Crypto exchanges on Zent: Bitget

Bitget is a popular CEX and the world's biggest crypto copy trading platform with 20+ million users. Empowering the future of finance, it provides a one-stop solution for institutions with low fees and proof of reserves. Explore Bitget’s strengths on Zent.pro.

Bitget overview

Launched in 2018, Bitget was inspired by the Bitcoin whitepaper and the Ethereum ecosystem. It boasts 1,500+ employees in 60 countries and regions, aiming "to inspire people to embrace crypto and improve the way they trade, one at a time."

As a fully-fledged crypto exchange, Bitget features spot and derivatives sections with a daily trading volume of 10 billion USDT. Users can trade futures on margin with high leverage, implement trading bots, and access copy trading and staking

According to CMC, Bitget is the second-largest derivatives exchange by trading volume after Binance. The BGB token is the fifth CEX token by market cap.

The platform is registered as a Virtual Asset Service Provider (VASP) in Poland. It also holds a VASP registration in Lithuania, enabling it to offer services within and from the Baltic nation.

In 2022, Bitget started a two-year collaboration with football icon Lionel Messi, who became its brand ambassador. Since 2021, it has also been the crypto partner for the Professional Gamers League (PGL), supporting major esports events.

Countries of operation

Bitget operates in over 190 countries across Asia, Europe, Africa, Latin America, and North America, requiring KYC verification. According to the Terms of Use, It does not serve users on trade or economic sanctions lists, such as the FATF list, the OFAC's "Specially Designated National" list, or the UN Security Council Sanctions list.

Cryptocurrencies available

According to CoinGecko, Bitget features 770 coins in 857 pairs as of April 2024. Its institutional page states that entities can trade over 180 futures pairs and over 550 spot trading pairs.

Products and services for institutions

Bitget offers a comprehensive suite for global institutions with 1:1 proof of reserves. It serves trading institutions, asset management firms, family offices, and brokers.

- Sub-accounts. Institutions may connect up to 1000 sub-accounts under a single main account to isolate access, positions, or assets.

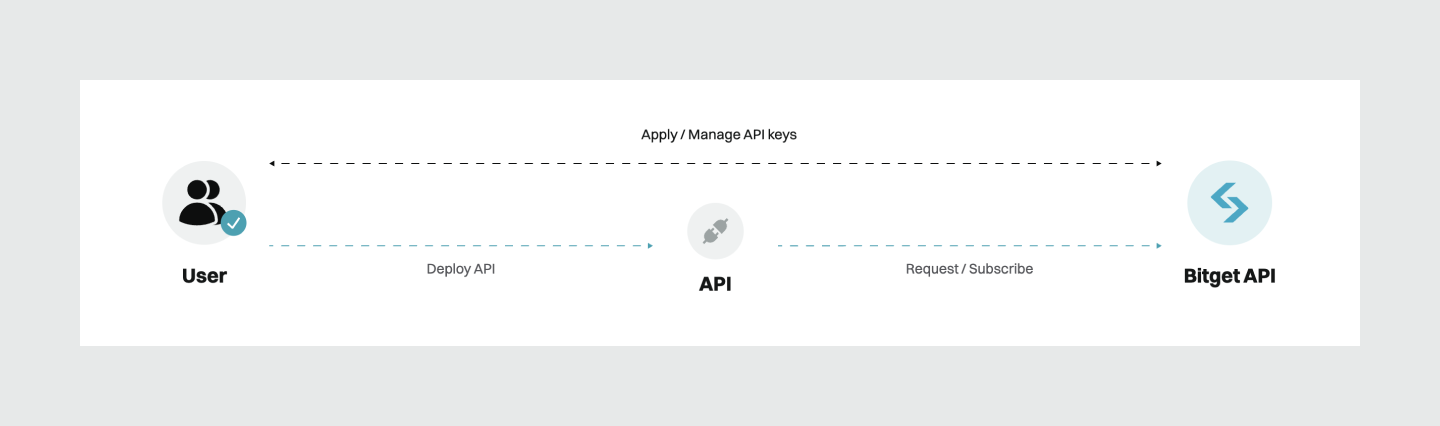

- API management. Bitget API makes trading faster and more flexible with program trading, data acquisition, integration of copy trading, and P2P ad publishing.

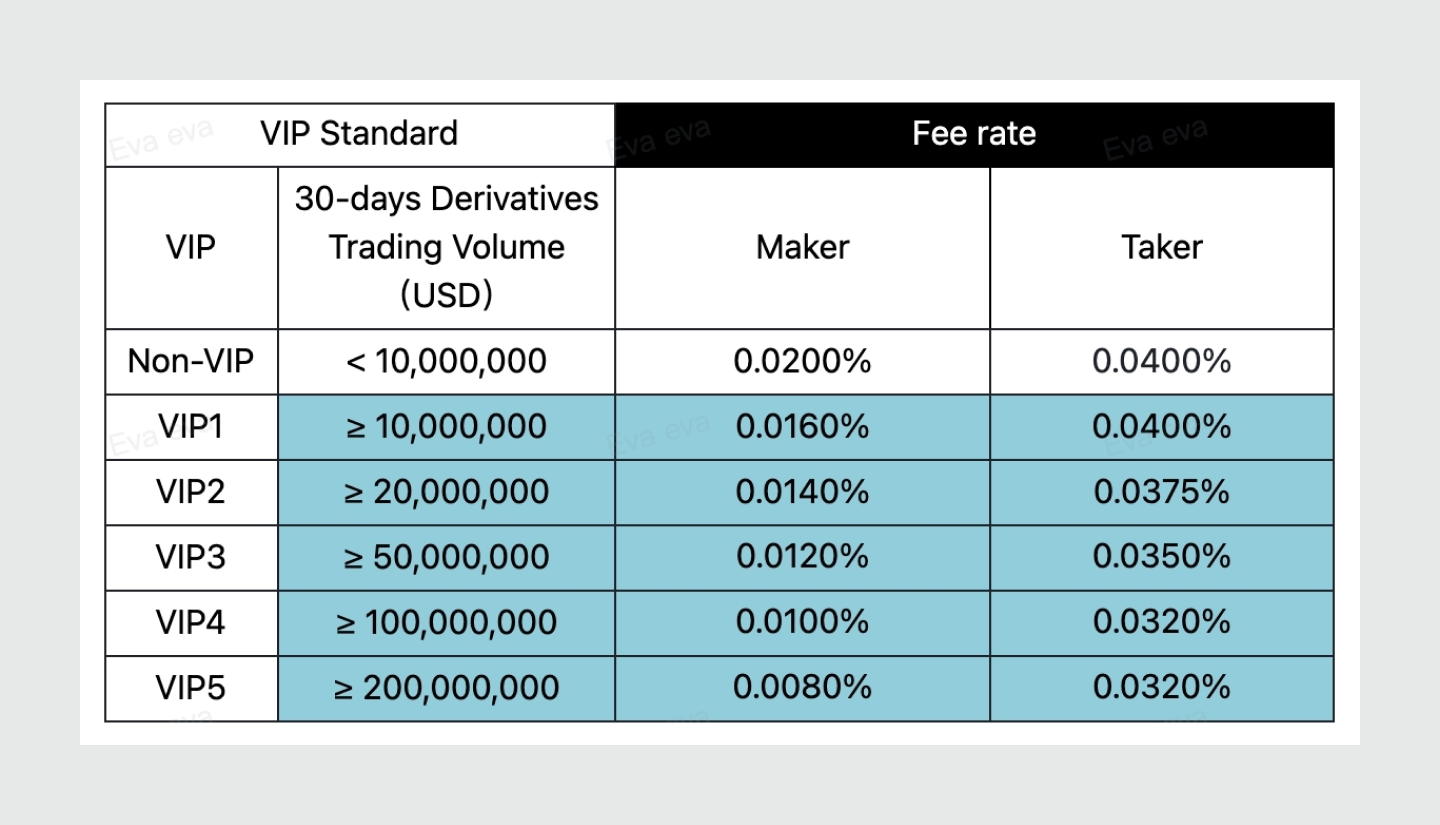

- VIP transaction fees. VIP users access some of the lowest fees and other upgraded perks.

- Asset custody. Bitget custody includes on-chain and third-party solutions, including off-exchange settlement.

- Broker program. Tailored broker solutions come with highly competitive commissions of up to 50%.

- Market Maker program. Bitget maker fees are as low as -0.015%, with monthly subsidies and low entry barriers.

- Custodial sub-account. Users may apply for sub-accounts or become delegated traders, provided they meet Bitget's criteria.

Trading fees

Bitget does not charge users for trading BTC/USDT or ETH/USDT, with the other pairs entailing 0.1% for both makers and takers. Holders of BGB — the native exchange token — receive deductions that reduce the costs to just 0.08% per trade.

Furthermore, six VIP levels (VIP 0 – VIP 5) are assigned based on the asset balance or 30-day spot trading volume in USDT. VIP 5 users enjoy the lowest maker and taker fees (0.0125% and 0.035%, respectively).

Security measures

Bitget prides itself on transparency, as users may verify their funds anytime. The platform's Merkle proof, proof of reserves, and platform reserve ratio are published monthly. According to the official website, the total reserve ratio is 173% as of April 2024.

The $300 million Bitget Wallet Protection Fund protects users' assets and transactions. If assets are lost due to platform vulnerabilities, the affected users have 30 days to apply to use the fund. The standard security features include:

- Two-factor authentication (2FA) via phone, email, or Google Authenticator.

- 24-hour hold on payments and withdrawals after a password change.

- Unique Fund Code, which activates a 24-hour freeze on payments and withdrawals when changed.

- Withdrawal whitelist.

- Anti-Phishing Code in every email from Bitget.

- Third-party account integration to streamline and simplify the login experience.

- Passwordless withdrawals with predetermined limits.

- Trusted device management, protecting against unauthorized entries.

- Account deletion.

- Disabling Google Authenticator's cloud sync.

Opening an account

To inquire about Bitget's institutional services, users should contact the team at the dedicated address ([email protected]). Signing up for a Bitget account requires the following.

- Click on the "Sign up" button on the home page.

- Enter your email address or phone number and create a strong password.

- Enter a referral code if available.

- Confirm acceptance of the User Agreement and Privacy Policy.

- Click "Create Account."

- Enter the verification code sent to the specified email/phone number.

Alternative login options include Google Account, Apple ID, Telegram, and crypto wallets (Metamask and Bitget wallet). After logging in, select the Identity Verification section to initiate the KYC procedure. The procedure requires government-issued documents and face recognition verification and takes 60 minutes to review.

Customer service

The Bitget support page features a self-service section, announcement center, product details, and FAQ. Additionally, users may contact the team through:

- Live chat on the official website

- X.com (@BitgetSupport)

- Email at [email protected]

Key takeaways

Bitget is a prominent centralized exchange with a global presence and powerful copy trading features. It is also one of the largest derivatives platforms with institutional-grade services ranging from sub-accounts to custody. Proof of reserves and diverse security features allow users to trade with confidence.