Decentralized physical infrastructure networks (DePINs)

One of the most peculiar blockchain innovations combines distributed ledgers, physical infrastructure, and tokens. DePINs allow large-scale projects to be managed without state support or immense corporate resources. This guide explores how these networks work and what benefits they bring.

What are DePINs?

As the term suggests, decentralized physical infrastructure networks (DePINs) leverage blockchain-based decentralization to create and maintain physical infrastructure. Their use cases are diverse and include projects requiring immense capital, such as electricity grids.

DePINs originated in the early days of blockchain when pioneers linked it with real-world operations. For example, OpenBazaar introduced distributed ledger technology to e-commerce, allowing users to buy and sell goods for BTC on its marketplace from 2016 to 2021.

Cornerstones of DePINs

DePINs aim to democratize technology by offering alternatives to centralized services. They are crowd-sourced options for resource sharing, service provision, and infrastructure.

These networks construct and maintain infrastructure environments based on several core principles.

Blockchain technology

Blockchain allows DePINs to be permissionless, working as P2P networks. All transactions within each ecosystem appear in its public ledger with the corresponding timestamps. For instance, the applications encompass payments and escrow contracts between users and service providers.

Tokenization

DePIN tokenomics incentivizes service providers to participate, as they receive tokens granting access to network resources. As participation increases, the token value may also rise, bolstering the stability of the environment.

Reward mechanisms significantly accelerate infrastructure growth, supporting a dynamic marketplace of ideas. As a result, DePINs foster ecosystems focused on innovation, recognizing contributions, and promoting continuous collaborative development.

Smart contracts

Smart contracts are self-executing agreements based on the “if-then” logic. They automate processes, such as rewarding, and allow for hardware interconnectivity while optimizing resource allocation.

The absence of a middleman reduces the cost of accessing the infrastructure, boosting convenience. Smart contracts can execute transactions of different complexity.

Transparency

Blockchain facilitates transparency and accountability. DePINs distribute governance across their networks, eliminating single points of control. Thus, they promote equity and fairness, offering a blueprint for responsible AI development.

Decentralization

Thanks to agile blockchain architecture, creators decentralize ownership and control over physical infrastructure. Thus, services become faster, cheaper, and more accessible with fewer entry barriers.

Agility

DePINs are adaptable, seamlessly operating across platforms and physical environments. Their flexibility enables deployments serving particular needs, from analysis of on-chain data to computational tasks in the real world.

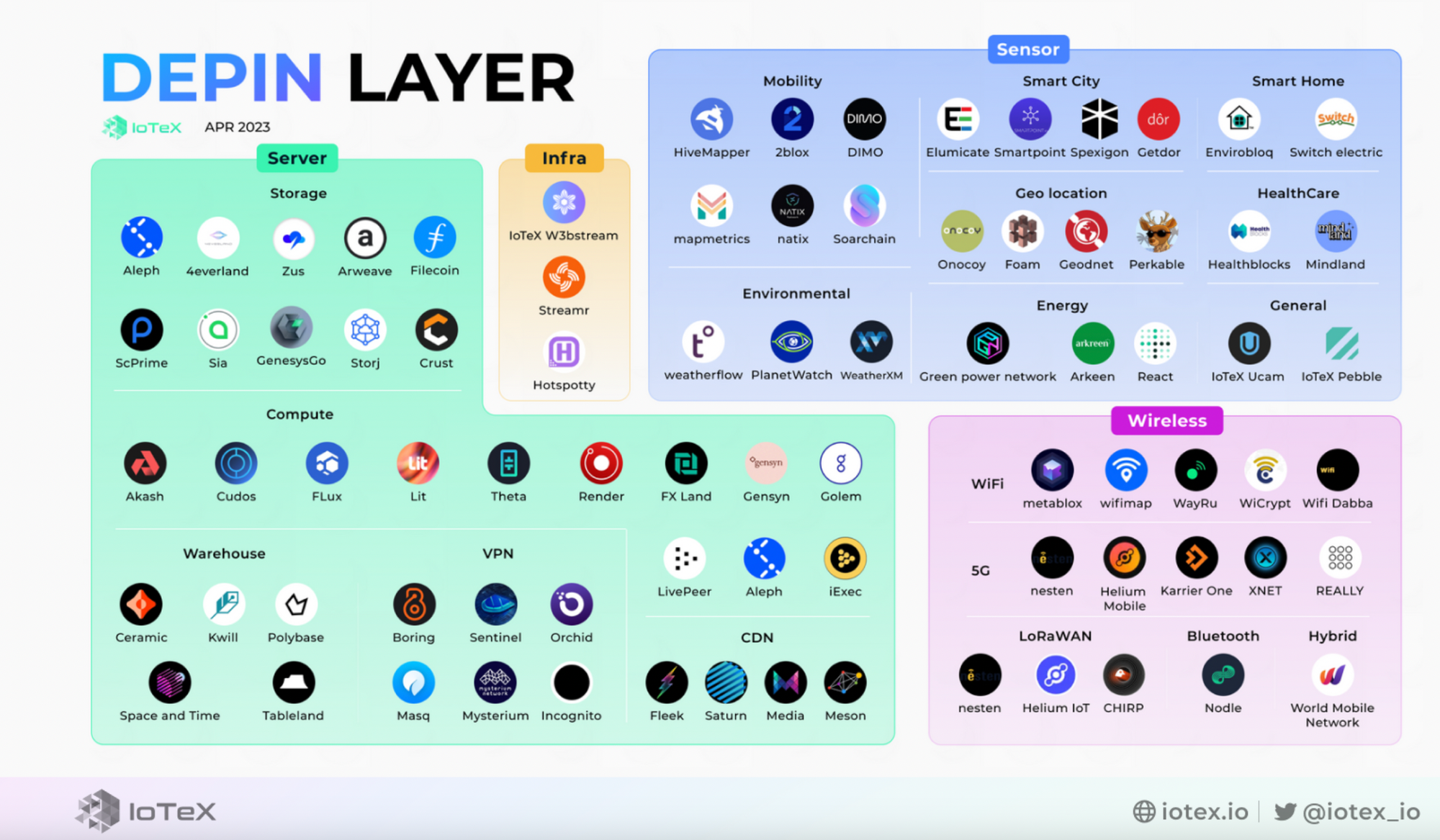

Types of DePINs

DePINs fall into two categories based on how they work and what resources they involve.

- Physical resource networks. These networks streamline the distribution of physical or tangible resources to optimize their flow, supply chain management, and other processes.

- Digital resource networks. These networks deal with digital resources, forming the back-end cloud for suppliers in such industries as storage, computing, and bandwidth.

Use cases

Participants provide their resources in return for crypto rewards. There are three general applications:

- Sharing of unused resources. For example, users may share computational power or excess energy generated by solar panels within a certain network.

- Constructing and maintaining infrastructure. Some networks incentivize users to build new infrastructure and maintain it. Examples include charging stations for electric cars or towers for centralized wireless networks.

- Rendering services or completing tasks. For instance, users may earn tokens for network activities like computation or data querying.

As noted by peaq, a network for DePIN building, members can support devices and machines in all four domains: land, sea, sky, and space. The cases are diverse, including:

- P2P electric car charging

- Ridesharing and sharing of electric bikes and scooters

- Monitoring of noise pollution with community-owned sensors

- P2P wind and solar energy trading

- Food and goods delivery

- Sales of fitness tracker data

- Community-owned robo-cafes

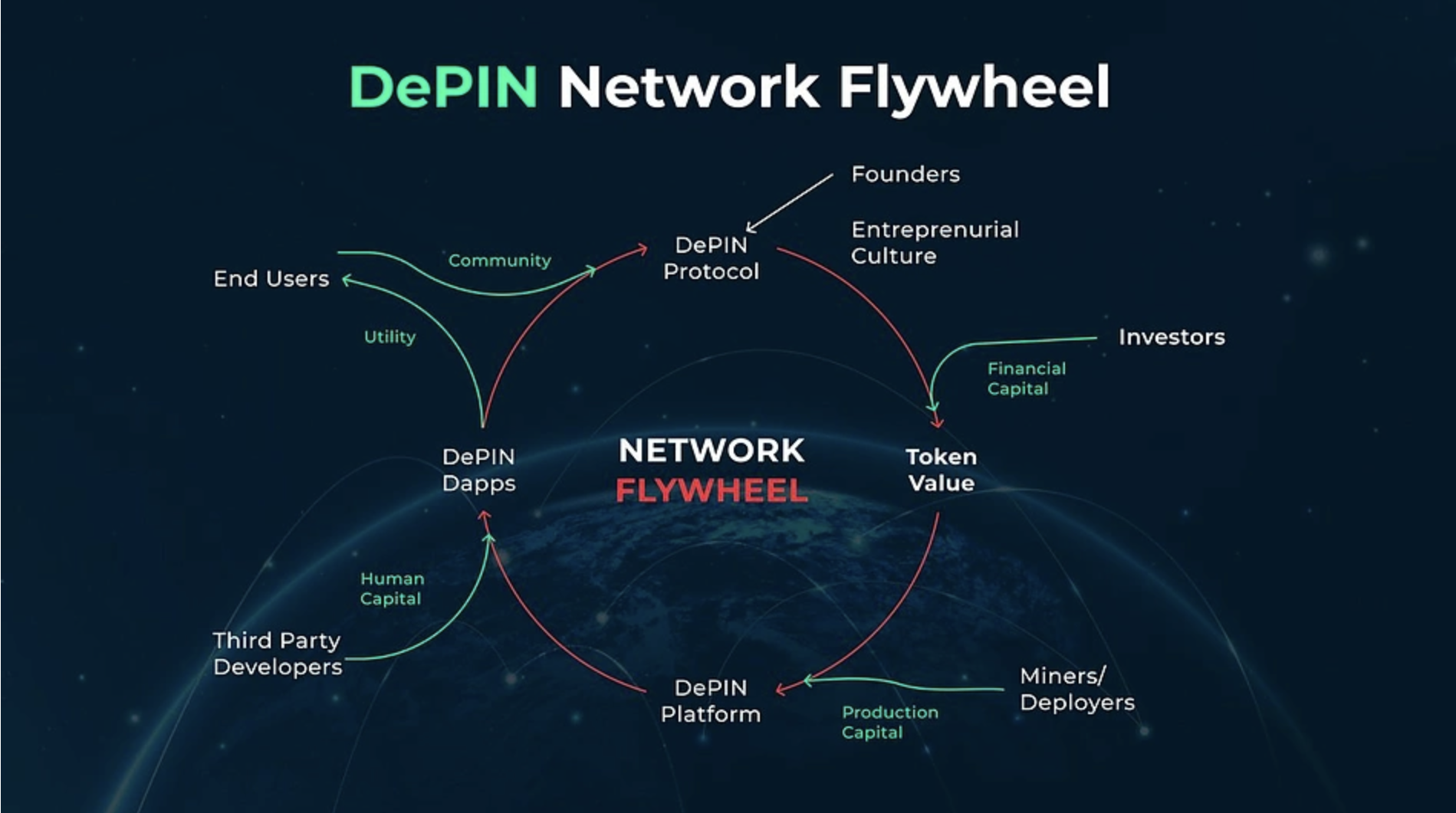

DePIN flywheel

This visual illustrates the key principles and components of DePINs. Within them, token rewards, transaction fees, network growth, and incentives are interconnected.

- Token rewards incentivize service providers (supply-side participants) to create and deploy infrastructure.

- Transaction fees (generated from end users utilizing the services) boost the ecosystem.

- As the network grows, more end users, developers, product builders, and service providers join in.

- As the community broadens, so do the token rewards for service providers, with the token price related to network usage.

Examples of DePINs in 2024

Render

This P2P network connects users needing GPU computing services, such as machine language training, AI, or 3D rendering. Working in both Web3 and Web5, Render rewards providers with RNDR tokens, allowing them to build a reputation over time and get more jobs.

Render is the decentralized GPU pioneer, operating since 2017. Its blockchain marketplace for idle GPU power enables artists to scale rendering work securely, cheaply, and significantly faster than via centralized GPU clouds.

As of June 21, 2024, it is the largest DePIN project by market cap. RNDR is up 226.6% YoY.

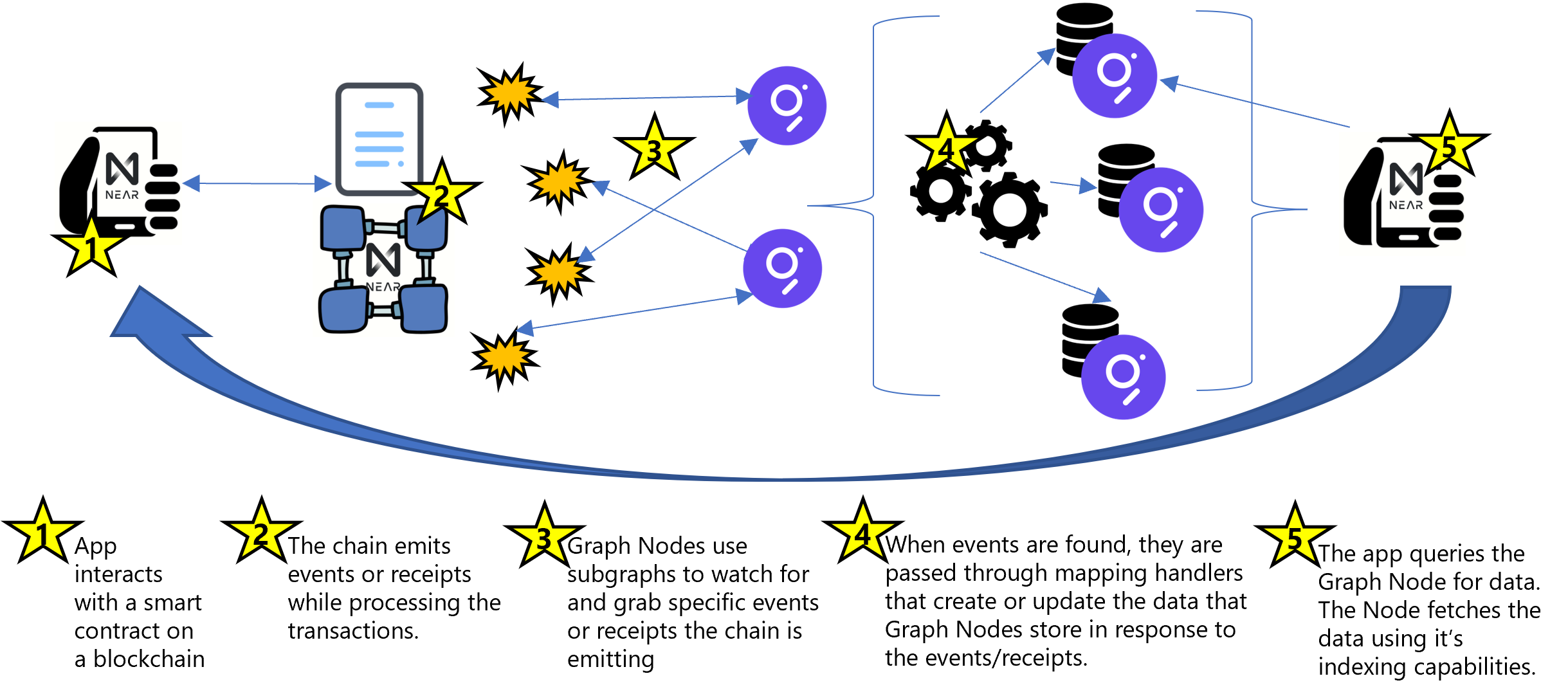

The Graph

A decentralized indexing project, The Graph lets users retrieve and read intricate blockchain data. Its competitive data market allows developers to build faster dApps without running their own data servers.

The Graph organizes and serves on-chain data to apps through open APIs, or subgraphs. It powers a rich Web3 ecosystem used by over 70,000 projects.

The native token, GRT, is used to pay lease service providers on the platform. At press time, it has gained 113.4% YoY.

Filecoin

Centralized storage services leave billions of users far away from their data and vulnerable to unfair price policies and geographic limitations. Filecoin decentralizes storage via an open market.

In this hyper-local economy, providers compete to archive clients’ files. Once a deal is made, the client sends their daughter, which the provider stores.

Contributors receive rewards in FIL. With a market cap of over $2.5 billion, Filecoin has grown robustly, and many exabytes of data have been stored since 2020.

Karrier One

This network has emerged to revolutionize the telecom landscape for worldwide 5G coverage. It is the first carrier-grade DePIN aimed at streamlining deployment and ensuring data integrity via a radio network run by users.

US and Canadian phone numbers turned into NFTs are immune to SIM swap attacks and more accessible to remote populations. The DAO mechanism ensures there is no undue influence or control.

At press time, Karrier One is at the early adopter stage. Participants will be rewarded with KONE tokens, which they may use to vote on improvement proposals, pay for services and fees, and more.

Challenges of DePIN use

Like any blockchain-related project, DePINs are susceptible to smart contract bugs and hacks. They are also complex and require significant technical expertise to set up and maintain. Finally, the tokens used for rewards may fluctuate in value, affecting the ecosystems.

Conclusion

DePINs are decentralized networks that leverage blockchain technology for building and maintaining physical infrastructure. They incentivize individuals to contribute, rewarding them for resource sharing.

Native tokens facilitate these operations through streamlined governance, staking, and service payments, supporting ethical network growth. Overall, DePINs embody a vision for a more empowered society — a future where technology is part and parcel of our daily lives.