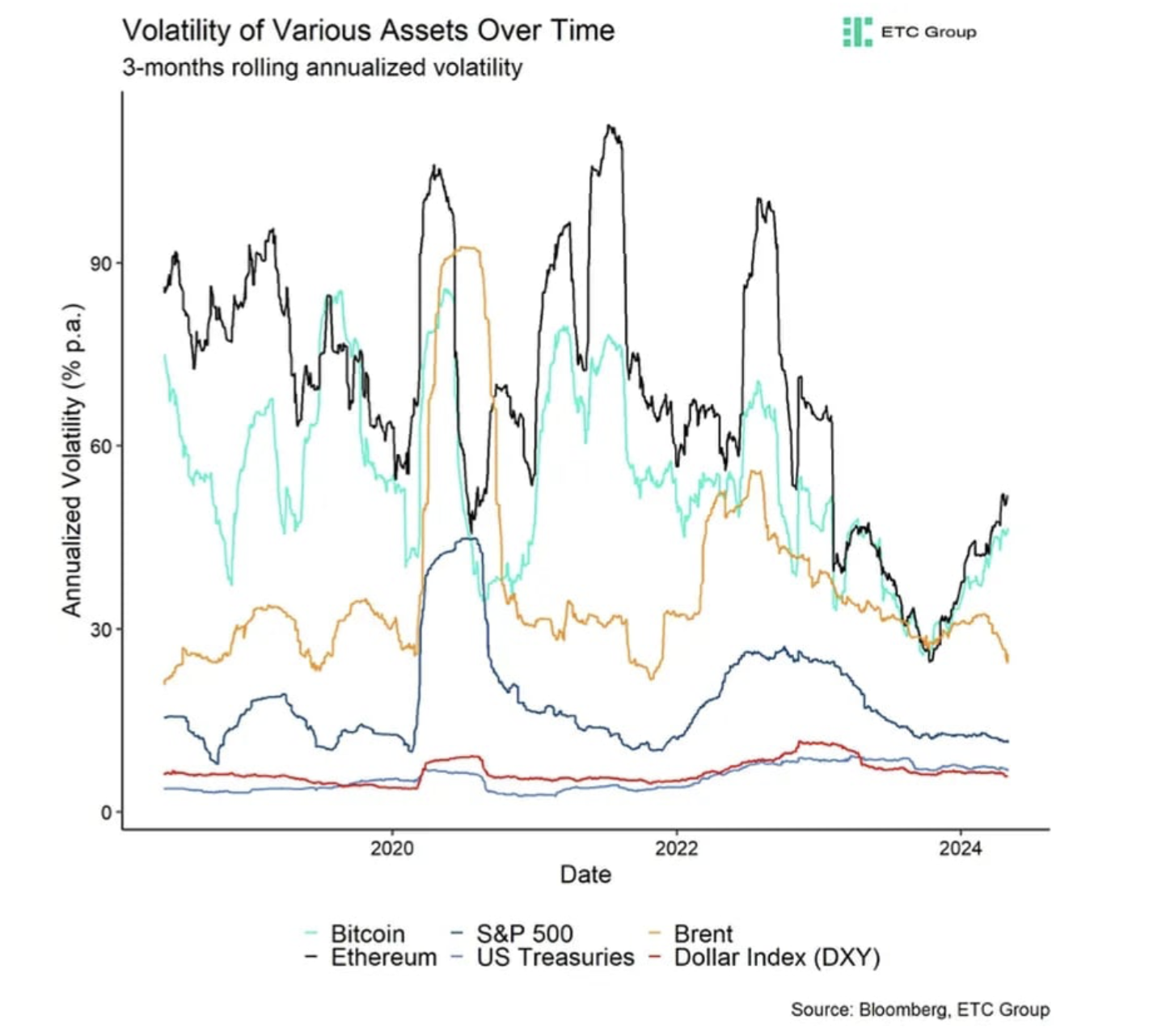

Cryptos are more temperamental than conventional classes like stocks, bonds, and most commodities. Over the past three months, the annualized volatility of Bitcoin and ether has held at 45%-50%, compared to roughly 15% for the S&P 500. However, during the first Bitcoin epoch, the coin's volatility was around 200%.

Volatility has long been a concern for TradFi investors, as confirmed by a Fidelity survey. However, Bitcoin halvings, occurring every four years, should gradually reduce it. The fifth event, scheduled for 2028, will make it four times as scarce as gold, as noted by CoinDesk.

Furthermore, predicted structural changes should support the decline. As retail and institutional adoption of crypto grows, it is expected to stabilize asset prices.

Historically, uncertainty around specific assets has contributed to their fluctuations. For instance, the annualized volatility of Amazon stock has declined from over 300% since the late 1990s to well below 50%.

The obstacles include questions like whether BTC can replace the USD as a global reserve currency and whether ETH will dominate real-world asset tokenization.

Diversification is Key

Thus, crypto's volatility does not mean advisors should ignore it. Instead, they may consider how it interacts with other assets within a balanced portfolio.

Diversification is key to achieving long-term results. Including crypto in portfolios provides several benefits:

- Lowering overall volatility due to low correlation with traditional assets

- Smoother investment returns, accommodating investors with unpredictable liquidity needs

- Avoiding emotional reactions to market fluctuations for long-term success

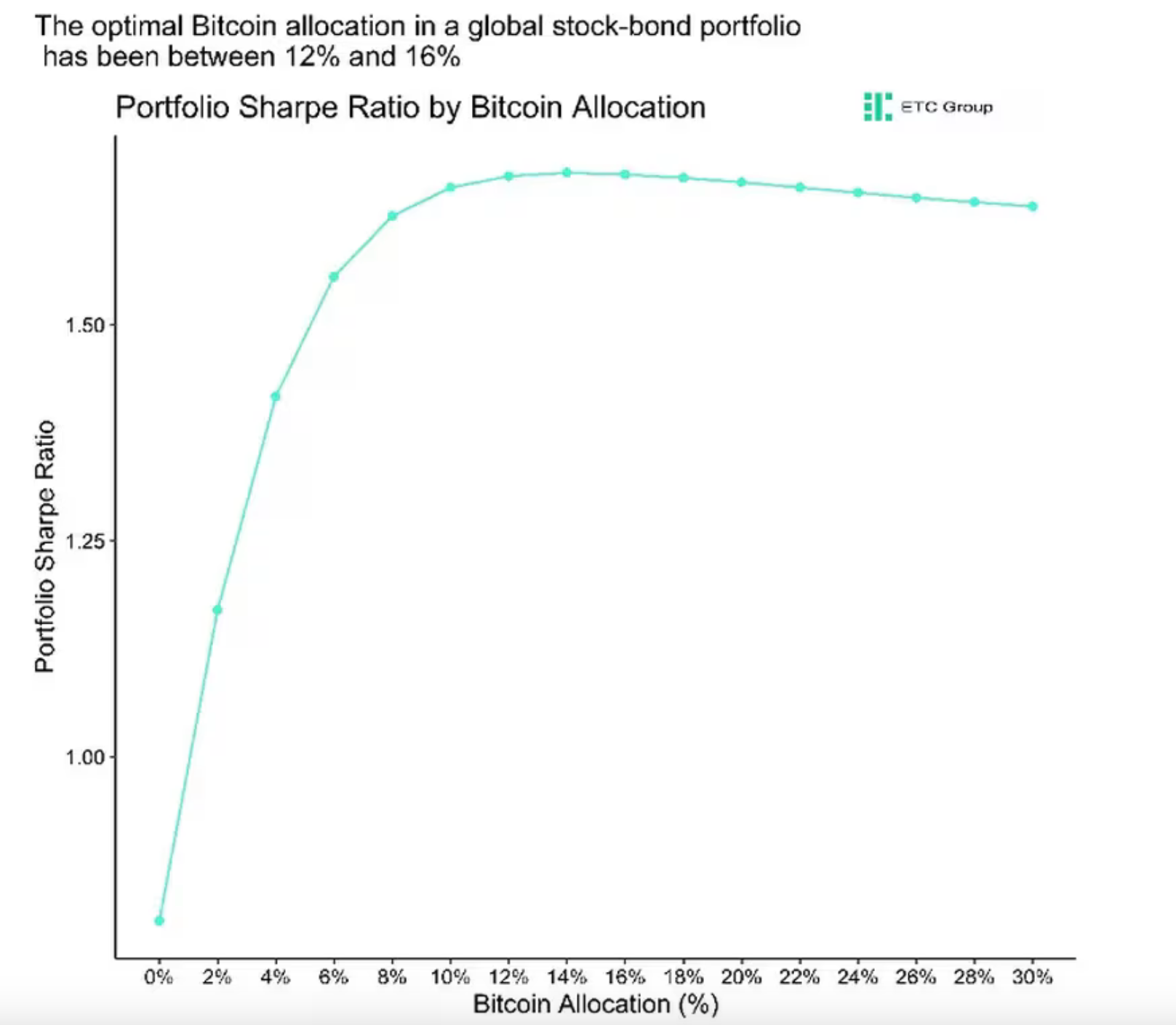

André Dragosch, head of research at ETC Group, and Sarah Morton, Co-founder of MeetAmi Innovations, Inc., note the benefits of increasing BTC allocation. Raised to 14% in a global 60/40 stock-bond portfolio, it maximizes the Sharpe Ratio — a gauge of risk-adjusted returns. For major coins like BTC and ETH, Sharpe is well above 1, so investors are "well-compensated for higher volatility."

Changing Attitudes Among Advisors

While cautiousness prevails, there are signs of changing tides. Compared to 2023, fewer financial advisors do not anticipate ever discussing crypto with their clients — 58.9% vs. 62.2% as per the Cerulli report. This shift suggests a gradual warming to incorporating cryptos into client portfolios.

Final words

The success of spot crypto ETFs marks a crucial milestone for the market, but most financial advisors are still wary. Regulatory clarity, institutional acceptance, and evolving industry practices will determine their future engagement with digital assets. As the landscape continues to evolve, advisors and clients must stay informed and adapt to navigate the dynamic world of crypto.