Cryptocurrency futures: How BTC and ETH contracts work

Similar to futures in TradFi, crypto futures are legal agreements to buy or sell digital assets at a specific price. While providing indirect exposure, they also offer the potential for high returns, albeit with high risk. Here's how to get started with crypto futures in 2024.

What are crypto futures?

A futures contract is a derivative used to speculate on the prospective price of the underlying asset, be it Bitcoin, wheat, or crude oil. Futures are bought and sold between two parties — investors placing bets on a specific price at a particular future date.

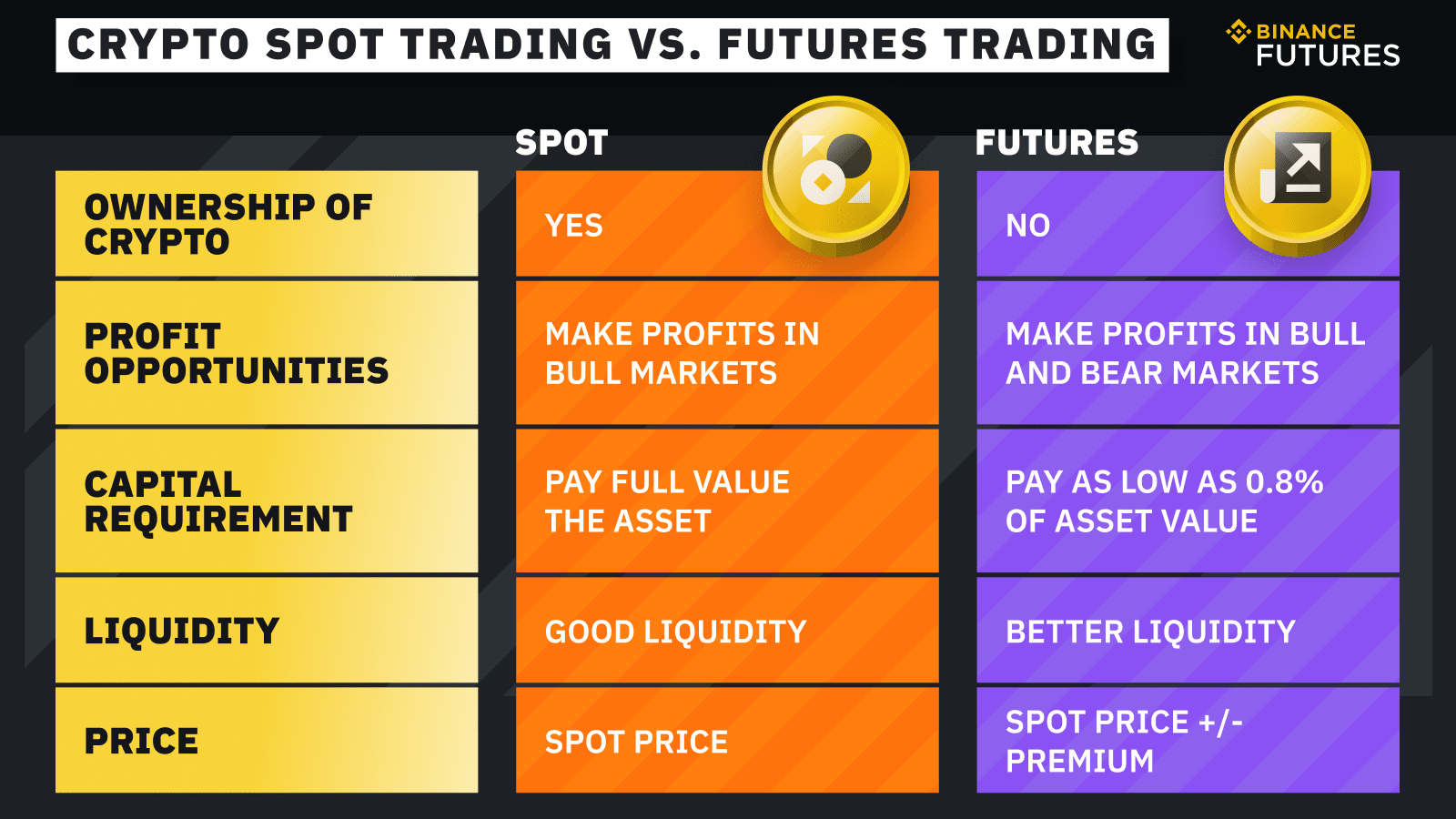

Trading a crypto futures contract allows you to bet on the trajectory of a token without the complexities of setting up digital wallets or dealing with spot strategies. This straightforward process bypasses the hassles of direct ownership and trading.

Futures and other crypto derivatives account for over half of all crypto trading volume, equivalent to billions of dollars daily. Here is how these direct agreements work.

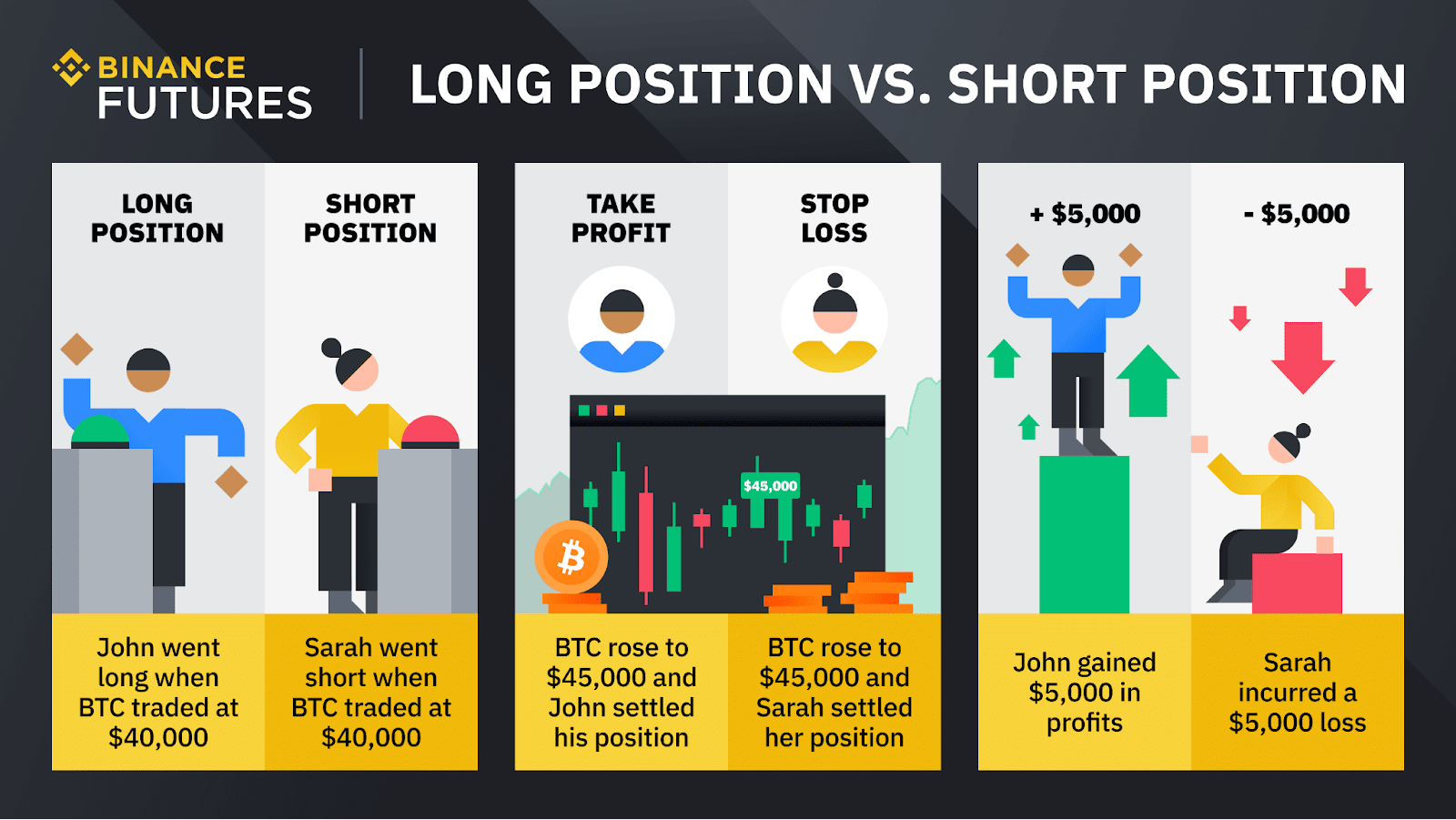

Suppose you are bullish on BTC, expecting it to rally by a specific date. Going long, you purchase a futures contract to sell it later and make a profit. Another trader may go short, projecting a decline by the agreed date — they sell a contract they don't own to buy it back later.

Thus, those who go long profit from future upswings, while those shorting need the price to fall. The party that "loses" the bet pays the difference between the settlement price and BTC's current spot market price to the "winner." A contract's buyer and seller agree upon its details before it is brokered.

Where to trade crypto futures

Crypto regulations and the availability of futures vary around the world. In the US, these instruments are legal and available to buy and sell on multiple venues, both regulated and unregulated.

Importantly, futures exchanges are not a counterparty to any trades, as they merely match buyers with sellers.

To start, set up an account with a registered futures commission merchant or broker. The options include crypto exchanges and the Chicago Mercantile Exchange (CME). The Chicago Board Options Exchange (CBOE) also offers margin futures for Bitcoin and Ether.

Bitcoin futures timeline

- December 2017: CBOE lists the first futures contracts for BTC but discontinues them later.

- December 2017: CME launches BTC futures for trading on the Globex electronic trading platform with cash settlement.

- January 2024: CBOE lists margin BTC and ETH futures, making it the "first US-regulated crypto native exchange and clearinghouse to offer both spot and leveraged derivatives trading on a single platform."

How cryptocurrency futures work

As shown above, futures trading is a zero-sum game. For one party to profit, the other one must incur losses. Each contract has four key parameters:

- number of units (lot size)

- price

- marginal requirements

- expiration time

- settlement methods

Number of units

The lot size shows how much BTC or ETH a contract represents. It can be priced in the underlying coin (1 contract = 1 BTC) or its fiat equivalent (1 contract = $1 worth of BTC).

On CME, each futures contract is for 5 BTC, quoted in US dollars and cents. For ETH futures, the standard size is 50 ETH. Some exchanges allow fractional trading — for instance, if a contract's unit size is 1 BTC, a trader can buy or sell as little as 0.0001 BTC.

Price

Contract value changes over time as cryptocurrencies remain highly volatile. On CME, BTC and ETH futures are based on the CME CF Bitcoin Reference Rate and the CME CF Ether Reference Rate, respectively. This gauge is the volume-weighted average coin price sourced from multiple exchanges and calculated daily between 3 PM and 4 PM London time.

At times of peak Bitcoin volatility, futures prices may mirror spot market prices or trade at a major premium or discount to them. Citing this instability, the SEC cautioned investors against crypto futures trading in 2021, noting that "Bitcoin, including gaining exposure through the Bitcoin futures market, is a highly speculative investment."

Marginal requirements

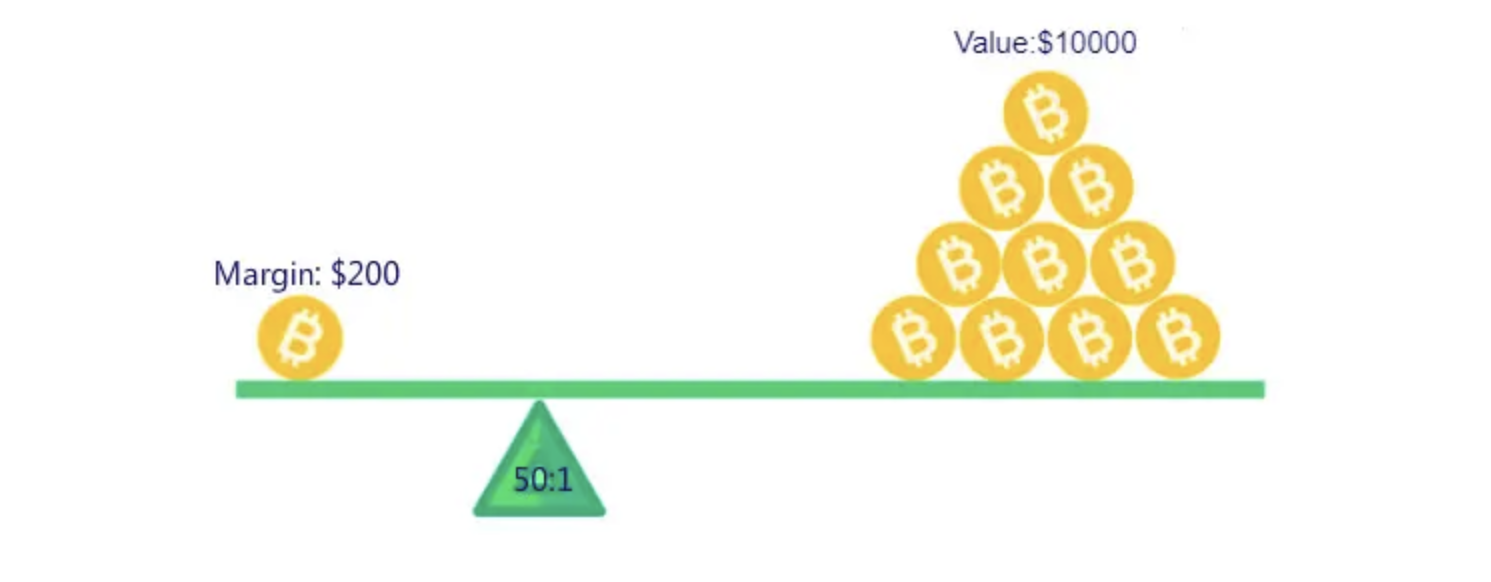

The amount one can trade depends on the margin amount — the minimum collateral you must deposit to execute trades. The more you want to trade, the greater the margin amount your provider requires.

Futures trading involves heavy use of leverage to execute trades. Leverage, essentially trading with borrowed money, can amplify potential returns and losses. For instance, if you have a 10:1 leverage, a 1% price movement in the underlying asset could result in a 10% gain or loss in your investment. The higher the leverage, the higher the potential volatility.

Due to crypto's inherent volatility, margin amounts are typically above those for traditional assets. Binance, for instance, imposes a 50% margin for BTC and 60% for ETH.

Brokerages, offering products from multiple sources, may have different requirements over and above the amounts charged by those providers. For instance, the TD Ameritrade broker can set margin rates on top of the base rate set by CME for its Bitcoin futures.

Expiration time

A futures contract closes at a preset date, with its value transacted. The parties agree on it when entering into the contract, and it defines the account maintenance amount. The further out the date, the higher the cost.

On CME, BTC and ETH futures contracts are listed for six consecutive months and two additional Decembers. They expire on the last Friday of the month at 4:00 PM London time.

Perpetual contracts, available on some platforms, have no expiration date. They use a funding rate to keep the futures price in line with BTC's spot value.

Settlement methods

Cash settlement is the most common — the "loser" pays the "winner" in USD or another fiat currency agreed beforehand. Some providers allow traders settlement in the underlying asset, known as physical delivery.

In this case, the seller holds the underlying coin and sells it directly to the buyer at the agreed settlement price. The difference between the latter and the current spot price constitutes the winner's profit.

Benefits of cryptocurrency futures trading

Futures contracts provide indirect and regulated exposure to leading cryptocurrencies. Holders do not have to deal with the technicalities of owning and trading actual Bitcoin, yet they capitalize on its price swings. Here are five top advantages of Bitcoin futures trading.

- Regulation. Established providers, such as CME, regulated by the Commodity Futures Trading Commission (CFTC), ensure confidence and recourse. This is particularly attractive to institutions, which constitute the bulk of futures holders.

- Ease. BTC futures offer a simplified means of investing without needing a wallet or custody solutions, security safeguards, etc. No spot exchange is involved.

- Cash settlement. Contracts settled in cash eliminate the risk of physically owning a volatile cryptocurrency.

- Adjustable risk exposure. Price and position limits in futures contracts limit holders' exposure to the asset class and its market swings. For instance, on CME, one may trade up to 4,000 front-month futures contracts for BTC and Micro BTC and 8,000 for ETH and Micro ETH. Binance offers a position limit adjustment tool supporting manual reconfiguration based on trading history and margin amounts.

Regulated exchanges

Trading is similar to managing futures with traditional underlying assets like commodities. After setting up an account with an authorized provider, one needs separate approval to start futures trading. The provider will typically consider the funding requirements and the user experience with derivatives.

The same parameters define access to leverage and determine margin amounts for each trade. Government agencies determine the maximum leverage amount allowed at regulated platforms.

Example: CME Group BTC futures contract

John buys two futures contracts for 2 BTC in total. One Bitcoin is traded for $40,000 at the time of purchase, bringing the overall value to $80,000.

Given the 50% margin requirement, John must deposit half of the contract amount — $40,000 — in his margin account. The other half of the contract may be financed using leverage.

Over time, the contract value fluctuates based on the Bitcoin Reference Rate (see above). John may hold on to it or sell it to another investor. After expiry, he can either roll it over to new ones or collect the cash settlement.

In the following illustration from Binance, John opens a position for 1 BTC and settles it when BTC is at $45,000, which brings him a $5,000 profit. Sarah, who bets on a decline, makes a loss.

Unregulated exchanges

CME it's the only major future trading platform regulated by the CFTC. Most exchanges facilitate trading outside the purview of regulation. Binance.US does not offer margin or futures trading, while Kraken limits these options to specific users.

Unregulated venues may allow excessive risk-taking. For instance, when Binance launched crypto futures in 2019, leverage reached 125 times the trading amount. This means that a 1% price movement in the underlying asset could result in a 125% gain or loss in your investment. Two years later, the exchange revised the figure to 20 times, still a significant risk for rookies.

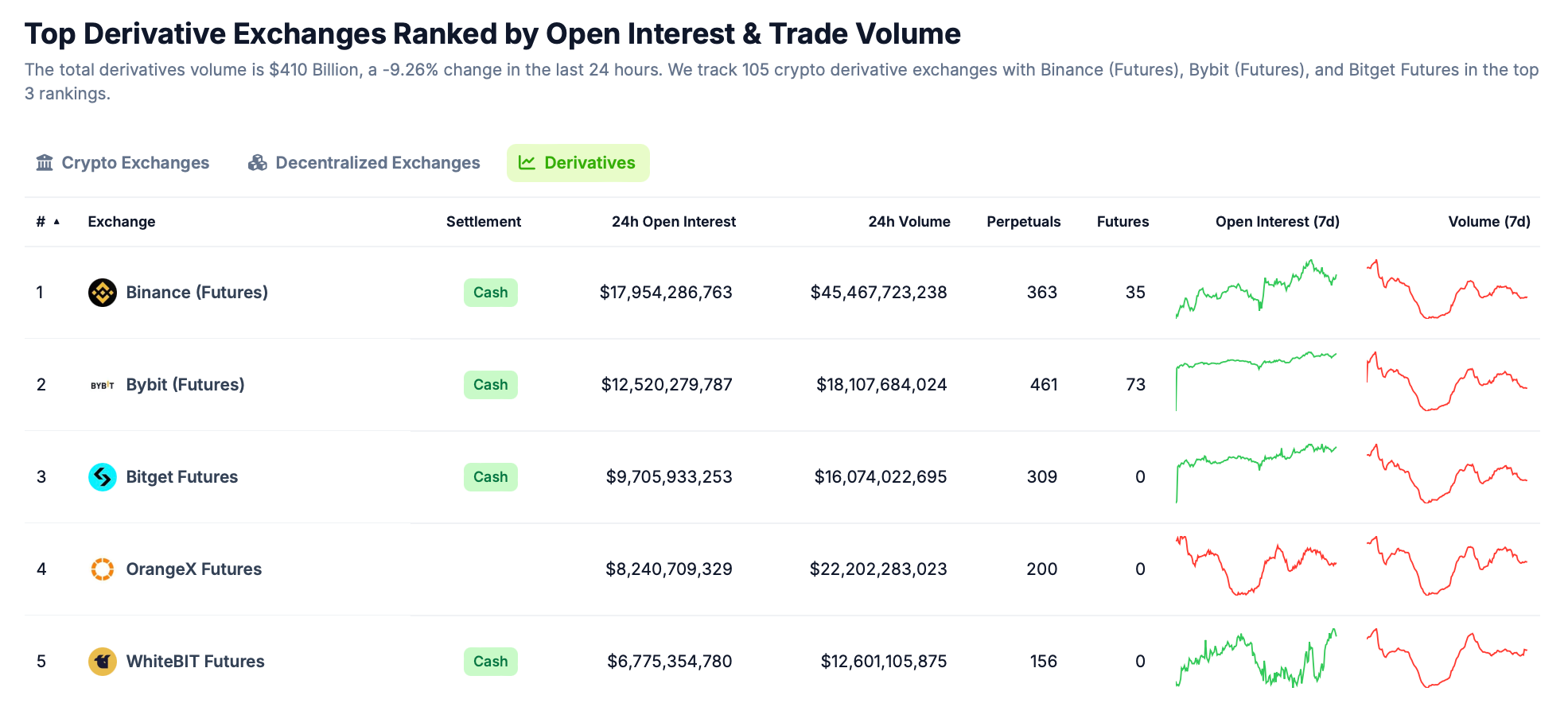

Popular exchanges for cryptocurrency futures

According to CoinGecko, as of September 26, 2024, the top five crypto derivatives exchanges by volume and open interest are:

- Binance

- ByBit

- Bitget Futures

- OrangeX Futures

- WhiteBIT Futures

Institutions and individuals may also gain exposure to crypto futures through exchange-traded funds or ETFs. Multiple ETFs track Bitcoin futures:

- Proshares Bitcoin Strategy ETF (BITO)

- ARK 21Shares Active Bitcoin Futures Strategy ETF

- Global X Blockchain & Bitcoin Strategy ETF (BITS)

- Bitwise Bitcoin Strategy Optimum Roll ETF (BITC)

- Bitwise Bitcoin and Ether Equal Weight Strategy ETF (BTOP)

- Valkyrie Bitcoin and Ether Strategy ETF (BTF)

- ProShares Bitcoin & Ether Market Cap Weight Strategy ETF (BETH)

- ProShares Bitcoin & Ether Equal Weight Strategy ETF (BETE)

Cryptocurrency futures vs. options

Crypto options emerged after the advent of futures. In 2020, CME introduced BTC futures options, followed by ETH counterparts in 2022. Crypto futures options are also accessible through brokers like Interactive Brokers, Edge Clear, Ironbeam, or TradeStation.

As standard options contracts, crypto options provide a right, but not an obligation, to purchase a certain token at a preset price on a specific future date. The underlying asset is represented by crypto futures traded at the CME. One options contract is equivalent to one futures contract for 5 BTC or 50 ETH. Currently, CME offers options for six consecutive months.

Those expecting the BTC price to rise buy call options, while bears aim to benefit from puts — bets on future declines. The gains and losses vary.

- Gains on calls are unlimited, as there is no limit to price rallies. Meanwhile, losses are limited to the premium the holder paid for the contract.

- Gains on puts are limited to the premium, while losses are uncapped — the BTC price may theoretically drop to zero.

Bitcoin options are risky assets due to their implied volatility. The higher the prices, the bigger the potential losses.

Final words

Cryptocurrency futures let traders speculate on digital asset value dynamics without owning the actual coins. Combining leverage and access to price fluctuations, they carry significant risks while delivering magnified returns and losses. Whether trading through regulated venues or more flexible exchanges, one should understand the intricacies of margin requirements, settlement methods, and market volatility.