Ethereum's Dencun: Effects on ETH and Layer 2

On March 13, 2024, Ethereum underwent the most pivotal event since the Merge, which slashed its energy consumption. Dencun marks a paradigm shift — discover its main effects on the network, the Layer-2 ecosystem, and the ETH price so far.

What is Dencun?

The Dencun upgrade brings multifaceted improvements to the blockchain, notorious for congestion and high gas fees. It ramps up network efficiency, scalability, security, and usability — the pillars of the DeFi economy.

Dencun is a hard fork, meaning it is not backward-compatible with previous specifications. It was named after two upgrades to Ethereum's post-Merge stack: one for the consensus layer (Deneb) and one for the execution layer (Cancun).

Ideological shift

Deneb enhances network participant agreement on the blockchain's state, while Cancun advances transaction management and processing. The previous significant upgrade, Shanghai, enabled ETH holders to unstake their coins in April 2023.

The latest transformation marks an ideological change for Ethereum, now focused on Layer-2 networks as its execution layer. Fidelity Digital Assets has described this new identity as a "fitting distributed database for other blockchains."

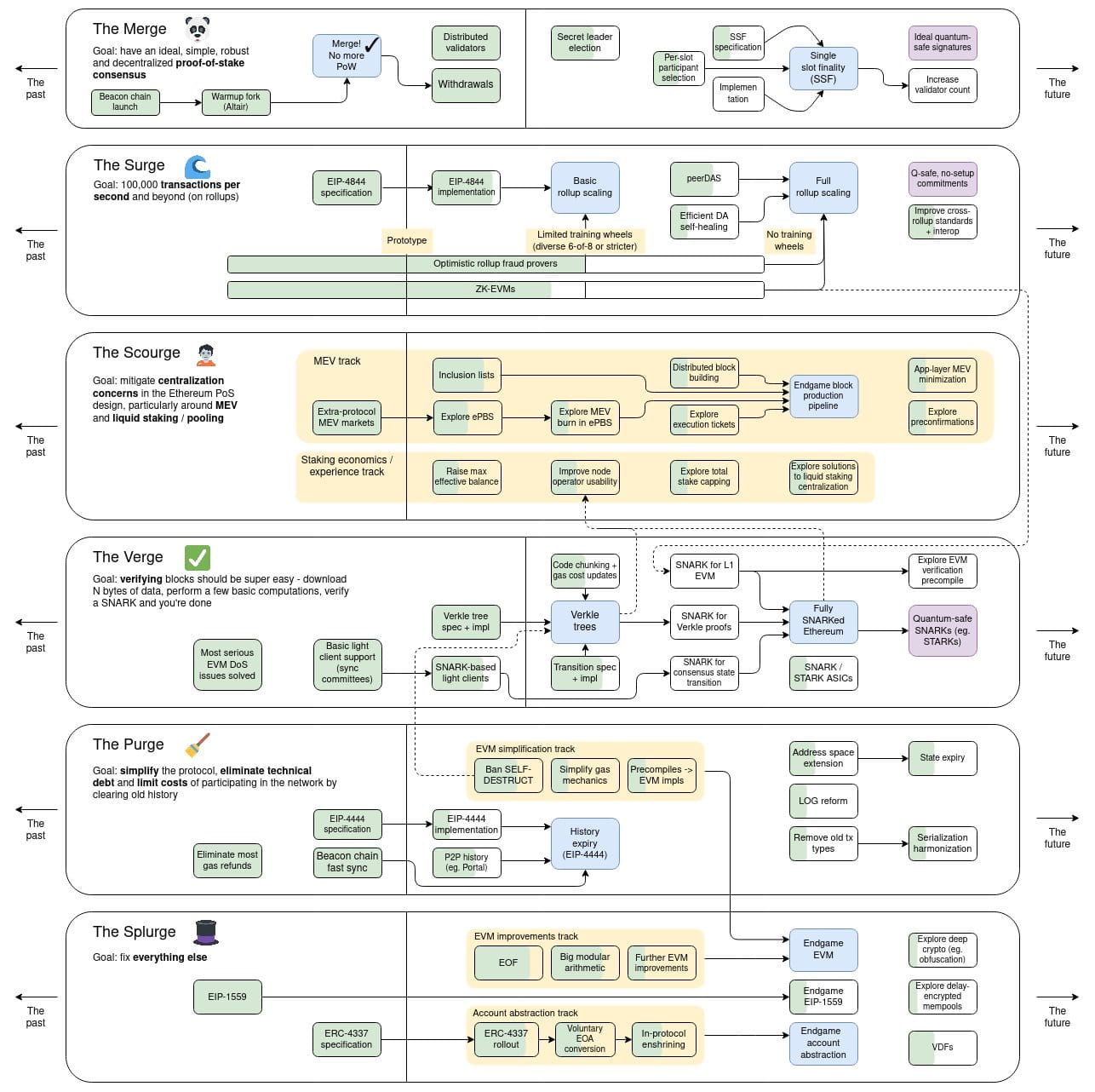

Dencun ushers in The Surge, a roadmap phase focused on scaling roll-ups to increase throughput above 100,000 transactions per second (TPS). Thus, Ethereum's new mission — servicing other blockchains — makes it more attractive for blockchain businesses.

Proto-danksharding

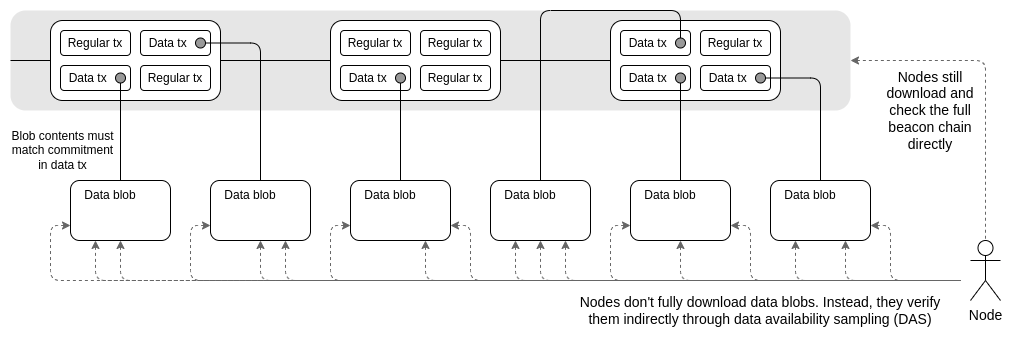

The highlight of this hard fork is EIP-4844, which introduces a novel type of transaction — shard blob (binary large object) transactions. Proto-danksharding divides the blockchain into blobs, so transactions and smart contracts can be processed in parallel.

The difference from the previous sharding proposals is stark. More space is provided for blobs of data instead of transactions. The protocol does not interpret blobs; it merely checks availability — the possibility of downloading them from the network. Meanwhile, L2 roll-ups use blobs to support high throughput.

Jesse Pollak, Head of Protocols at Coinbase and the creator of its Base blockchain, has compared blobs to a carpool lane — a "fast path" for L2 transactions. He said, "This was really the first step in what is a long-term strategy for making Ethereum and the Layer 2 on top of it scale to thousands — tens of thousands, hundreds of thousands of transactions per second."

Key network effects

Post-Dencun, Ethereum is poised to attract new developers, aiming to become the most scalable and secure settlement layer for Ethereum-based Dapps. Its modular vision (Ethereum 2.0) has split the network into specialized parts, with execution and settlement separated.

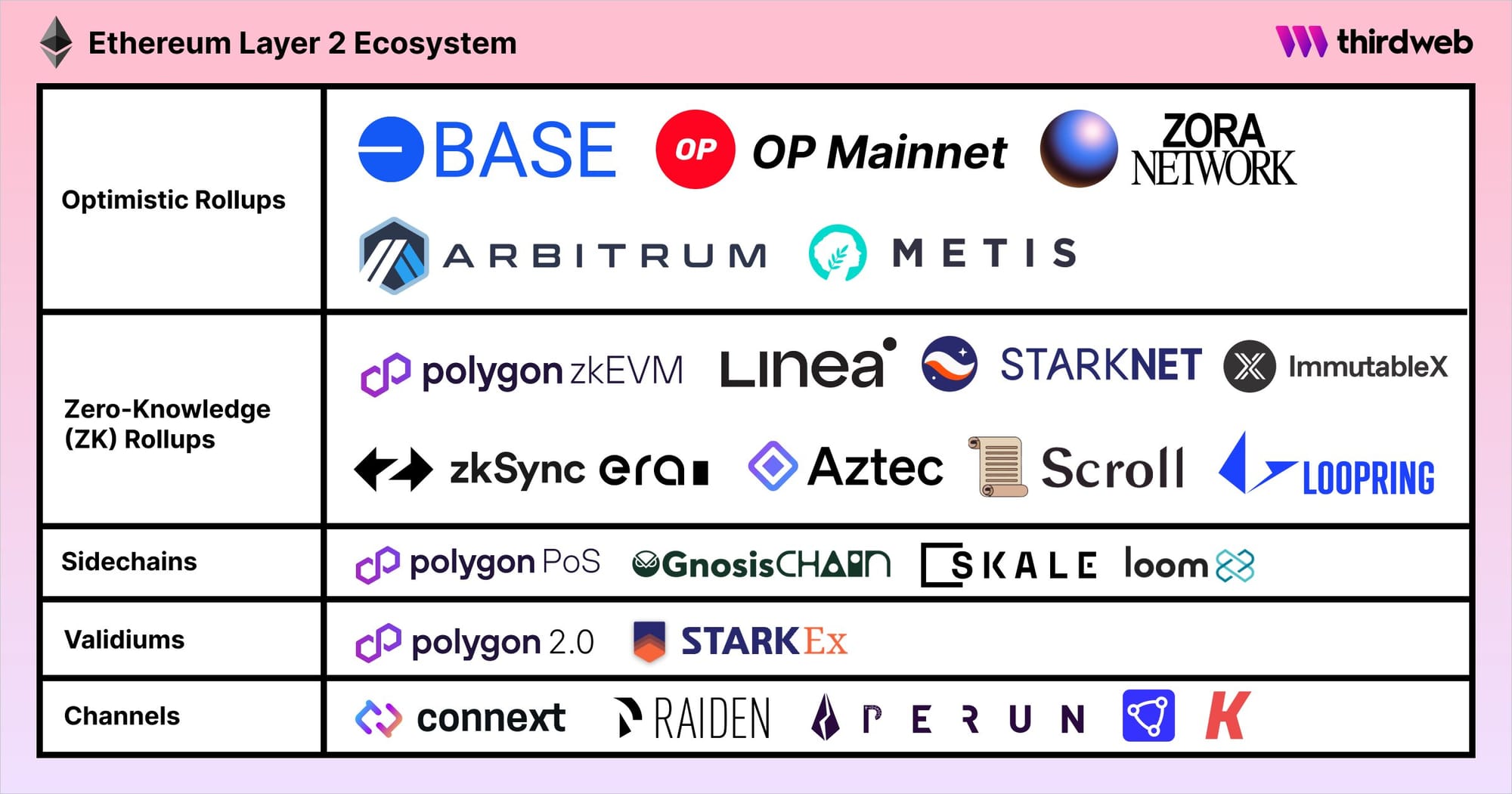

This division has given rise to independent L2 projects like Arbitrum. They solve scalability pain points by processing transactions off-chain, batching them together, and sending their compressed versions back to the mainnet for settlement.

Now, Dencun makes L2 cheaper to use, bringing Ethereum closer to its target. And there's more.

Lower gas fees

As blobs are modestly sized, disk use remains manageable while capacity and fees are improved. This component is pivotal to making L2 networks cheaper. Experts have predicted decreases of as much as 75%, while CoinDesk cites a consensus of 90%.

L2 blockchains batch and compress transactions before sending them to the mainnet. Thanks to blobs, they can abandon costly call data. By Vitalik Buterin's estimates, 125 KB of call data costs around 0.06 ether ($238). A blob of a similar size may cost as little as 0.001 ether (under $4), as stated by Polymarket.

Another difference is longevity. Call data is stored permanently, while blobs store data off-chain, remaining accessible for just three weeks.

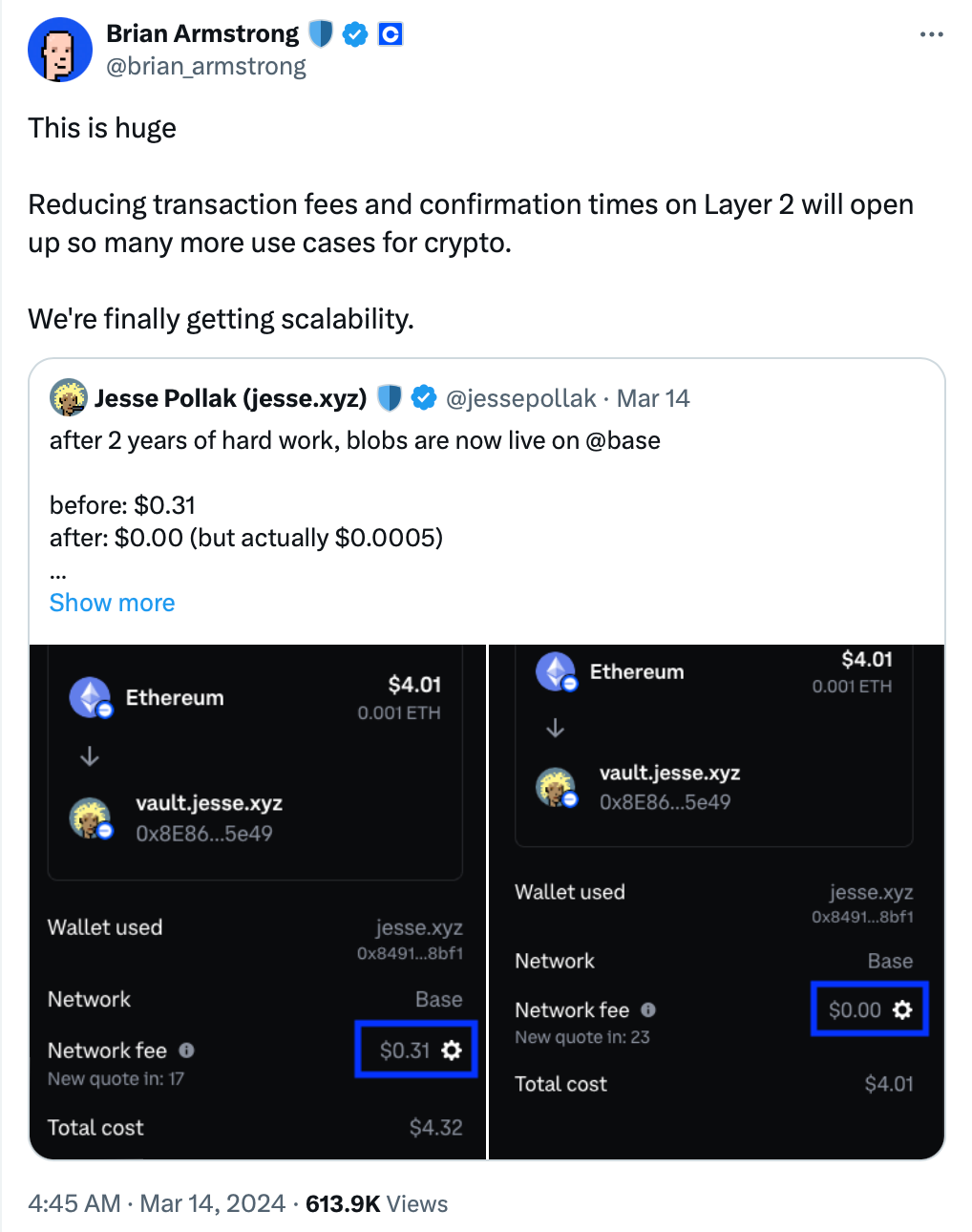

Following Dencun, the average transaction costs on Optimism declined from $1.4 to nearly $0.04. They also slid on Arbitrum and Base, Coinbase's L2 network. CEO Brian Armstrong shared a drop from $0.31 to $0.0005.

Starknet, accounting for the most significant share of L1 data availability costs, is the top beneficiary. According to its team, the gas fee reduction exceeds 90%.

Aside from proto-danksharding, gas efficiency is optimized through other Ethereum proposals: EIP-1559 (fee market change), EIP-2929 (state access cost increase), and EIP-2537 (BLS curve operations).

Enhanced interoperability

As noted by Grayscale, Ethereum is unrivaled in terms of the total number of Dapps and developers. Its TVL of $45.9 billion, over five times that of the runner-up, is a crucial sign of ecosystem liquidity.

L2 contributes to the broader ecosystem, combining enhanced throughput and lower costs with Ethereum's hallmark security.

EIP-4788 has modified the architecture of cross-chain bridges and staking pools to enhance their interaction with Layer 2. This solidifies and validates Ethereum's approach.

Dencun enhances the communication between the two layers. Previously, staking-related Dapps relied on an oracle system with node providers —— these were trusted to verify and report data about Ethereum's consensus state independently.

With trust assumptions lowered, the consensus state is now effectively exposed in the EVM. Consensus likens this to "introducing an oracle, enshrined at the protocol level, which relays Ethereum's consensus state to Ethereum mainnet."

More efficient data storage

Introduced via EIP-1153, transient storage opcodes improve smart contract execution, reduce costs, and streamline data management for L2 networks. They enable more efficient and cheaper data referencing between transactions on both layers.

Previously, communication between multiple execution frames was only possible via EVM storage, which made it costly. Transient storage is more gas-efficient: data is stored temporarily and accessed across frames without expensive EVM writes.

Commenting on this aspect, Pollak said, "I think both 1153 and 4788 have really kind of opened up the design space for developers building on Layer 2 and Layer 1, and we're going to see a ton of new use cases over the next six months that leverage that new technology."

Transient storage is the third form of storage, in addition to permanent (contract) and fleeting (memory). The Consensys article provides more details.

Improved security

Proposals EIP-4788 and EIP-6780 enhance the network's security posture. The former is a robust liaison between its consensus layer — secured by validators — and its execution layer, where all transactions are processed.

EIP-6780 alters the operation of the "SELFDESTRUCT" function in smart contracts. As the name suggests, self-executing agreements may essentially destroy themselves. From now on, this feature is more difficult to abuse for malicious purposes.

"Dapp-for-everything culture"

Eli Ben-Sasson, co-founder and president of StarkWare, which launched Starknet, sees Dencun's key strength in facilitating Dapp development. He told Forbes, "...developers can now start building the kinds of decentralized applications that just weren't practical before." Dencun's launch "will go down as the date of birth for a dapp-for-everything culture."

Industry professionals expect fresh growth in games, financial exchanges, social networks, and other types of Dapps. Coinbase software engineer and lead Base developer Roberto Bayardo anticipates "that the application of sophisticated machine-learning models within on-chain apps will also become more practical, leading to entirely new application classes yet to be conceived."

Effects on price & supply

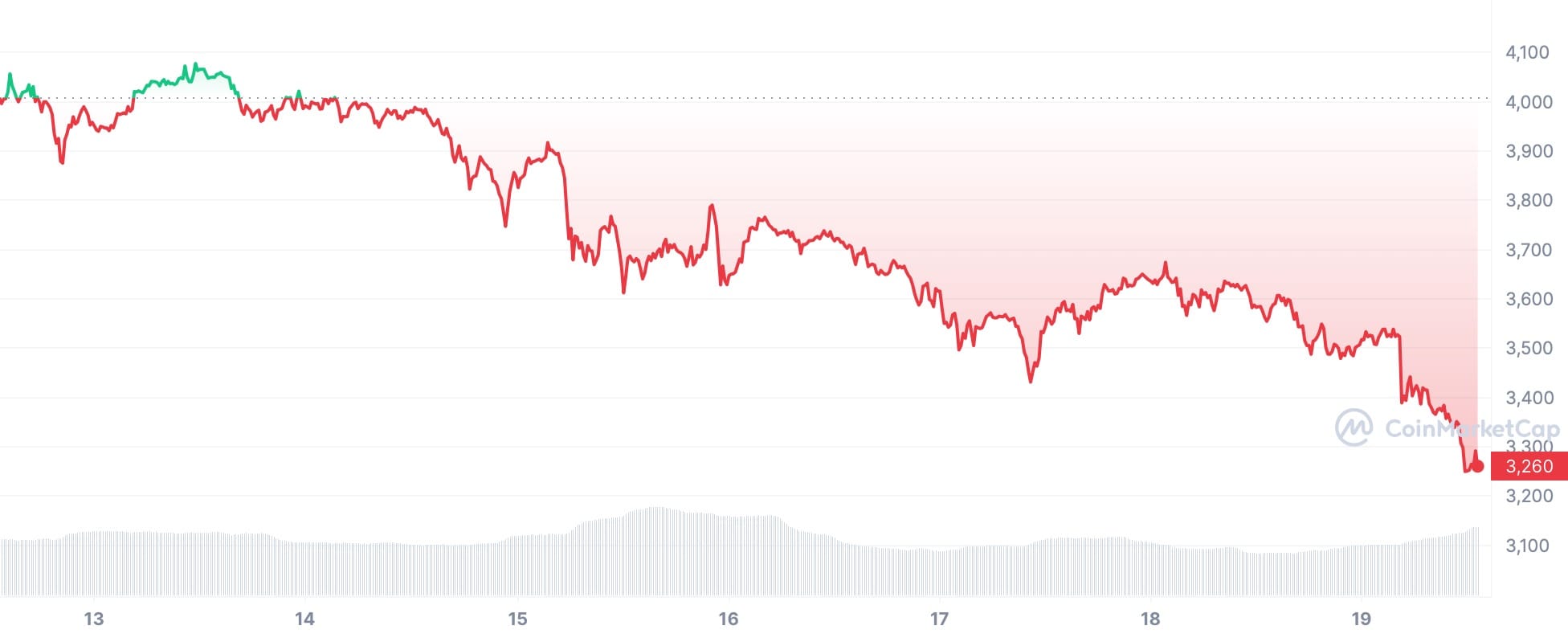

Historically, network upgrades have rarely significantly swayed ether's price. This time was different. As the hard fork went live on March 13, ETH saw a sharp plunge from a high of $4,082 to $3,932 on CoinMarketCap.

The drop continued the next day. As of March 19, the coin has shed over 18% over seven days. Trading at $3,258.66, it is 32.99% below the all-time high of November 2021 ($4,891.70).

The current dip was foreseeable: QCP Capital has warned of a potential price correction in light of changing market sentiment. Lately, the likelihood of the first spot ether ETFs getting approved by May 31 has dwindled to just 31%.

The coin supply has also dwindled, falling to levels seen in 2022. This decline may have been triggered by a rapid increase in transactions on the network, resulting in more fees burned. If both increased activity and shrinking supply persist, the ETH price should be boosted.

Concerns and overall sentiment

Dencun is the most impactful network upgrade since Shanghai. It lays a solid foundation for future advancements in Ethereum and paves the way for further innovations in smart contracts and Dapps.

Despite the negative immediate price impact, Dencun drives progress toward resolving Ethereum's woes. It will help create a more accessible, agile, and affordable ecosystem.

Following the dramatic fee reductions thanks to blobs, L2 costs may rebound as more chains enter the ecosystem. Saturation of the blobs fee market is a possibility, while the growth in net bandwidth is less impressive than some experts hoped.

Tarun Chitra, the founder and CEO of Gauntlet, has noted that Dencun is not "as big of a deal as people claim," although it will "push the DA layers to really have to optimize." The prevailing sentiment is that experimentation and optimization of roll-ups must continue to ensure continued growth and scalability.