Investment DAOs: Guide to decentralized venture capital

Blockchain technology has given life to a new form of collective investing — decentralized autonomous organizations. Individuals can pool funds for a common cause in a transparent, democratic, and programmatic way. Here is the lowdown on investment DAOs in 2024.

What is investment DAO?

Decentralized autonomous organizations (DAOs) are a crypto-powered phenomenon. In recent years, they have spread across the crypto economy, encompassing DeFi, NFTs, memecoins, and beyond.

These structures streamline business or community processes by spreading control through token distribution. Free from conventional hierarchy, they exist online, supported by groups of users committed to common goals.

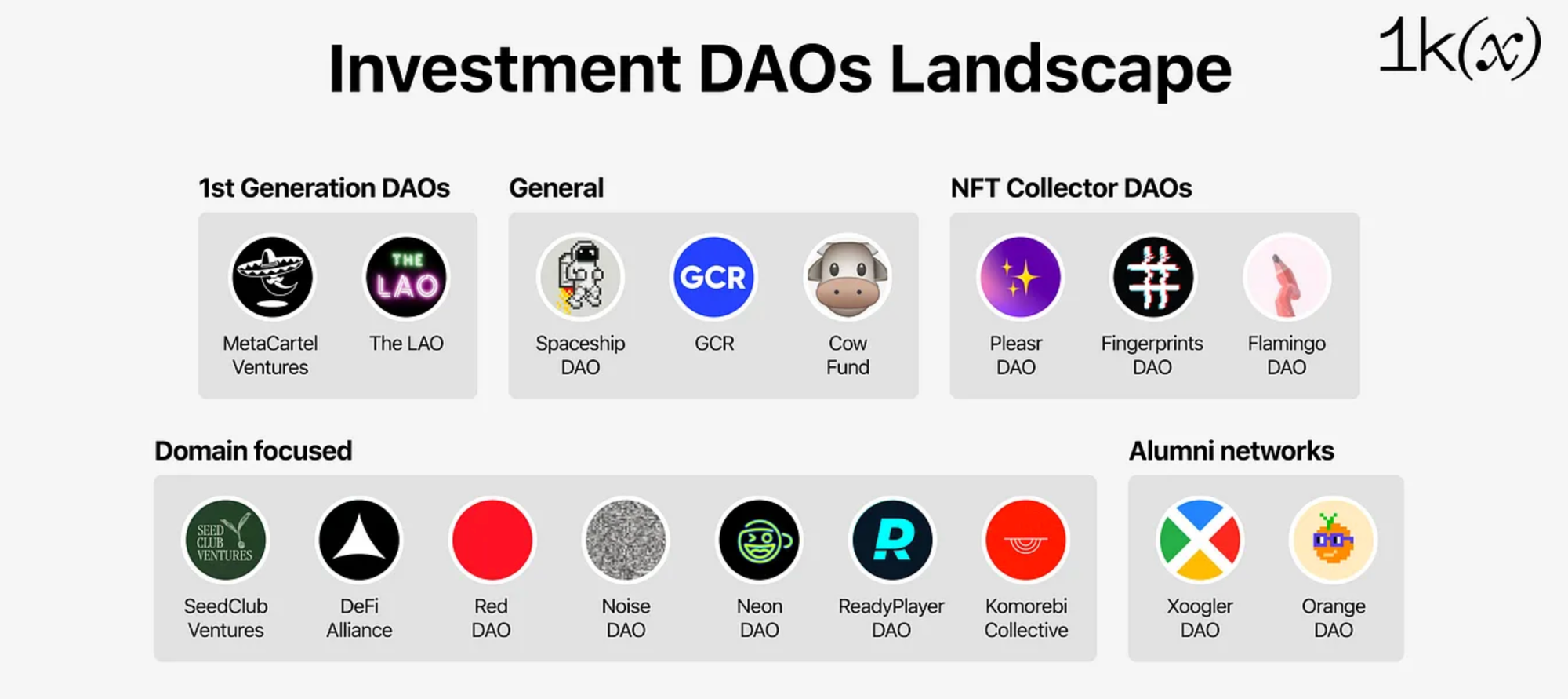

Types of investment DAOs

Some DAOs are merely online users pooling funds — like the famous attempt to buy a copy of the US Constitution at Sotheby's. Others resemble orthodox commercial entities, with investment funds, lobbies, and service providers.

Many DAOs focus on early-stage investment in Web3. While the exact forms vary, there are two distinct purposes:

- enabling users to accumulate funds for project investment collectively

- sourcing deal flow to share with the community

Classic DAOs

Users buy into traditional DAO models with capital, receiving tokens representing the corresponding stake. Subsequently, they source investment deal flow or opportunities for the organization to tackle.

Once a deal is presented, DAO members vote on it with their stakes. Yet as DAOs are not created equal, some handle operations differently based on their setup and purpose. For instance, Hydra Ventures is dedicated to "backing and incubating other investment DAOs across the Web3 ecosystem."

Syndicates

These DAOs unlock user access after purchasing an NFT or a specific cryptocurrency amount. Such is the case with Vanta DAO, gating access to its investing avenues with a membership NFT.

Hence, members buy non-fungible tokens instead of pulling their capital for investment. They seek opportunities and vote on them with personal contributions, benefiting from a higher-quality deal flow compared to individual investment.

Collective participation also enhances scrutiny, with multiple members sourcing deals for the entire organization to vet. Crowd wisdom is an essential benefit, but herd mentality is a potential flipside.

How investment DAOs work

Regardless of the exact form, investment DAOs reap the perks of self-sufficiency and democratization. By nature, they put a twist on traditional business models, broadening accessibility via three crucial characteristics — decentralization, autonomy, and programmatic organization.

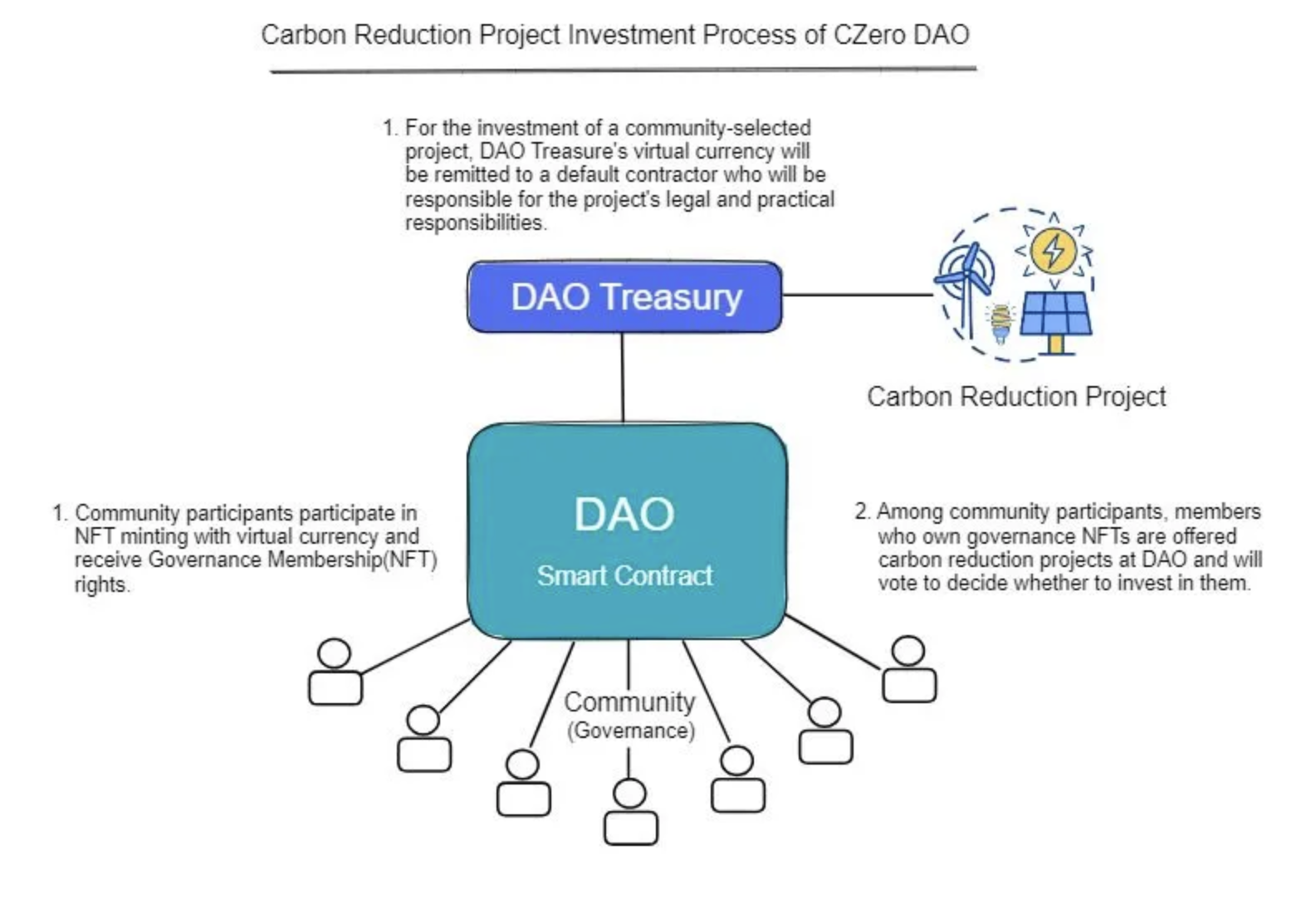

A smart contract creates a proprietary DAO token, aka governance token, native to the organization. Investors typically deposit crypto into the treasury and receive these tokens in return, affording them voting rights. All voting happens on-chain — i.e., the results are documented on the blockchain.

Programmatic enforcement ensures decisions are neither manipulated nor ignored. The code allows audits for compliance with applicable financial regulations. To illustrate how DAOs function, consider CZero, aiming to fund the construction of renewable energy power plants (see graph), or the Web3-focused Vanta:

- To get started on Vanta, users purchase a membership NFT on any supporting marketplace. All sales proceeds go to the treasury governed by the DAO members.

- Members may participate through contributions or simply explore the deal flow. A contributing member can take on several operation-related roles — for instance, researchers paid through the treasury assemble reports on deals that other members propose.

- Members seeking novel opportunities receive a percentage of the total investment made in those deals.

Key advantages of investment DAO models

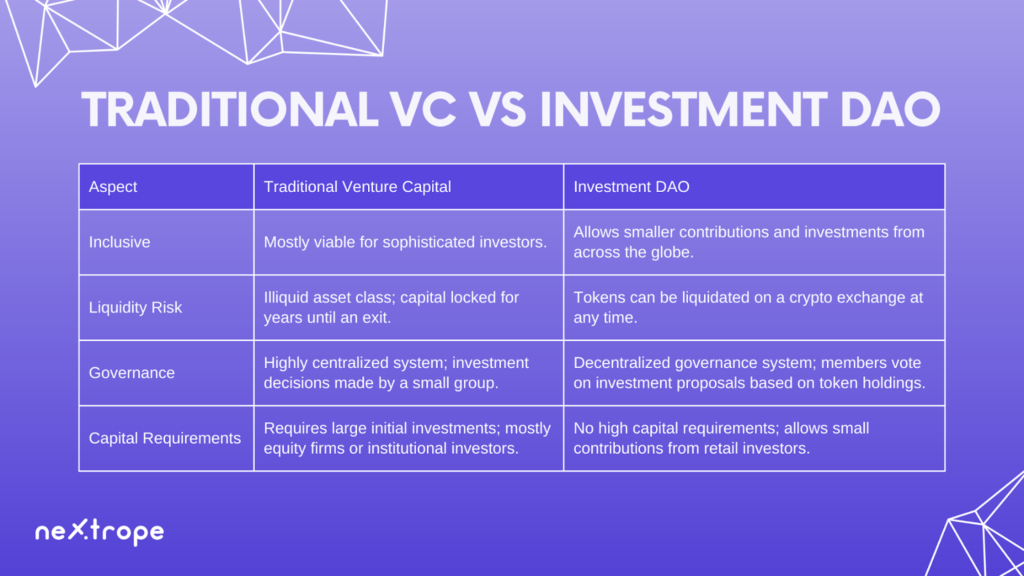

In DAOs, there is no central point of control, with the investors themselves deciding on capital allocations. Thanks to community voting, investment is more democratic and participatory in general compared to TradFi.

- Transparent investing. Every treasury transaction is recorded publicly, while venture capital entities like LPs may conceal certain fees, fuzzy accounting, or mistakes.

- Democratized participation. Investment DAOs decentralize fundraising across many different sources, eliminating unhealthy concentrations of power.

- Lower risk and fees. Investment DAOs may diversify risk by spreading it across asset classes and projects. Members' exposure to any failing enterprise is thereby limited, and fees are typically below those in TradFi owing to decentralization and autonomy.

- Virtuous cycles. DAOs allow under-represented investors to connect to and support under-represented people, firms, communities, or locations.

Disadvantages of investment DAOs

As a blockchain-based phenomenon, investment DAOs are not immune to smart contract exploits. Faulty code could be hacked to drain the treasury or break the funding mechanisms. Bad investment decisions may still be taken, resulting in a negative return on investment.

Another limitation pertains to regulations that must be followed, similar to other investment vehicles. For example, many DAOs refrain from accepting contributions from US residents unless they are accredited investors.

Applications of investment DAOs

DAO models support multiple real-world verticals. Here are a few existing examples:

- Crypto projects: most commonly, building Web3 properties and infrastructure.

- Startup funding: investing in early-stage companies without a centralized authority like a venture capitalist.

- Real estate: property investment, building portfolios through ownership-representing tokens or funding projects like new developments or renovations.

- Entertainment: funding new releases or tours.

- Intellectual property: streamlining payments and licensing arrangements while reducing operational expenses.

Moloch DAO framework

Decentralized investment organizations often use the Moloch DAO framework, created in response to an attack on the pioneering DAO.

The trailblazer DAO ("The DAO") launched on Ethereum in 2015 based on Vitalik Buterin's concept, intended to support the network.

Then, a hack divided the community: half of the members preferred to revert to Ethereum's pre-hack state, and others wanted to leave things as they were. Eventually, Ethereum Classic — a hard fork from the original Ethereum blockchain — was born.

In 2019, Moloch DAO offered reusable framework features to support future DAO development. The core innovation was the rage-quit function, a direct response to "The DAO" chaos. It lets members quit the DAO with their funds when they reject a proposal but cannot outvote it.

Today, the Moloch DAO framework underlies hundreds of DAOs, including investment ones, and thousands more have been started.

Final words

Investment DAOs, powered by blockchain technology, raise and allocate capital based on the members’ voting majority. Emanating from code, they enhance, democratize, and streamline investment, offering superior transparency and programmatic enforcement of decisions.

These DAOs have critical advantages over traditional fundraising, embodying a seismic shift. Yet crowd wisdom does not eliminate poor judgment; specific regulations limit access, while smart contract vulnerabilities, such as bugs or exploits, may result in treasury drain.