Guide to dollar-cost averaging (DCA) in crypto

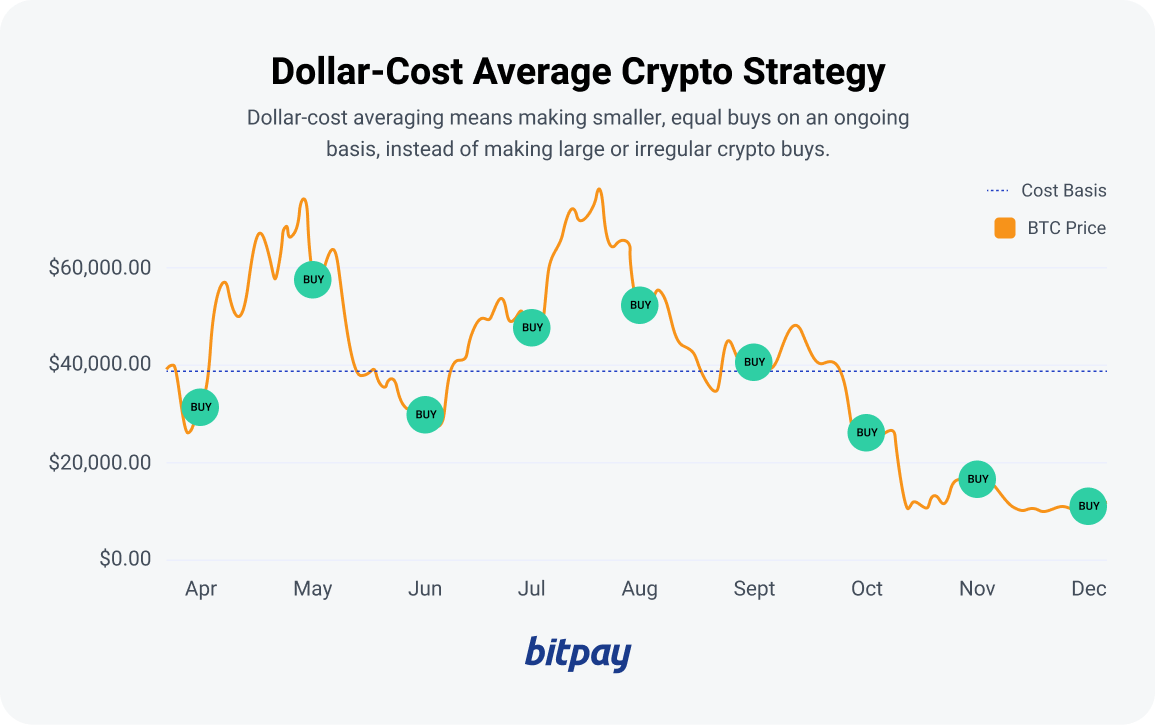

Crypto investors accept the market's innate volatility, with swings on intrinsic and macro cues. Dollar-cost averaging aims to shield holdings from the frenzy by making purchases automatic. This alternative to lump-sum buys takes emotions out of the equation, enabling profits with minimal effort. Here's how it works.

What is dollar-cost averaging (DCA)?

The DCA strategy involves buying identical token amounts at regular intervals over a set period. Executed at various prices, these smaller increments average the cost over time. DCA brings three fundamental advantages facilitated by modern software.

- Convenience. DCA is passive, automated investing via user-friendly tools. It is relatively simple compared to manual strategies.

- Mitigated volatility. DCA evens out the impact of price deviations by spreading the amounts over time. While it cannot eliminate negative volatility altogether, it offers a strategic approach to navigating market swings.

- Lower cost basis. In downtrends, programmed DCA purchases ensure execution at falling prices, reducing the average cost per unit and potentially amplifying returns. Besides a lower purchase price compared to the lump-sum scenario, DCA may entail lower fees than hectic buying/selling.

- Eliminating emotions. Delegation to DCA tools takes emotions out of the equation. Software is immune to irrationality triggers — FOMO (the fear of missing) and FUD (fear, uncertainty, and doubt). With fixed intervals and amounts, investors ignore market highs and lows, escaping the pressure to chase trends.

- No more timing the market. Besides predicting market movements, which is challenging even for professionals, one must factor in contingencies like economic disasters, political shocks, and investor sentiment influence. Those who DCA do not have to try to always "buy at the right time," a task impossible in itself.

Unlike speculators tracing momentary fluctuations to maximize profits, those who DCA do not wait for the optimal times to enter or exit. Through smaller regular purchases, they buy more of an asset in downturns and less when the prices hike. Tokens are accumulated steadily and consistently in a more passive approach.

Example

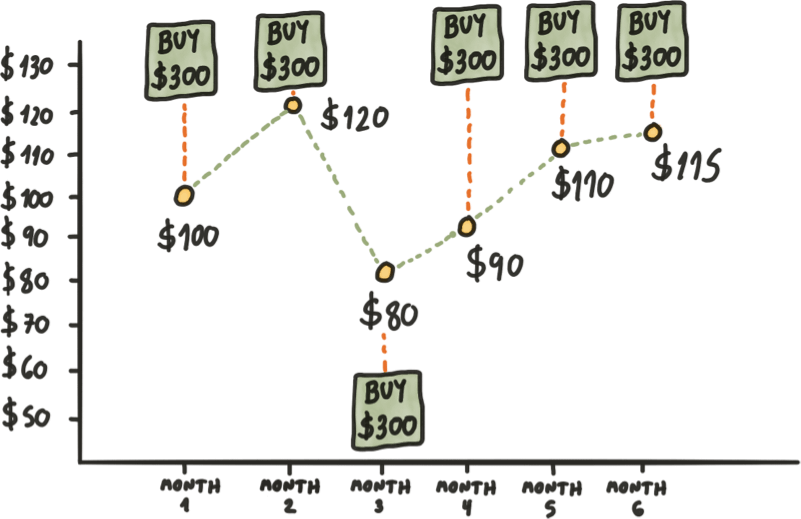

Suppose John has $1,800 and wants to invest in SOL but doubts its short-term direction. Opting for DCA, he buys SOL regularly in smaller amounts over a predefined period — instead of spending all available capital in one go.

John may buy $300 worth of SOL every month for the next half year to balance out the cost. That way, he will accumulate SOL wherever the chart goes.

DCA vs. lump-sum investing

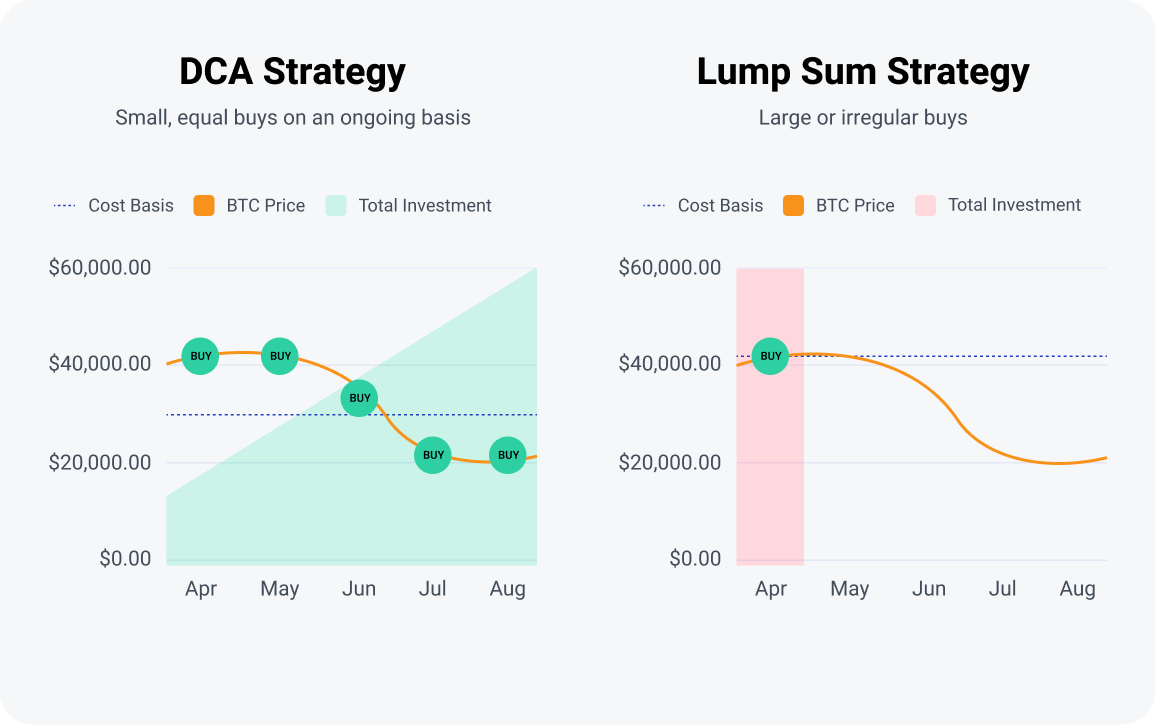

DCA involves a few general parameters for the entire desired duration: asset, frequency, amount, and time. Manual trading is taxing — investors place orders separately and spend hours glued to candlestick charts to pinpoint entry and exit points.

In upturns, lump-sum investing may yield higher returns, as it immediately exposes a significant amount to the momentum. Yet when the market goes south, losses are amplified. In downturns, DCA may secure a lower purchase price. Risk tolerance, the investment horizon, and available funds should guide your choice between the two approaches.

DCA on Zent

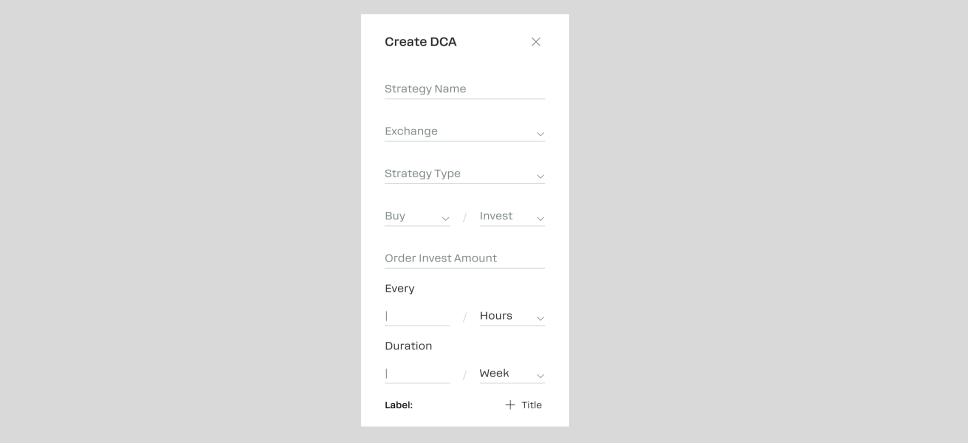

Zent includes robust tools for highly customizable DCA strategies, using the total amount or the order amount as the starting point.

Users set up and fine-tune passive investing quickly across multiple exchanges. Orders are executed in regular intervals (hours, days, weeks, or months) based on the set duration, as long as the available balance allows.

- Per Order: The user specifies the amount and assets to buy/sell with each order. The total amount is calculated automatically.

- Total Investment: The user specifies the total amount and assets to buy/sell. The order amount is calculated automatically.

Monitoring DCA

Zent users can track DCA progress in fine detail, with a comprehensive view of the parameters on each strategy card:

- Asset pairs

- Order and total amounts

- Start date, period, duration, interval, and overall progress

- Individual orders with date, size, and status

Order Details contain all included trades and order parameters. Users can copy Order IDs in one click for easy reference and search.

Setting up DCA: Common questions

Due to its horizon, DCA is mainly chosen by those confident in the sustained future of an asset, as opposed to speculators chasing momentary moves. Automation takes the stress out of order placement based on user settings. Here are the key aspects of DCA setups.

What token/coin to DCA?

Do your own research. DCAing must always be preceded by due diligence to establish project longevity.

- Fundamentals. Examine the whitepaper and other project documentation, the background of the team, its social media presence, and tokenomics. Check out our full guide to tokenomics research in the Zent blog.

- Market trends and sentiment. Analyze the prevailing dynamics and perception of the token before committing your funds. The core metrics include trading volume, liquidity, and historical price performance.

How often to DCA?

Crypto platforms equipped with DCA tools offer a range of options for recurring orders, but no one-size-fits-all solution exists. Some investors trade every few hours, while others do it daily, weekly, bi-weekly, or monthly.

How much to invest?

One may feel comfortable with up to 10% of savings, but there is no universal rule. Start with your financial circumstances and goals to find what works best. Given the monthly budget, risk profile, and asset volatility, how much do you plan and can afford to buy?

Put the essentials like mortgage, rent, bills, and savings first to avoid compromising your financial needs. Even with DCA, volatility is inherent, so do not risk more than you are prepared to lose.

When to DCA?

Every investor can establish the most suitable time based on their preferences, opportunities, and goals. The asset's historical price performance may highlight the optimal interval each day, week, or month.

Focus on the times that delivered marginally better results. While the past never guarantees future gains, DCA lets you stick to whatever timing you pick.

How long to DCA?

Common advice is between 6 and 12 months, but some extend the horizons to 10-15 years. The answer boils down to one's subjective goals and time available for investing. Market conditions may also cut a DCA period short or prompt a prolongation.

Disadvantages of crypto DCA

Despite mitigating volatility, DCA has imperfections like any other trading strategy. There are three key drawbacks:

- Additional expenses. These are trading fees, particularly on centralized exchanges (CEXs). They add up over time, which means that high-frequency DCA ramps up the costs.

- Reduced returns. When most DCA orders on the buy side are executed in a rising market, the returns may be lower than expected. Those cashing out when prices are below the average risk making a loss.

- Less flexibility. DCA users commit to purchasing specific crypto over an extended period instead of moving funds between assets. With other potentially profitable tokens out of reach, opportunity costs are unavoidable.

Final words

Unlike lump-sum investing, DCA tools let you “set it and forget it.” This strategy appeals to those looking to accumulate crypto passively over the long term, balancing out the costs. It is a popular hands-off solution facilitated by smooth auto-features of crypto tech. DCA’s commitment to specific assets may limit returns in uptrends, but it also eliminates impulsive trading and the hassle of timing the market.