Crypto exchanges on Zent: Kraken

Kraken is one of the oldest and leading cryptocurrency exchanges. It offers a rich spectrum of digital assets and corporate services with competitive fees. However, some of its features are inaccessible to US-based investors — here are the key things to know.

Kraken overview

Kraken (legally named (Hayward, Inc.) is based in San Francisco. Founded in 2011, it was one of the first platforms to offer leveraged spot trading, regulated derivatives, and index services. The current Kraken CEO, David Ripley, took over from co-founder Jesse Powell in 2022.

Trading operations were formally launched in 2013. A year later, Kraken and Coinbase were chosen as sources of Bitcoin trading market data for the Bloomberg terminal. Shortly afterward, Kraken partnered with TradingView, continually expanding its range of trading instruments.

Kraken has a reputation for strong security, a wide choice of assets, and low fees. It is registered in multiple jurisdictions, including Italy, Australia, and the Middle East. In the US and Canada, it is registered as a Money Services Business with FinCEN and FINTRAC, respectively.

In the UK, Kraken is registered as a cryptoasset firm with the FCA. In February 2024, it also secured a VASP registration from the Dutch Central Bank to expand its operations to the EU.

Legal controversies

In November 2023, the US Securities and Exchange Commission (SEC) filed a lawsuit against Kraken. The allegations included commingling customer's crypto and cash with company holdings and running an "unregistered securities exchange, broker, dealer, and clearing agency."

Furthermore, in February 2023, the platform agreed to pay a $30 million fine and shut down its on-chain staking operations to settle with the regulator. However, a subsidiary is still providing staking-as-a-service for clients outside the US.

Countries of operation

Kraken operates in over 190 countries and serves over 10 million clients. The prohibited regions include Afghanistan, Belarus, Cuba, Iran, North Korea, Russia, and Syria. The Terms of Service include all eligibility criteria.

Cryptocurrencies available

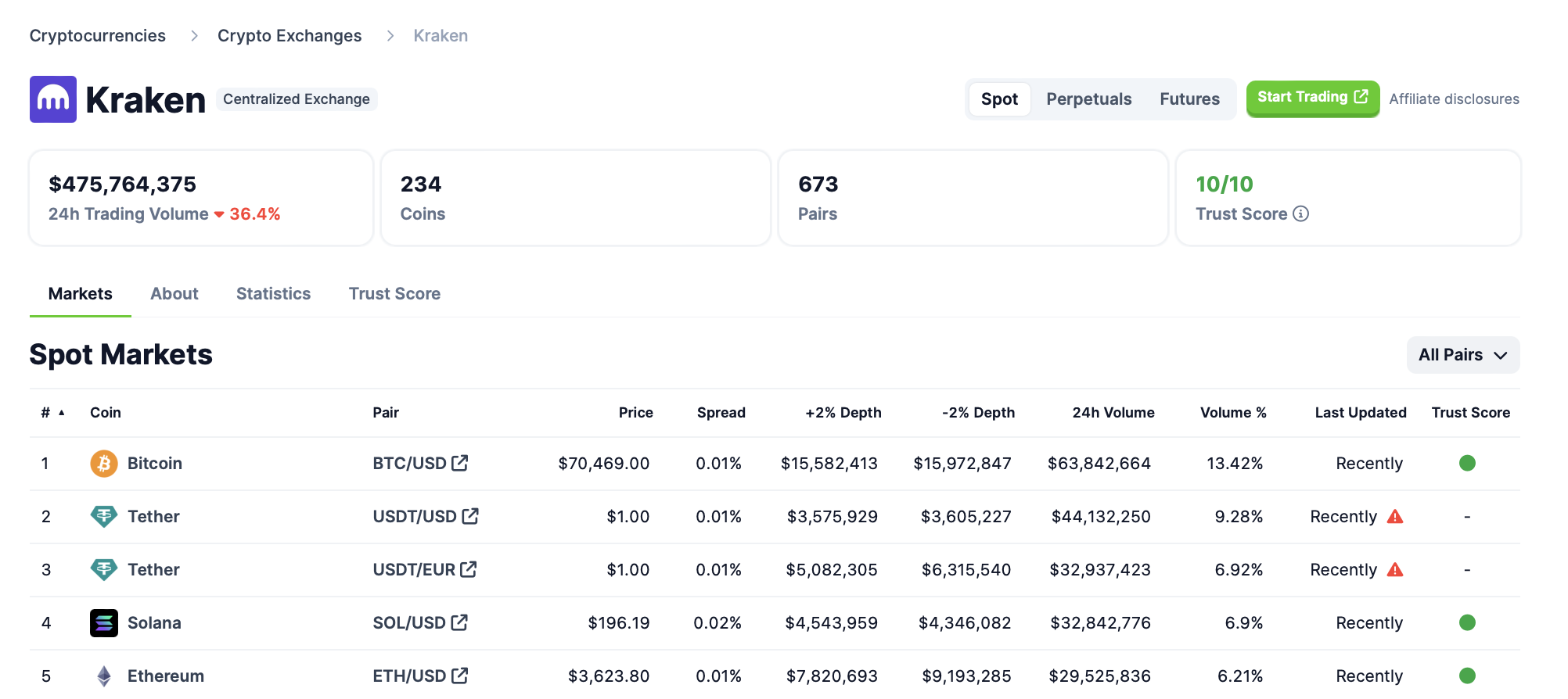

According to the CoinGecko statistics, Kraken users may trade 234 cryptocurrencies in 673 pairs. Deep liquidity ensures execution with spreads as tight as one pip.

Kraken's maker fees are some of the lowest in the crypto industry, ensuring superior liquidity for all users. According to the official website, it is the world's largest exchange by euro volume and one of the top exchanges by Bitcoin liquidity.

Products and services for institutions

Kraken's comprehensive suite of institutional tools includes trading, staking, custody, and more. It serves the needs of trading firms, investment funds, intermediaries, asset managers, private clients, and investment advisors. The corporate features include:

- Spot trading with deep liquidity via API or Kraken Pro.

- Multi-collateral futures trading in some locations with fee rebates and a regulated MTF.

- Qualified digital asset custody with MPC and HSM-based key storage and policy enforcement.

- Staking solutions with rewards for network validation.

- OTC for executing large orders with a single quote for orders over $100K.

- Proprietary digital asset index provider CF Benchmarks.

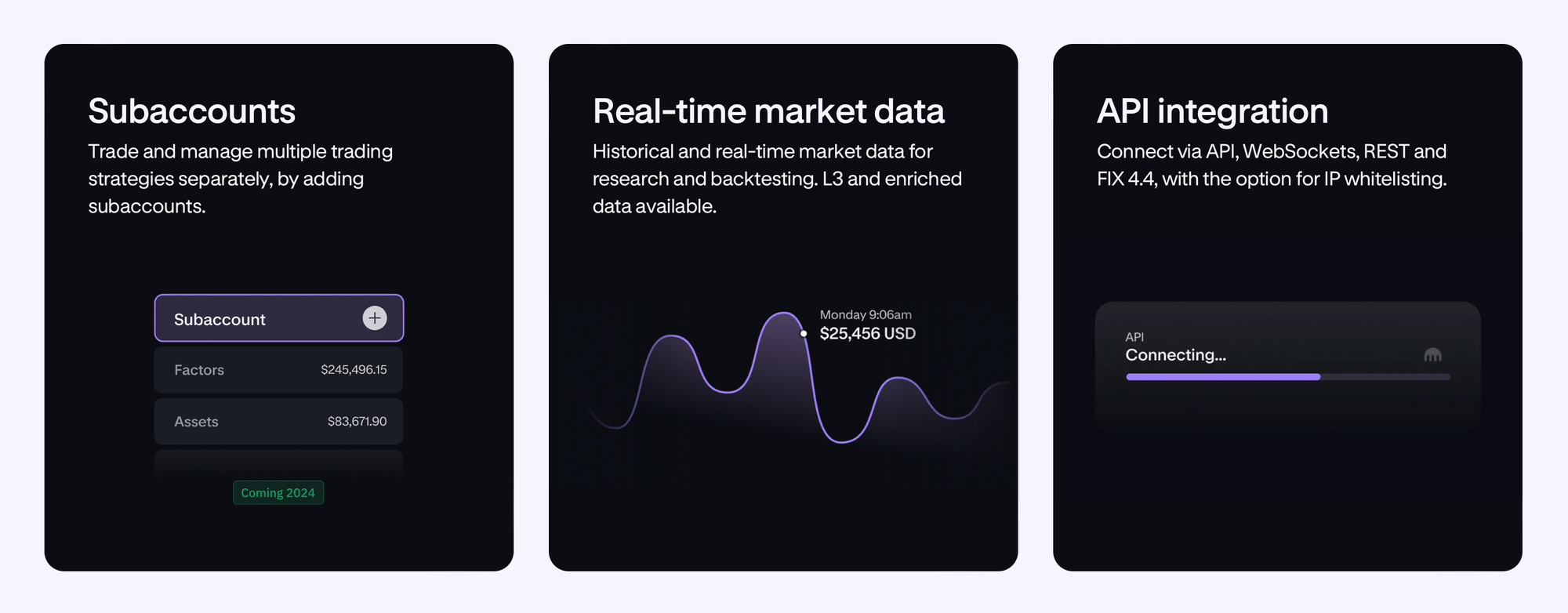

- Historical and real-time market data for backtesting and research.

- API integration, including WebSockets, REST, FIX 4.4, and IP whitelisting.

- Subaccounts for separate trading and management of multiple strategies (coming in 2024).

Kraken Institutional is an umbrella brand for the corresponding client base. It consolidates products and services as a centralized platform, delivering reliable, scalable, and easy-to-integrate solutions.

Trading fees

Kraken prides itself on industry-leading fees across all of its products. Its spot maker-taker fees include volume incentives based on 30-day activity, encouraging market makers to add liquidity.

The deepest discounts are unlocked by users trading over $10 million monthly. As of March 2024, the maker fees range from 0.00% to 0.25%. Takers pay between 0.10% and 0.40%.

Security measures

Kraken's comprehensive security approach safeguards cryptocurrencies, NFTs, and user data. It offers proof of reserves, robust banking relationships, and high legal compliance standards, reflected in the ISO/IEC 27001:2013 and SOC 2, Type 1 certifications. The features include:

- 2FA through Google Authenticator and Yubikey.

- No phone/SMS account recovery to prevent SIM swap attacks.

- Withdrawal confirmation by email with self-serve account lock

- Customizable account timeout.

- Customizable API key permissions.

- Global Settings Lock, preventing unauthorized access even when the password and 2FA are compromised.

- Optional PGP encryption for emails.

- Advanced cold storage and hot wallet solutions.

Opening an account

Getting started with Kraken Institutional is simple.

- Complete a corresponding website form specifying the company name, country of business, your full name and email address, the type of business, and the size of assets under management.

- Confirm your agreement to the Terms of Service and Privacy Policy and click "Send."

- Wait for a response from a member of the Kraken institutional team.

Customer service

Users can find answers to common questions in the support center articles or contact the team in various ways. These options include:

- Chat in the official mobile apps.

- Kraken Live Chat on the official website.

- Submitting a support ticket on the site after selecting a topic and logging in.

- By phone (Monday through Friday).

Key takeaways

Kraken is a popular crypto trading destination for institutions ranging from trading firms to advisors. Aside from attractive fees, it boasts deep liquidity, a rich choice of trading instruments, qualified custody, and other trusted and easily integratable solutions. However, legal clashes with the SEC have limited its services for US-based clients.