Solana ETFs: How they work and how to invest

This year’s emergence of US spot ETFs linked to Bitcoin and ether marked a watershed moment in crypto's maturation. Solana was next in line, with Brazil green-lighting local spot exchange-traded funds in August. A robust ecosystem supports this emerging investment vehicle — here is a deep dive into how it works, its risks and benefits.

Advent of Solana ETFs

While much of the attention in the crypto world is on BTC and ETH, the Solana-based funds are also gaining traction. They provide a regulated avenue to invest in the SOL token within a familiar brokerage environment. In addition to the spot funds, Solana futures underlie another group of existing products.

Institutional interest is strong, as reflected by filings from major asset managers, including VanEck and 21Shares. Currently, futures ETFs are more widely available than their spot counterparts. In August 2024, Brazil launched the world's first spot Solana ETF, ahead of all the other global jurisdictions.

Solana ETFs entail specific risks and challenges, remaining susceptible to market volatility and regulatory changes. However, unlike BTC or ETH, SOL offers exposure to staking rewards.

How SOL ETFs work

As standard investment funds, Solana ETFs (spot and futures) trade on stock exchanges, reacting to SOL's performance. Accessible and regulated, they simplify exposure to Solana for individuals and institutions alike.

SOL is the native cryptocurrency of Solana, a blockchain platform supporting decentralized and scalable applications. Launched in 2017, it operates as open-source, managed by the Solana Foundation based in Geneva. Boasting high speed, Solana can handle significantly more transactions than rivals like Ethereum while offering much lower fees.

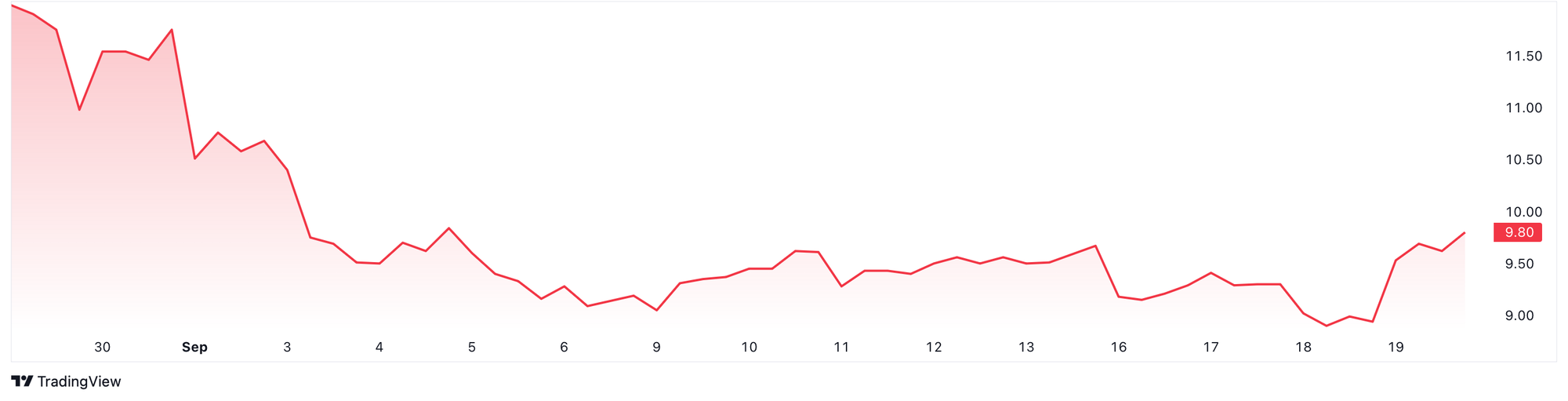

The SOL price surged nearly 12,000% in 2021, reaching a peak market cap of over $75 billion. As of September 20, 2024, it ranks 5th by market cap.

Types of Solana ETFs

Similar to the Bitcoin and ether ETFs, the products fall into two categories.

- Spot ETFs, mirroring real-time price fluctuations of the SOL coin. Their issuers hold corresponding amounts of physical SOL in custody.

- Futures ETFs, investing in futures contracts without holding physical SOL.

In the US, the SEC treats Solana ETFs as securities. They meet the four requirements of the Howey test: an investment of money through a common enterprise with an expectation of profits and chances of profits derived from the efforts of others.

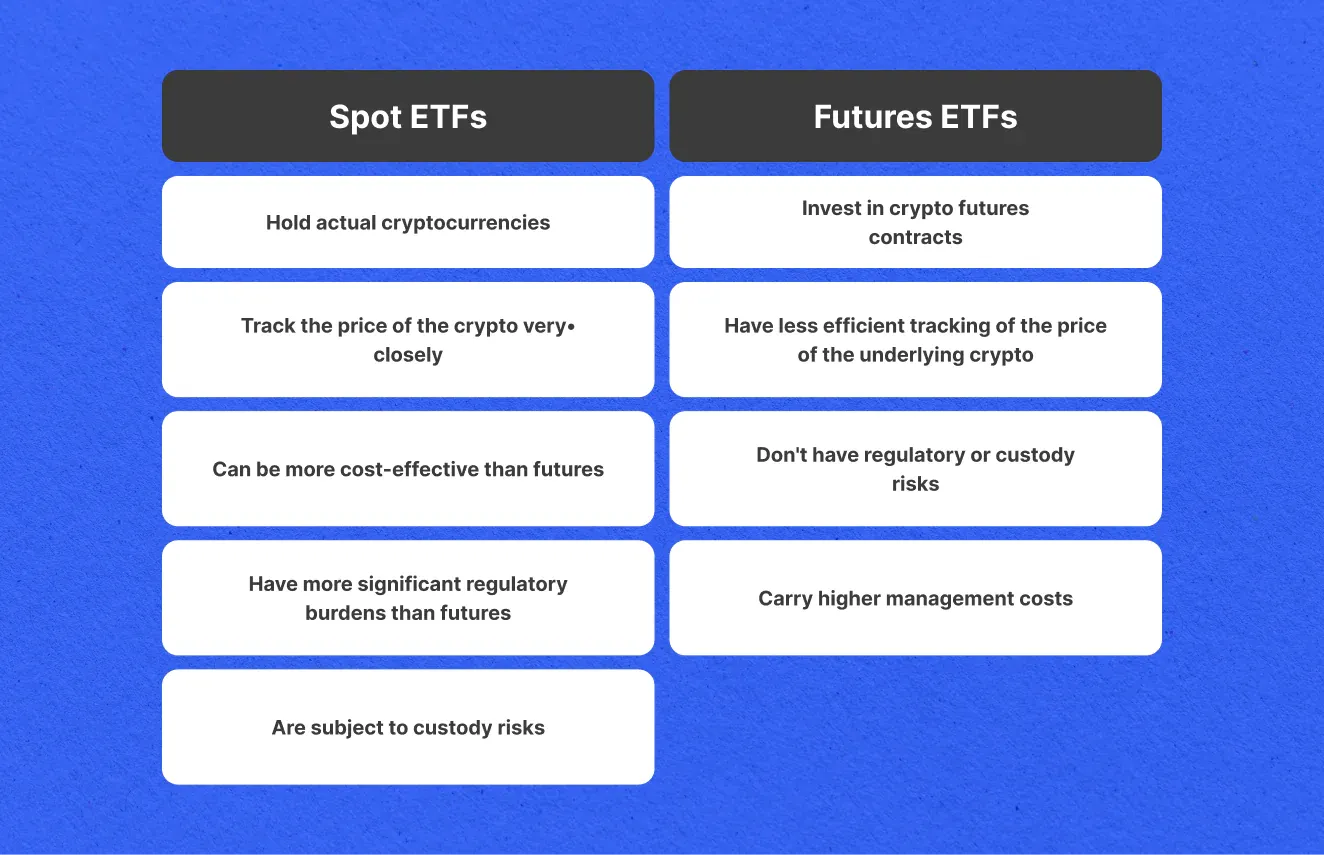

Spot Solana ETFs vs. futures Solana ETFs

As mentioned above, the key distinction between the two types is the underlying assets — actual coins or futures contracts for the same cryptocurrency. There are other differences as well:

- Tracked price. Spot ETFs track the actual, real-time price of Solana coins. Futures ETFs track the expected price.

- Exposure. ETFs provide exposure to Solana's current and future market performance, respectively.

- Strategies. Long-term investors prefer spot ETFs due to actual asset ownership. Speculators and short-term traders favor futures.

- Price stability. Spot ETFs are less volatile due to the absence of futures contracts and leverage (using borrowed capital to increase potential returns).

- Risks. While futures ETFs do not entail custody risks, they have leverage and rollover risk (associated with switching a contract approaching its expiry date with another contract whose expiry comes later). Both types are susceptible to market volatility and regulatory changes.

- Liquidity. Generally, spot ETFs are the most liquid due to direct asset ownership.

- Costs. Trading futures ETFs is more expensive due to leverage and rollovers.

Trading mechanism

ETF shares are bought and sold through traditional brokerage accounts. The market is highly liquid as the price changes throughout the trading day, moved by supply and demand. Compared to direct crypto trading, entering and exiting positions is easier.

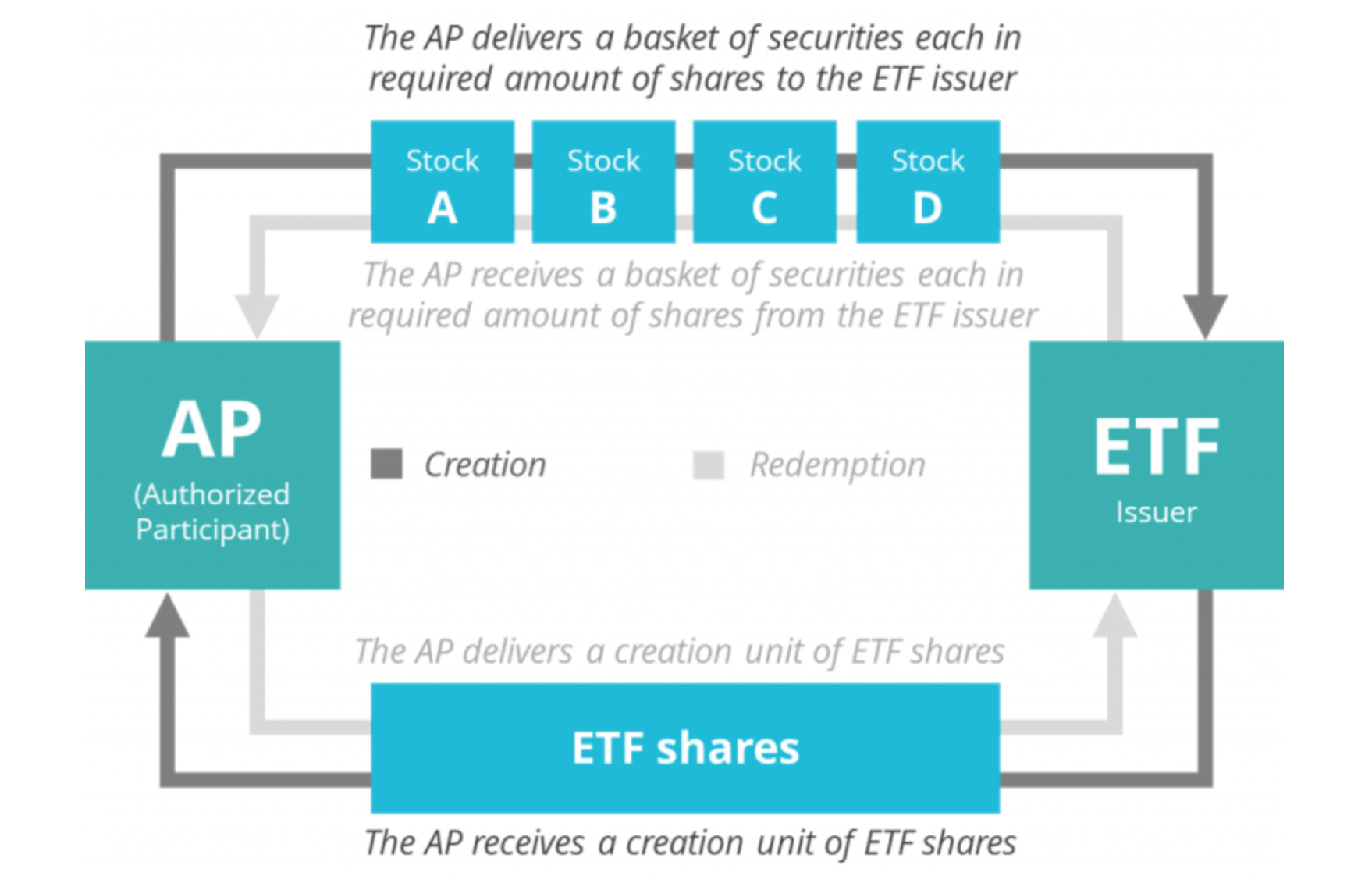

Creating and redeeming Solana ETFs

Solana ETFs are created, managed, and redeemed in a transparent and regulated way, ensuring sufficient liquidity. Thanks to creation and redemption procedures, the Solana ETF price closely follows the underlying SOL's net asset value.

Creation flow

- Initiation. ETF shares may only be created by APs (Authorized Participants) — usually major financial institutions.

- Basket deposit & share issuance. The custodian of the ETF receives a corresponding amount of Solana to hold the underlying assets securely. In exchange, it issues new ETF shares to the APs.

- Market introduction. Those newly issued ETF shares appear on the market via major stock exchanges so that they may be traded.

Redemption flow

- Redemption request. Authorized participants can also remove ETF shares from the market. When APs need to redeem shares, they contact the ETF provider.

- Returning shares. Upon receiving the ETF shares from the APs, the custodian releases the equivalent amount of SOL back to them.

- Settlement: Once the APs receive the redeemed SOL, redemption is complete.

Benefits of Solana ETFs

- Diversification of investor portfolios through exposure to crypto.

- High liquidity, ensuring smooth entry and exit.

- Regulatory oversight, giving investors peace of mind.

- Access to staking rewards for some products (e.g., 21Shares Solana Staking ETP).

- Accessibility through familiar brokerage tools.

- Reduced fees due to the absence of wallet setup, exchange fees, and other costs involved in direct training.

Risks of Solana ETF investing

Spot ETFs require physical coins, making custody and technological risks actual. Furthermore, with regulators wary of spot crypto ETFs beyond Bitcoin and ether, the legal landscape presents its own risks.

The perception of Solana's strengths as a digital asset may also evolve while market volatility affects spot and futures funds alike. Finally, while liquidity is high, it is not a guaranteed constant.

Solana's network stability could become an issue — on February 6, 2024, it suffered the 11th outage in 2 years, highlighting reliability issues. There are concerns about a future supply-demand disbalance — over 162k tokens have been issued as validator rewards. This high minting rate may drive selling pressure and destabilize value in the long term.

Solana vs. Ethereum ETFs

Both products serve the same objective — tracking the underlying coin's price changes and staking yields, actual for SOL and potential for ETH. Both track either the cryptocurrencies or related futures contracts.

However, that's where the similarities end. Here are five primary distinctions:

- Regulatory status. The SEC has approved both futures and spot ether ETFs in the US, while Solana investment is only accessible through futures. It is unclear if and when sport Solana ETFs will become available in the US, although they are already trading in Brazil.

- Performance & applications. Solana is praised for its enhanced throughput and low transaction fees. Meanwhile, ETH has a veteran market presence with extensive use cases in smart contracts and decentralized apps. It is more mature, and Layer-2 networks solve its scalability issues. Following the Dencun upgrade, introducing blobs in March 2024, the transaction fees on many of them dropped close to zero.

- Risk factors. While market volatility and regulatory changes are common risks for all cryptos, Solana has also experienced repeated outages. Generally, Ethereum is associated with stability in a more mature ecosystem, while Solana emphasizes innovation.

Solana vs. Bitcoin ETFs

Like Ethereum ETFs, pioneering Bitcoin ETFs are more geared toward stability and maturity. Furthermore, they exclude staking opportunities due to the nature of Bitcoin.

Both types aim to make crypto more accessible through conventional brokerage tools. They also share general volatility and regulatory risks as crypto regulations are evolving.

Major issuers of ETFs or ETNs

- Canada: 3iQ Digital Asset Management's QSOL, the first Solana ETF in North America tracking SOL's price and offering staking yields.

- Germany: VanEck's Solana ETN (VSOL), replicating the movements of the underlying SOL index with a collateralized debt obligation backed by physical coins.

- Switzerland: 21Shares Solana Staking ETP (ASOL), offering staking rewards while tracking the SOL price.

- Germany, France, and Switzerland: WisdomTree's Physical Solana (SOLW), an ETN physically backed by SOL and offering direct exposure for long-term investment strategies.

Spot Solana ETFs in Brazil

Brazil's first spot Solana ETF is QSOL11, issued by QR Asset Management and managed by Vortx, was listed on the B3 stock exchange on August 28, 2024.

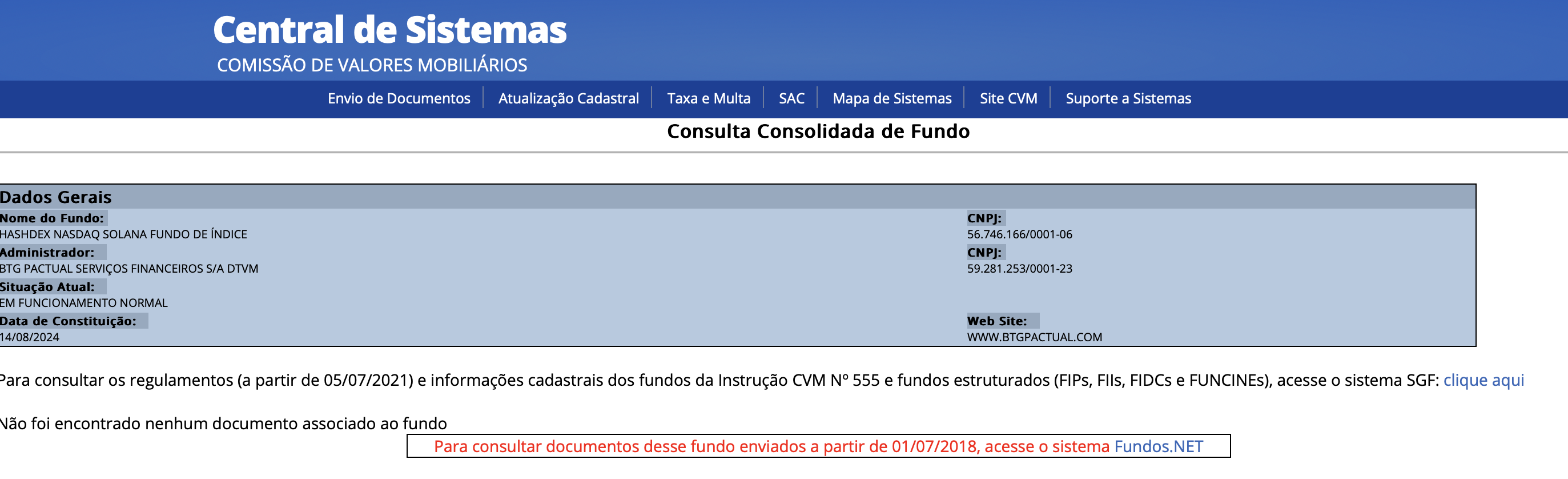

The second ETF (SOLH11) was launched by Hashdex, a local asset manager, in partnership with the local investment bank BTG Pactual. According to the CVM database, it is functioning normally at press time.

Applications for spot Solana ETFs in USA

In the US, VanEck and 21Shares have filed for spot Solana ETFs, aiming to list on the Cboe BZX Exchange. However, Insiders say those Cboe’s 19b-4 filings were rejected.

Meanwhile, the Grayscale Solana ETF (GSOL) provides exposure to SOL's price movements as a private trust or fund ETF. It does not require SEC approval.

Future of Solana ETFs

The outlook for Solana ETFs appears promising, though not without hurdles. Regulatory transparency will play a crucial role, and the state of the broader cryptocurrency market will heavily influence their success.

While Brazil has been a frontrunner in embracing this innovation, US regulators remain cautious. Solana's appeal is largely based on its performance and affordability — if it continues to build on its current momentum, related ETFs could become more accessible worldwide.