Order Rules in detail: Our unique advantage

Institutional traders move markets, but their power is impeded as vast amounts enter public order books. Zent solves big players’ challenges with a single feature – its one-of-a-kind Order Rules.

We minimize delays and the market impact of institutional-grade positions. Order Rules are unique and streamline execution for any trading strategy: no more slippage or fund blocking, however large the volumes.

What do Order Rules do?

The Order Rule feature splits large trading volumes into chunks for incremental execution. These bits are customized by you and go live only at a price match. Until the trigger is reached, they remain completely invisible to market players.

No need to worry about others acting on your open positions in order books! Zent users can even adjust the length of the millisecond intervals or have the chunks executed in a random sequence.

Overview of Order Rule section

The Order Rules section is an all-in-one dashboard for creating, managing, and tracking all Order Rules on Zent.

Viewing Order Rules

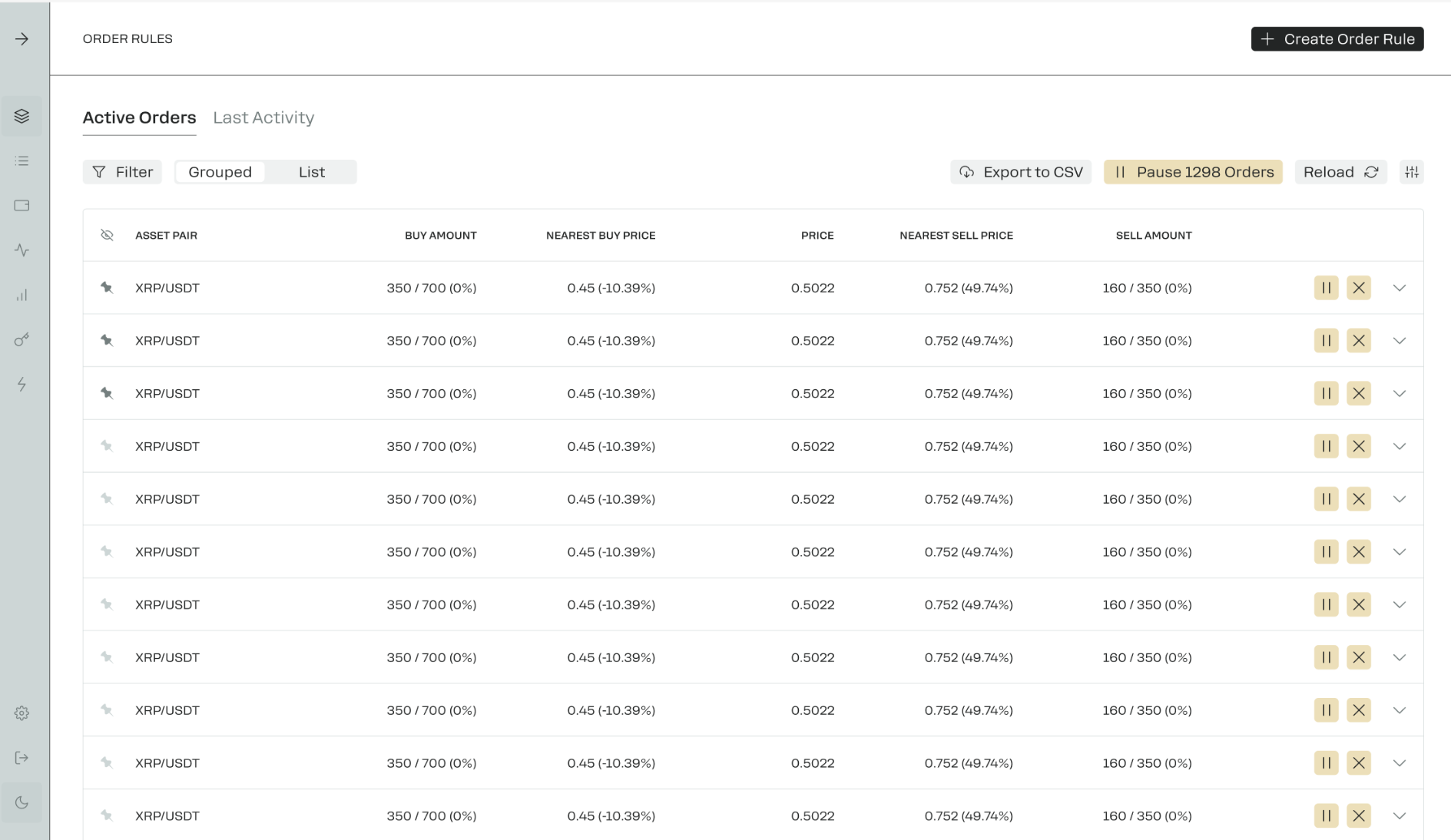

The Active Orders tab shows all Order Rules created in your Workspace –– listed and grouped by asset pair. You can see the status, trigger, account, price, and type for each one.

Real-time monitoring for Running Orders includes the percentage of completion based on the total amount.

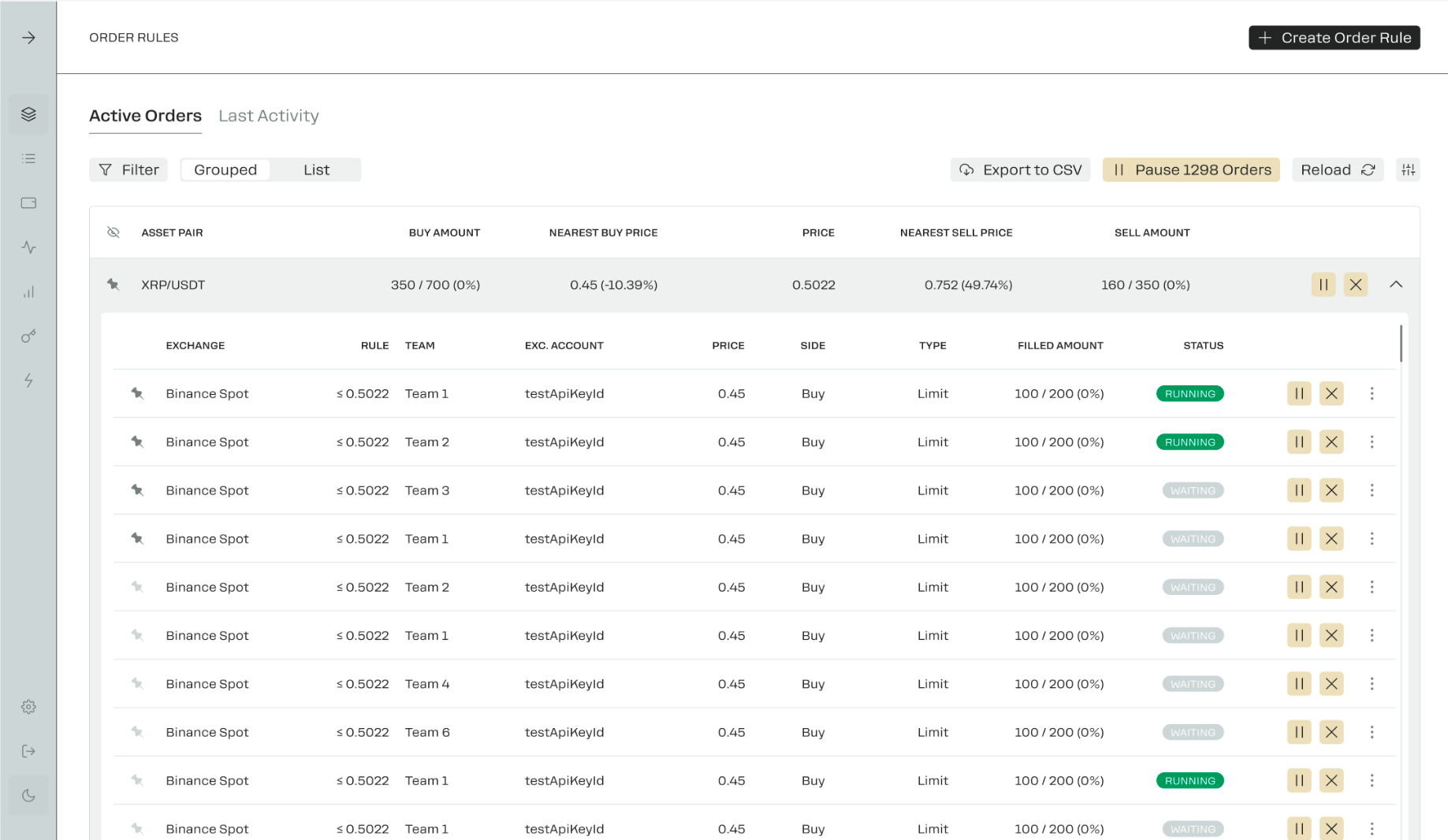

Clicking on any pair opens a drop-down with details of the associated Order Rules. Each has one of the five status types:

- Running (being executed)

- Waiting (awaiting the execution trigger price)

- Paused

- Completed

- Canceled

Each Waiting Order Rule awaits the trigger price that will launch its execution. You can pause, resume, copy, or cancel such Order Rules with one click.

Once execution starts, the status switches to Running. The Workspace Owner is alerted of the change via a pop-up and a notification through their chosen channel (Slack, Telegram, or email), while the event is recorded in Activity Log.

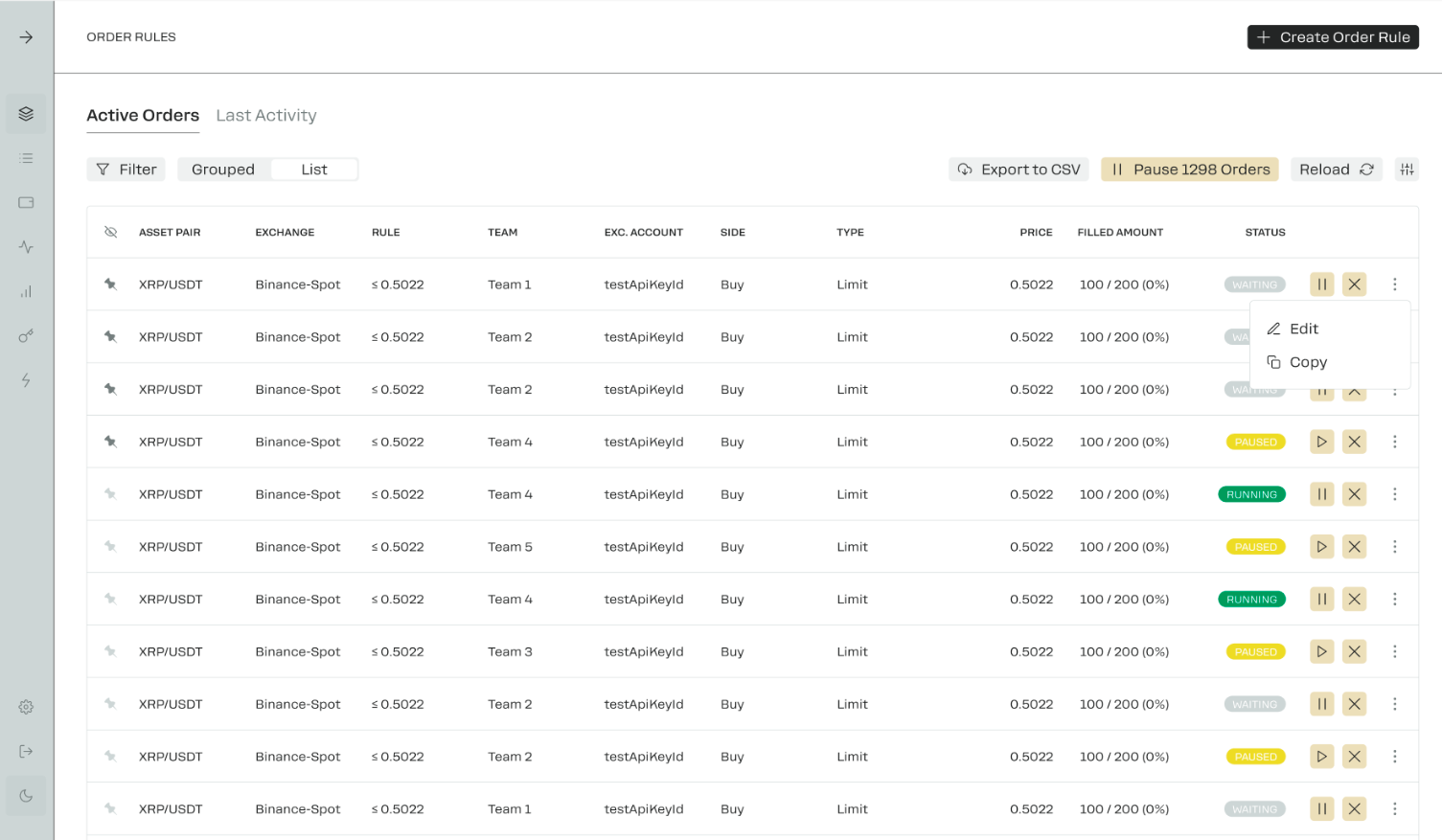

List vs. Grouped view

The List view conveniently sorts all Order Rules based on your chosen filters. The options include:

- Search (asset ticker)

- Member

- Exchange

- Status

- Date (creation date)

Review all paused Order Rules at once to resume them instantly, or check the ones awaiting execution. You can view Order Rules initiated by a particular trader, for a particular pair or exchange account, and more!

The “Date” filter offers standard (from today to the past month) and custom periods, down to the hours and minutes.

Creating Order Rules

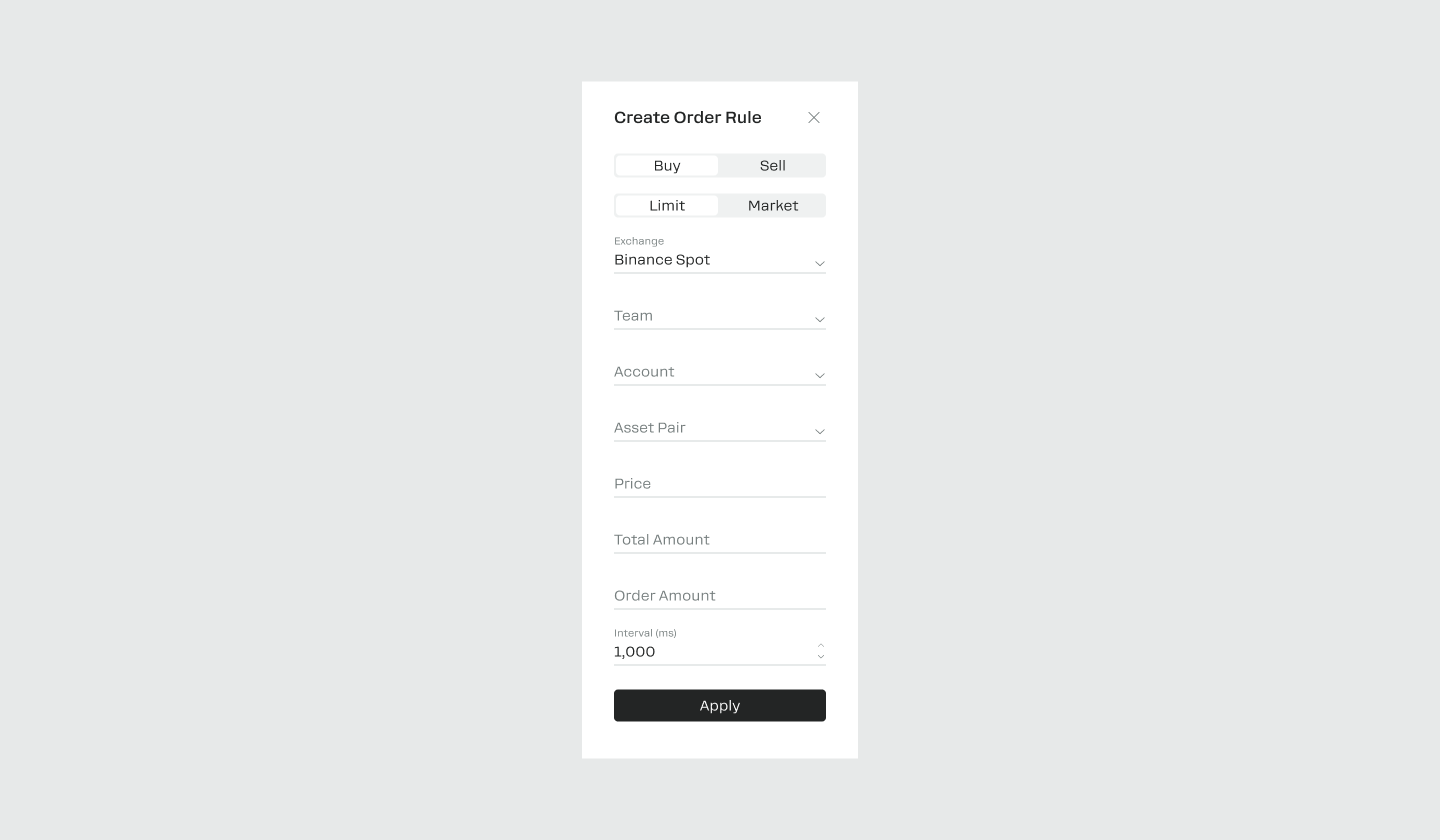

The setup process is intuitive and quick. Begin by clicking or tapping the Create Order Rule button in Order Rules. Then, fill in the form with the following parameters:

- Type (Limit/Market)

- Side (Buy/Sell)

- Exchange

- Account

- Team

- Asset Pair

- Price

- Total Amount

- Order Amount (chunk size)

- Interval (msec)

By default, Zent provides an interval of 1,000 msec. Extend it if you want to take your time, or enter a shorter one depending on your exchange account status and limits. Please note that high request frequency may trigger restrictions at crypto exchanges based on their policies.

Click “Apply,” – and the new Order Rule is all set. It is immediately added to the corresponding Active Orders group.

Monitoring Positions

All Order Rules that are Running (being executed) transform into Positions monitored in Statistics. The latter lets you track profit dynamics via RPL and UPL in real time, with details like base and quote amounts, entry price, and current price.

Viewing past Order Rules

Historical Data accumulates information on all inactive Order Rules ever created in your Workspace. By status, these are divided into three categories:

- Canceled

- Completed

- Error

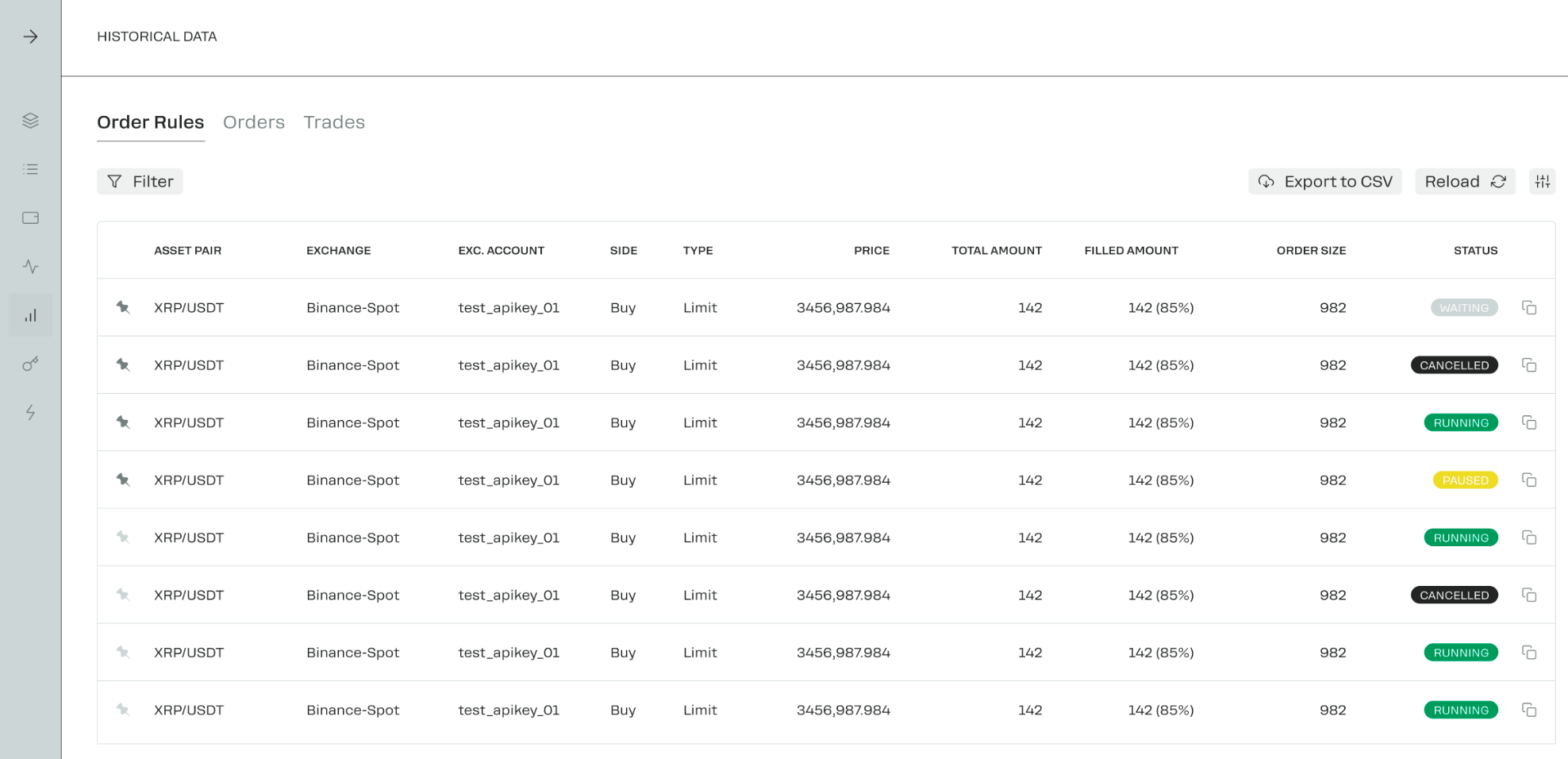

Order Rules in Historical Data on Zent

The history of Order Rules can zero in on the Orders and Trades involved in their execution. Adjust sorting with the same broad range of filters: search by asset ticker, member, exchange, status, or creation date.

With its detailed evidence for performance assessment and accounting, Historical Data caters to the needs of treasurers, analysts, and employers. Narrow it down to specific users or teams, and export the records to CSV in just one click!

Supercharge your trading – try Zent today

Unlock higher profits with our convenience and speed! We supercharge institutional trading for all strategies and team sizes. Explore Order Rules with a Zent demo – feel free to contact us for quick access.