Real-world assets (RWAs): New institutional frontier

Real-world assets (RWAs) encompass a broad spectrum of tangible and intangible resources that transition onto the blockchain, unlocking the benefits of decentralization. BlackRock's embrace of RWAs sets the stage for explosive growth in the institutional space. Zent's guide covers the essentials of RWA crypto, from technical aspects to the regulatory landscape.

What are real-world assets (RWAs)?

RWAs are cryptographic tokens representing real-world assets existing outside the blockchain realm. Their rapidly growing range encompasses artworks, real estate properties, precious metals, and intellectual property.

RWA tokens are significantly more liquid and accessible than their physical counterparts. These tokens resemble mainstream cryptocurrencies in many ways. They are programmable and tradeable and support immutable, secure, and transparent transactions.

Significance of real-world assets (RWAs)

Despite the advent of spot Bitcoin ETFs, the crypto market has yet to mature. Cryptocurrencies' volatility and perceived detachment from the physical world deter the conventionally minded.

Real-world assets (RWAs) present a compelling solution — a bridge between the world of decentralized finance (DeFi) and traditional finance (TradFi). By tokenizing assets like bonds or real estate, RWAs may appeal to a broader investor base, contributing to the maturation of the crypto market.

This convergence holds the potential to transform financial paradigms, a prospect not unnoticed by institutions. BlackRock CEO Larry Fink heralds RWAs as the "next generation for markets."

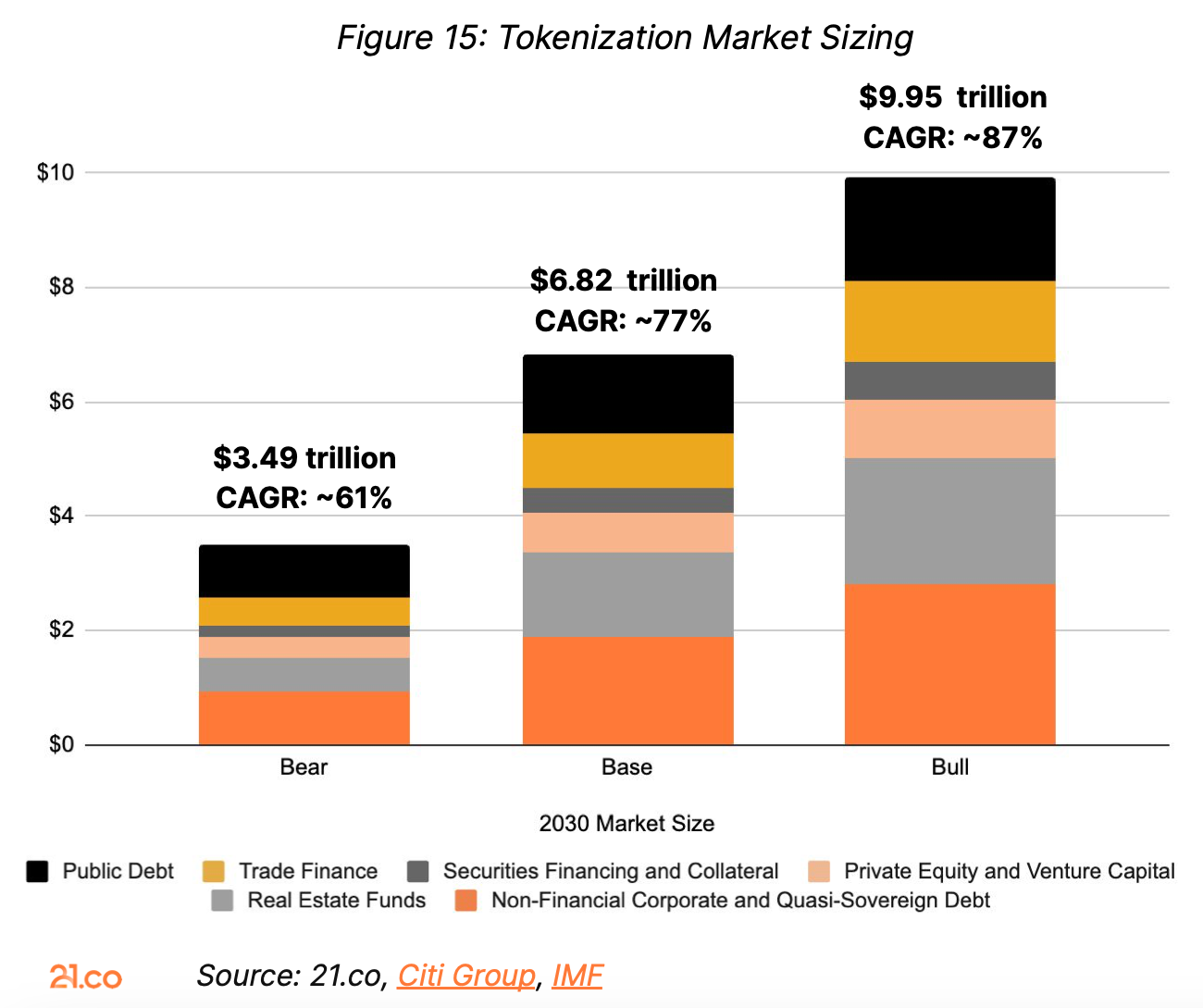

Projections indicate that RWAs could amass a staggering $16 trillion collective value by 2030. According to digital asset manager 21.co, the market could reach $10 trillion in a "bull case" and $3.5 trillion in the "bear case".

Diverse choice of RWAs

Institutions have a broad choice of RWAs, each with unique investment protocols and opportunities. Investors can leverage them to diversify portfolios and capitalize on the strengths of decentralization.

Some RWA tokens are traded on decentralized exchanges; others require dedicated platforms. As institutional interest grows, navigating the nuances of this emerging asset class is paramount.

RWA tokenization: Key steps

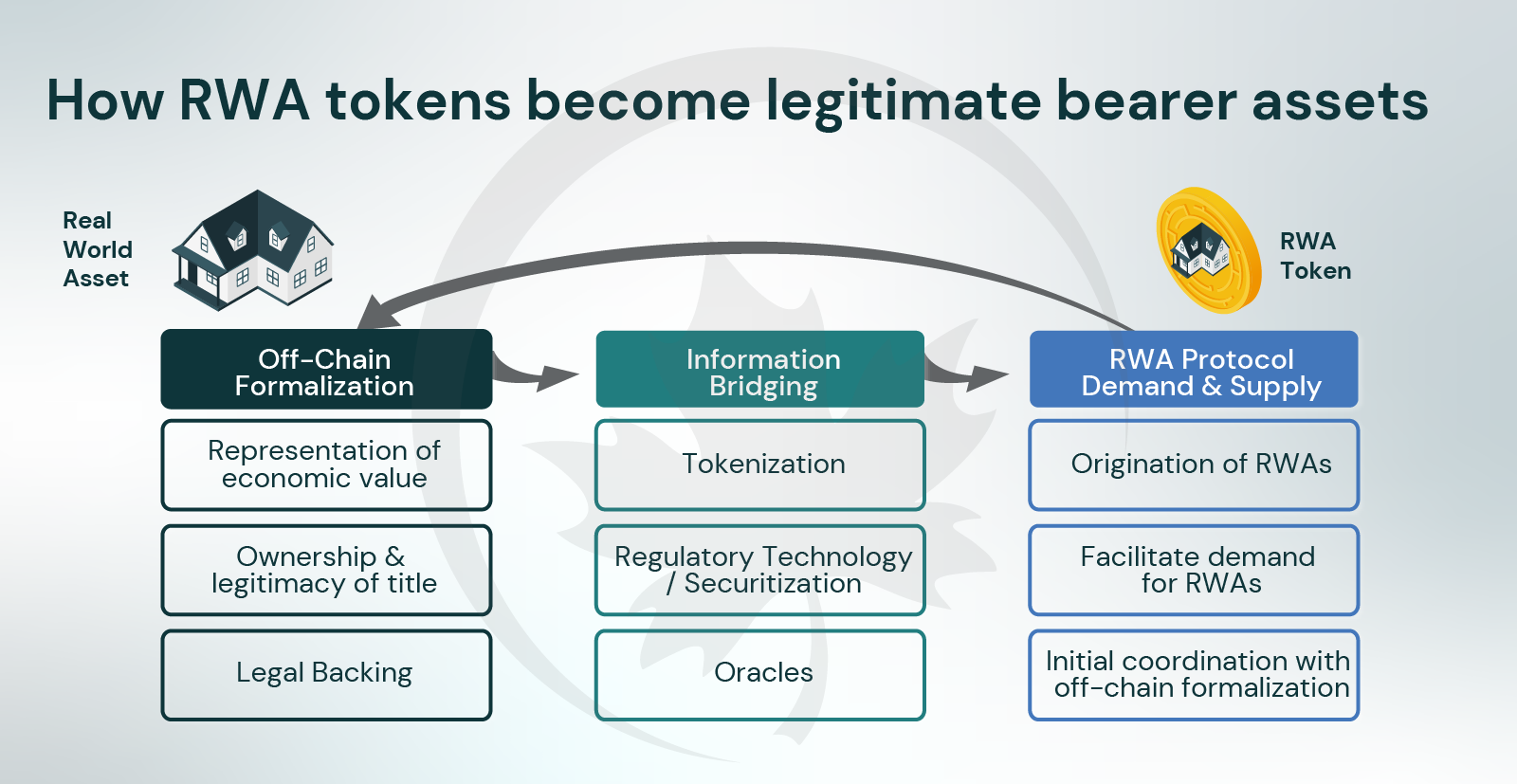

RWA tokenization translates real-world property rights into blockchain-based tokens, effectively digitizing ownership. Thanks to substantial economic value, RWAs support diverse transactions and financial benefits — including the transfer of ownership through licensing or sale.

Tokenization entails several key stages:

- Asset selection and evaluation. Any conventional item, whether tangible or intangible, may be transformed into RWAs. The issuer chooses the asset to represent on-chain, defines its value, and conducts asset audits.

- Development of the legal framework. The issuer must establish the rights and responsibilities of future holders, paying meticulous attention to compliance and contractual obligations. Global regulatory inconsistency complicates this stage.

- Token specifications and blockchain selection. RWAs may be tailored to various blockchains and token standards, such as Ethereum's ERC-20 or ERC-6960, developed by Polytrade. They may exist on one or more blockchains (public or private) and engage cross-chain operability protocols for wider reach.

- Off-chain linking. RWA token management requires a stable connection to external (off-chain) data sources to ensure accuracy and reliability.

- Token issuance. Once the RWA tokens appear on the selected blockchain(s), the focus shifts to generating and supporting sufficient liquidity and demand.

Overview of RWA use cases

RWAs have a plethora of applications across sectors. Commodities like real estate, precious metals, and rare metals are among the assets finding representation on the blockchain. Here are a few examples.

- The tokenization of financial instruments, such as securities, equity shares, debt bonds, and deposits, streamlines their management and accessibility.

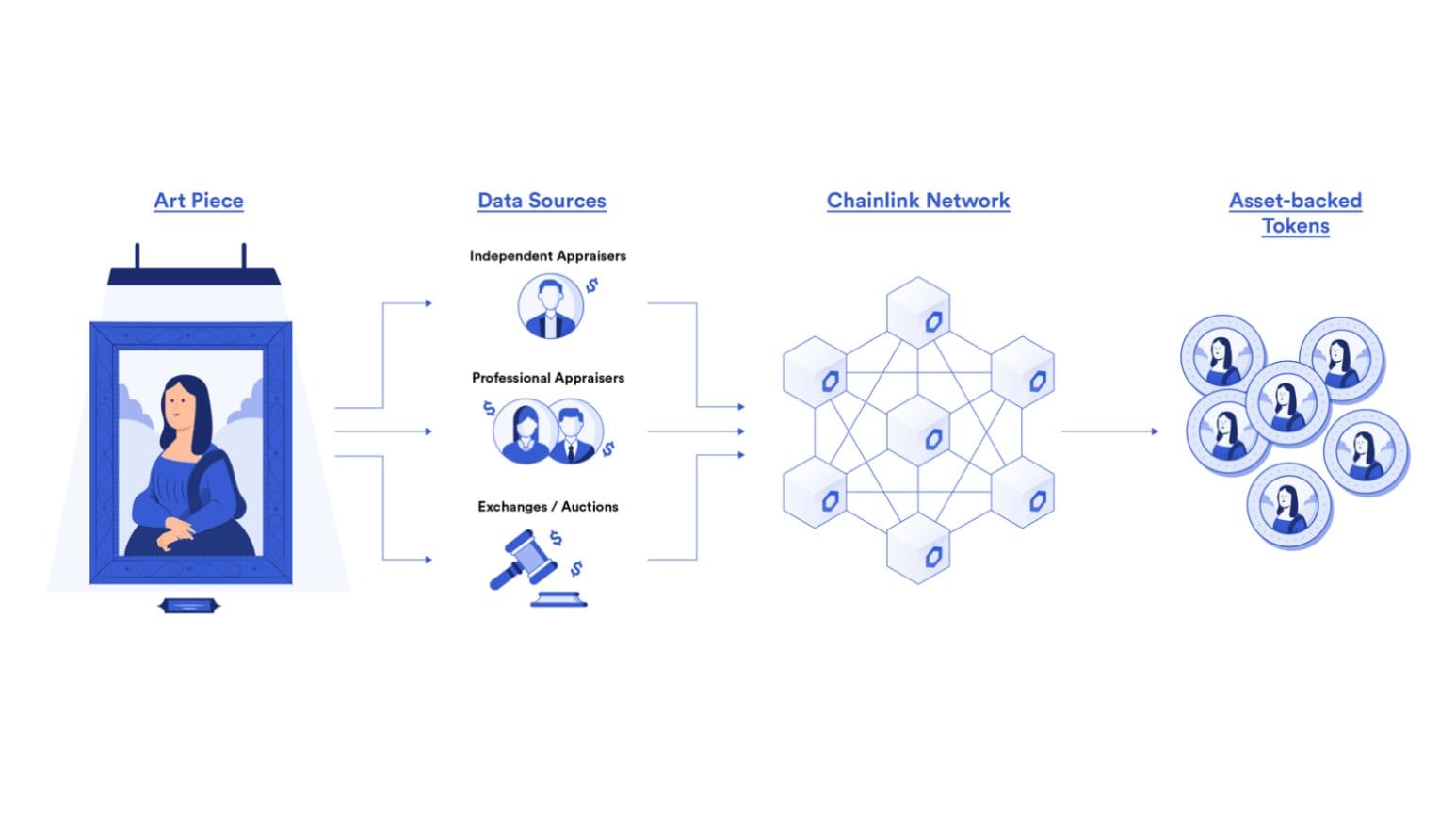

- Physical collectibles, from fine art to automobiles to antiques, are being tokenized to enable fractional ownership and facilitate global transactions.

- Intellectual property rights, including patents, licenses, trademarks, and copyrights transferred on-chain, unlock new opportunities for creators and innovators.

- Venture capital funds are embracing blockchain technology for governance, fractional ownership, and efficient due diligence processes, enhancing transparency and accessibility for investors.

- Energy assets, from fossil fuels to renewable sources to carbon credits, are being tokenized to facilitate trading and investment opportunities.

- Consumer product RWAs (clothing, pharmaceuticals, food, and more) optimize supply chains and loyalty benefits for consumers.

- RWAs linked to luxury goods and services, from fashion to travel perks, unlock unique experiences and ownership opportunities.

- In agriculture, land, crops, equipment, and storage facilities may all be tokenized to streamline supply chain operations and transparency.

- Tokenized music royalties, merchandise, and tickets bring artists new avenues for monetization and distribution with enhanced protection of intellectual property rights.

Benefits of RWA tokenization

RWAs' fractional ownership opportunities cater to smaller investors, democratizing access and removing capital constraints. Institutional issuers and investors gain multiple distinct advantages.

These benefits include enhanced liquidity, transparent asset management, global reach, diversification, and new revenue opportunities through tokenization and blockchain integration.

Increased liquidity

As traditionally illiquid assets become more easily tradable, investors can adopt more agile and diversified strategies and respond to market changes more quickly and efficiently.

Transparency

RWAs ensure transparent and traceable asset movements, facilitate auditable management, and support accurate assessments of leverage and risk.

Global accessibility

Blockchain's borderless nature transcends geographic limitations, unlocking new investment opportunities worldwide.

Tamper-proof records

While not impervious to all forms of interference, blockchain's immutable and public nature significantly mitigates fraud risks.

Diversification opportunities

Institutional and private investors may hedge portfolios by mixing RWA tokens with TradFi and crypto holdings, which enhances stability and resilience.

New revenue streams

The flexibility of RWAs fuels innovation, creating new profit avenues in decentralized finance (DeFi), such as dividends or rental income.

Downsides of real-world assets: Institutional concerns

Along with the benefits, RWAs bring a unique set of risks. Investors can navigate their complexities with greater confidence and resilience by prioritizing security and diligence. Here are five crucial concerns.

Custodial challenges. The custody of physical assets is the core concern, as issuers must maintain secure storage and proper connection to the digital realm. Reliance on third parties for custody and asset acquisition also entails centralization and counterparty risks.

Vulnerabilities and bugs. Like other on-chain assets, RWAs may be susceptible to interference and smart contract bugs, making tailored security paramount. Proactive security, including robust asset verification, compliance procedures, and smart contract audits, is vital.

High initial costs. The creation, launch, and management of RWAs may require substantial capital. Issuers must also factor in audits and legal compliance.

Legal complexity. Real-world tokenization operates in a regulatory gray area, with inconsistent laws and regulations across different jurisdictions. Navigating this legal landscape adds layers of complexity and uncertainty for issuers.

Liquidity concerns. Token issuers must follow comprehensive strategies to support sufficient market liquidity and demand.

Real-world asset regulation around the world

Regulation of RWAs varies across regions, presenting challenges for global adoption. As of February 2024, only a few key hubs have established regulatory frameworks for RWAs.

- Switzerland is a proactive innovative hub. The Swiss Financial Market Supervisory Authority (FINMA) oversees RWA issuance, sale, and trading. Risk-based regulations promote global competitiveness with tailored requirements for asset types.

- In Singapore, the Monetary Authority Of Singapore (MAS) prioritizes consistency in regulatory principles, referring to the "same activity, same risk, same regulation." Collaboration with foreign regulators and organizations, such as Switzerland's Financial Stability Board (FSB), fosters a global market perspective.

- In the United States, regulators, led by the Securities and Exchange Commission (SEC), approach RWA regulation cautiously. They aim to apply existing securities laws, leading to uncertainty in the industry in the absence of formal guidance.

- The United Kingdom, through the Financial Conduct Authority (FCA), also references existing securities laws while remaining open to innovation. Regulations emphasize disclosure, investor protection, and Anti-Money Laundering (AML) requirements to maintain market integrity.

RWA fund structure: BlackRock's BUIDL fund

The world's biggest wealth manager with $9 trillion in AUM revealed its RWA money market fund, created in collaboration with Coinbase, in March 2024. The BlackRock USD Institutional Digital Liquidity Fund, represented by the BUIDL token, operates on the Ethereum blockchain network.

Key structure facts

- Underlying assets and yield instruments. The BUIDL fund generates yield by investing USD in overnight repos and US Treasury bills (T-bills). These are low-risk instruments providing stability and potential returns.

- Transfer agent. Securitize LLC, registered with the SEC, acts as the on-chain administrator for BUIDL. It manages the issuance and management of BUIDL's LP shares on Ethereum, ensuring compliance and transparency.

- Stablecoin and its issuer. Circle, a US-based company, issues BUIDL's primary stablecoin, USDC, facilitating on-chain investments and redemptions.

- Borrower. The US Treasury Department oversees federal finances, and Treasury bills have no default risk as the US government guarantees them.

More about Securitize LLC

Launched in 2017, Securitize is a leading stock transfer agent in the USA, known for its compliance with regulatory standards. Serving over 3,000 clients and managing 1.2 million investor accounts, Securitize offers a comprehensive suite for digital securities management.

As of April 2024, the platform has facilitated investments totaling $600 million, highlighting prominence in the digital securities market. Although the platform supports multiple blockchain networks, Ethereum is the primary blockchain for Securitize's operations.

Other examples of RWAs

The expansion of Real World Assets extends beyond physical assets, encompassing digital capital market products and integration into existing on-chain protocols. Here are several notable examples:

Swarm Markets

Swarm Markets tokenizes various assets beyond blockchain, including cryptocurrencies, carbon credits, securities, and real estate, catering to traditional finance players seeking regulatory compliance. Tokenized stocks issued by SwarmX GmbH subsidiary adhere to SEC requirements, providing compliant asset trading within a regulated environment.

Ondo Finance

Ondo Finance combines OUSG, the first tokenized US Treasuries product, with the Flux Finance lending protocol. Users convert stablecoins into USD to purchase highly liquid and low-risk assets, receiving RWA tokens in return. Additionally, Ondo USD Yield (USDY) offers a tokenized note secured by short-term US treasuries and bank demand deposits.

Maple Finance

Maple Finance redefines DeFi lending by utilizing RWAs as loan collateral. Borrowers can pledge invoices, credit instruments, and other assets evaluated by the community or third-party validators. Loans are provided in Ethereum- and Solana-based stablecoins and US institutions can use receivables as collateral for USDC loans.

Polytrade

Polytrade operates as an RWA marketplace supporting fractional ownership. It simplifies asset tokenization and liquidity provision for various asset types, including real estate, collectibles, bonds, watches, and loans. Custodial arrangements ensure asset security. Sandeep Nailwal, Polygon's CEO and founder, serves on the Polytrade Council.

stUSDT

stUSDT, the first RWA platform on TRON, functions as a money market fund product where users stake USDT to receive RWA tokens, earning over 4% APY. stUSDT bridges traditional finance to crypto, leveraging blockchain technology to provide users with more investment options and transparency.

MakerDAO

This leading credit protocol generates a significant portion of fee revenue from RWAs, which are used as collateral for its DAI stablecoin. RWAs, such as T-bills, generate yield that benefits DAO users indirectly through buybacks in DSR and MKR.

Final words

RWAs continue diversifying the asset landscape, offering new investment opportunities and bridging traditional and decentralized finance. However, navigating legal frameworks, custody, valuation, and security risks remains crucial as this asset class evolves toward broader global adoption.