Navigating tokenomics: Guide to intelligent investing

Tokenomics research is the cornerstone of wise crypto investment. This blend of "token" and "economics" describes how digital assets function within their ecosystem, including and beyond distribution. Our guide breaks this strategic foundation down into a basic actionable framework.

Definition of tokenomics

Tokenomics — cryptocurrency economics — is the financial structure that underpins a digital asset, whether mined or issued otherwise. Like the rules of a game, it outlines how it functions within its native blockchain environment.

In a sense, tokenomics is like the DNA of a cryptocurrency. It lays out its purpose, functionality, and design in the context of the issuing network and its vision.

To gain insights from tokenomics, one must track and analyze the project's market cap, token supply, emission rate, and other public metrics. Tokenomics is indispensable for objective project and protocol comparison.

Role of tokenomics in investment research

Crypto prices do not depend linearly on tokenomics, but a meticulous design can pave the way for success. The foundation affects various aspects, from the total supply of tokens to their distribution, security, and use.

Investors should avoid projects with underdeveloped or poorly developed token metrics and look beyond the suggested token price. Market cap and supply provide a more reliable picture of long-term viability.

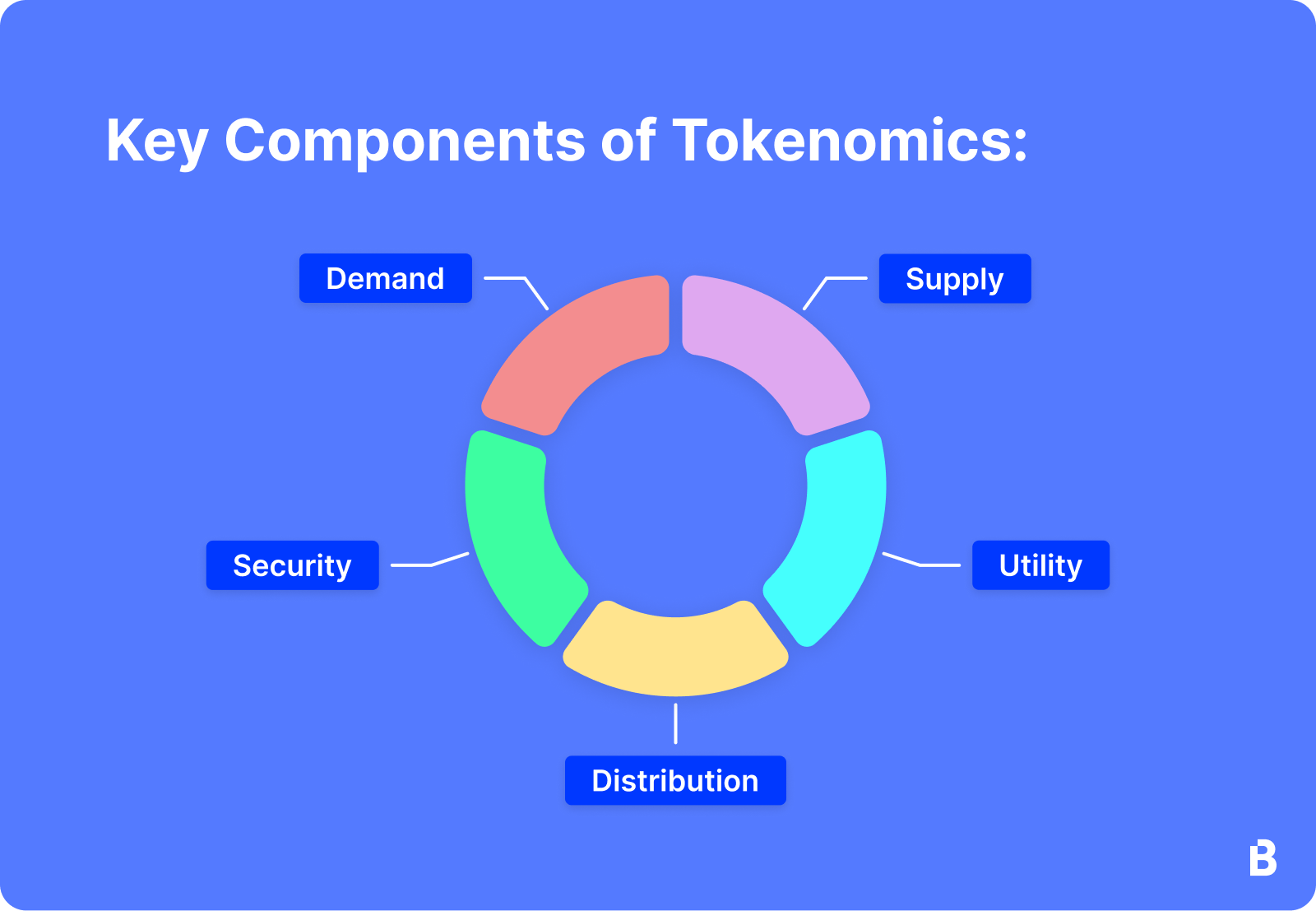

Key elements of tokenomics

How a token operates will tell you if it is a worthy pick for your portfolio. Here are the crucial questions to ask.

How is the supply structured?

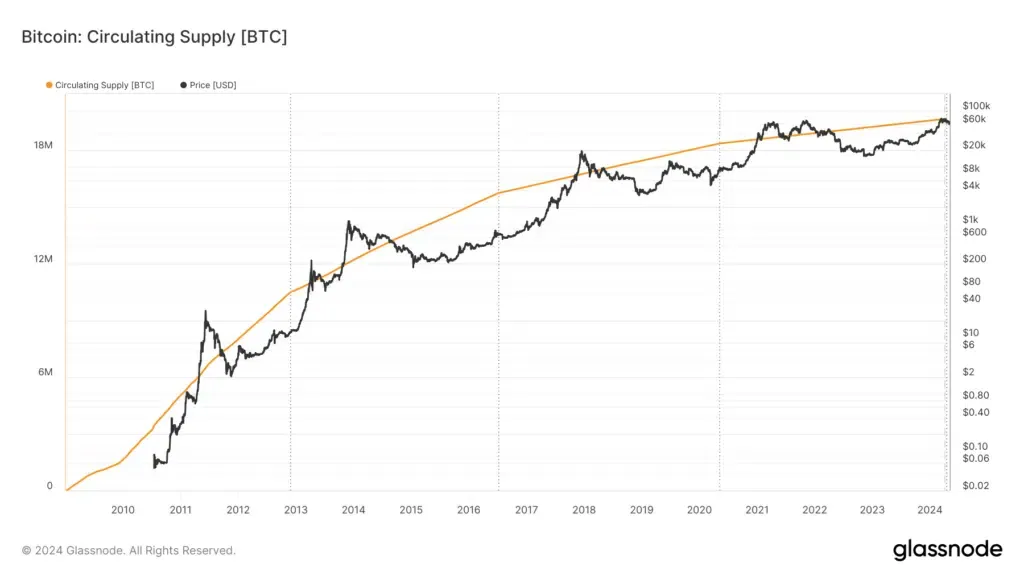

Supply-wise, tokenomics includes three fundamental dimensions: max (maximum), total, and circulating.

Max supply is the biggest number of tokens that will ever exist for the cryptocurrency in question. Introducing scarcity, it is reminiscent of precious metals. A capped supply can boost demand and, thereby, value. Coins like Bitcoin, Bitcoin Cash, and Litecoin all have a finite supply.

Circulating supply is the amount of tokens that may be currently bought, sold, or traded. Once it matches the maximum supply, mining stops. Many projects start small, with the circulating supply zooming before slowing down over time.

Bitcoin's quadrennial halvings have reduced the number of coins minted every 10 minutes from 50 BTC to 3.125 BTC. Other projects may burn — destroy — tokens in preset amounts. This may concern protocol transaction fees or massive one-time burns. The contraction of supply is designed to bolster the price or investor interest.

Total supply is the total number of tokens created minus those permanently removed (burned). Despite being a unique gauge, it typically coincides with the max or circulating supply. The total and circulating supplies of Bitcoin and ether align — the coins mined (BTC) or issued as staking rewards (ETH) instantly enter circulation.

Projects issuing all their tokens at once may earmark and reserve some for specific uses. They could be stored in the project's treasury, allocated as rewards, or belong to early-bird investors and the team. For example, a portion of LDO tokens is locked in the Lido DAO treasury.

How will the tokens be distributed?

Trust requires a transparent and fair allocation among stakeholders, including developers, investors, the community, and reserve funds. Disbalances may lead to power or wealth concentration, which makes assets vulnerable to manipulation. For instance, Initial Coin Offerings (ICOs) often detail token distribution with valuable insights into long-term viability.

What problems does the project solve?

The term "utility" describes the token's use cases and purpose within its network, illuminating intrinsic value. Some tokens grant voting rights on protocol upgrades, some are used for service payments, etc. The clearer, more diversified, and in-demand the utility, the higher the potential. While BTC is largely viewed as "digital gold," Ethereum-based tokens are crucial to many decentralized apps.

How secure is the issuing network?

The diversity and scope of cyber threats require all-around safeguards. From consensus mechanisms to attack prevention to the overall security of wallets and exchanges, robust measures are paramount. Flaws can lead to loss of funds or trust.

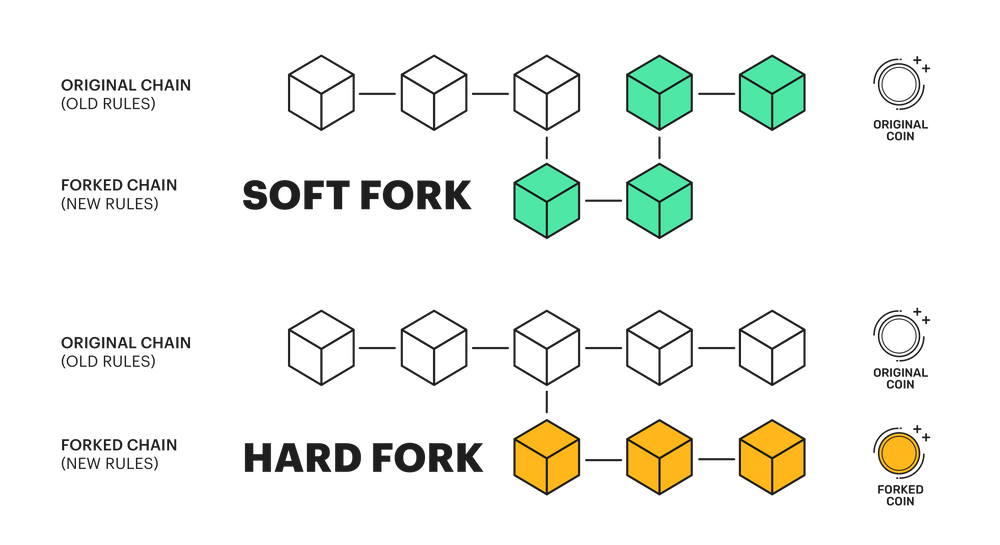

When tokenomics evolves

Tokenomics is not set in stone. After launch, new protocol or governance decisions may alter token utility, allocations, or value. For instance, hard forks create new tokens, modifying supply and demand based on different use cases or features.

A hard fork — a split in a blockchain — produces a second blockchain that shares its history with the source but strays away in development to implement community-approved standards or functions. Unlike soft forks — akin to software upgrades — such forks are not backward-compatible with the previous blocks. Bitcoin Cash and Bitcoin Gold both stemmed from the Bitcoin blockchain.

Tokenomics checklist

These five criteria will help you make informed decisions based on tokenomics.

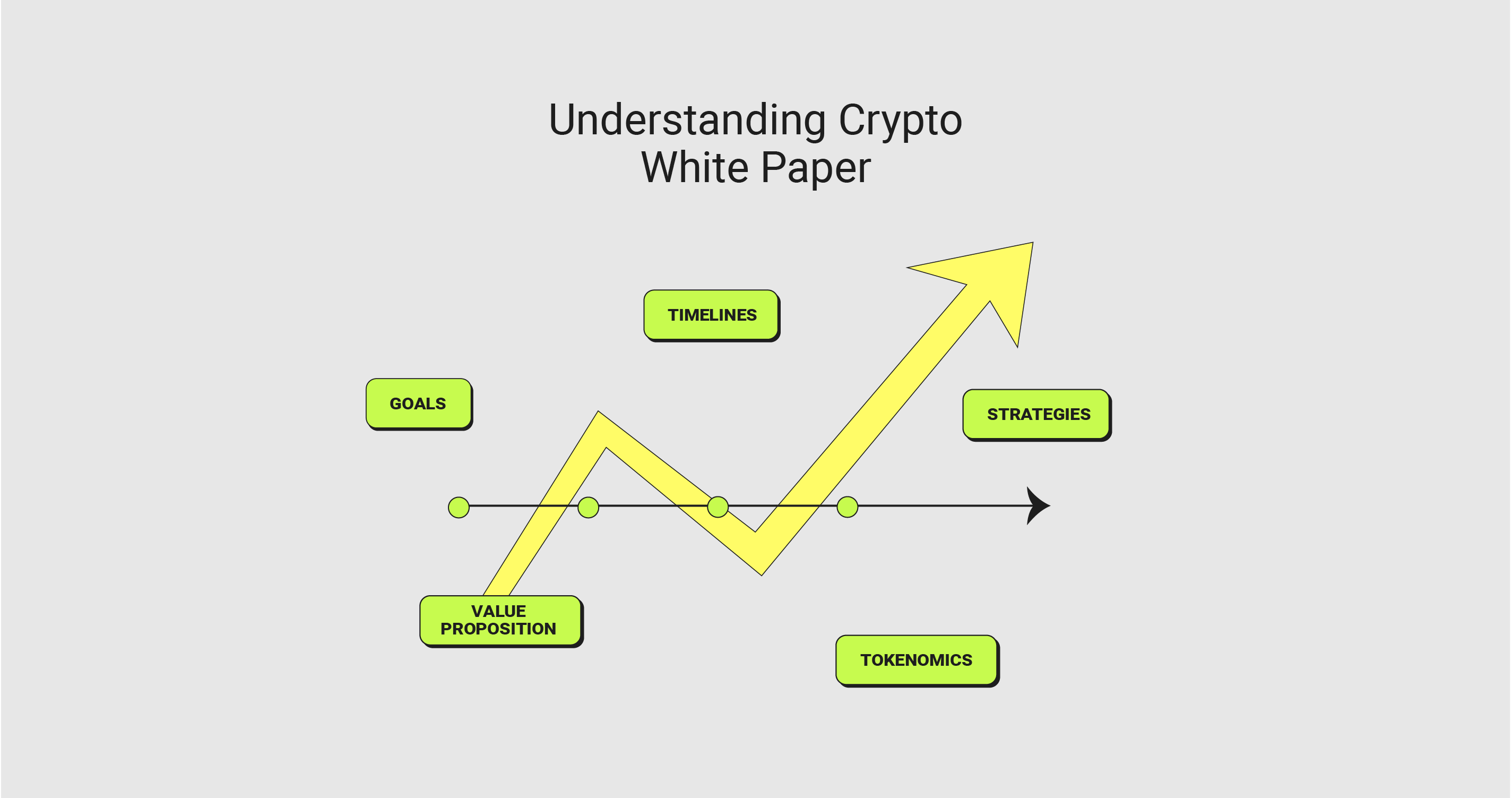

Examine white paper

A project's white paper outlines its tokenomics, from supply to security. This document can illuminate the founders' vision — the philosophy, technology, and mechanics behind the token and its potential value.

Look into community

Does a dynamic and active community back the project? Discussions on forums and social media provide a glimpse into the community sentiment and highlight potential concerns.

Assess demand and use cases

Utility defines a token's role in the native ecosystem. Is it merely speculative, or does it serve a unique purpose? Real-world applications and demand are keys to intrinsic value.

Compare economic models

The existing types — inflationary, deflationary, and hybrid — define future token value dynamics. Deflationary assets typically appreciate as their supply shrinks, while inflationary mechanisms have the opposite effect.

Zoom in on regulatory compliance

Verify projects' adherence to local and international regulations to minimize legal risks. The regulatory landscape is constantly in flux.

In brief: Four steps to intelligent decisions

Like the white paper, tokenomics is the centerpiece of investors' due diligence. Always read project documents thoroughly and make decisions based on sound analysis, not trends or FOMO.

- Study the white paper to gather the official specifics.

- Engage with the community to understand community perspectives.

- Evaluate real-world utility to ensure there is a clear purpose and demand.

- Consult a financial expert to explore and minimize the risks.

To sum up

Tokenomics is the cornerstone of any digital asset that shapes its potential and guides market decisions. Supply, distribution, utility, and security intricacies help investors make informed choices aligned with their crypto strategies and the market's dynamic nature.