Restaking guide: Why risks outweigh benefits

Traders have moved over $18 billion worth of tokens to restaking platforms, chasing bigger returns. As prices rally, risk-taking soars, but experts warn this novelty may “blow up” crypto. Here's how restaking works and what makes it dicey.

What is crypto restaking?

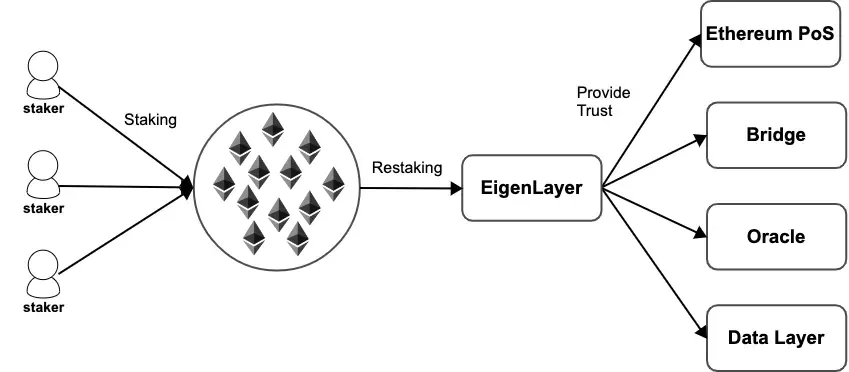

At the heart of this boom is EigenLayer, a startup that raised $100 million from Andreessen Horowitz's crypto arm in February. In half a year, the value of crypto restaked via the platform has gone from $400 million to $18.8 billion as of May 31, 2024.

EigenLayer is the first such protocol on Ethereum's mainnet. It was launched in 2021 by Sreeram Kannan, a former assistant professor at the University of Washington in Seattle.

As the term suggests, users may reallocate staked assets. Kannan’s invention expands the long-standing practice of staking, letting users maximize returns across proof-of-stake (PoS) services.

Staking vs. restaking

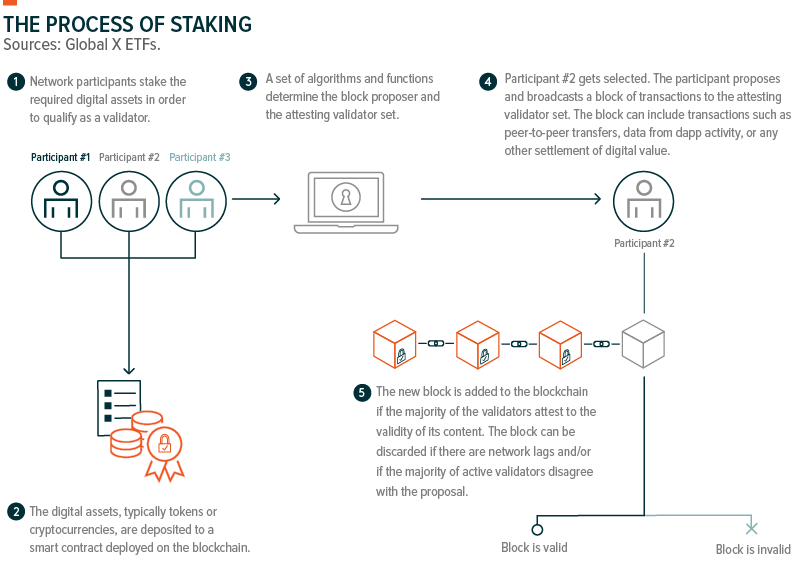

PoS is a consensus mechanism underlying the security of blockchains like Ethereum and Solana, where validators lock (stake) their crypto to support network operation.

Unlike Bitcoin and other proof-of-work blockchains, these networks do not need miners that expend computing power. Stakes ensure data is reported honestly. Every validator is rewarded proportionally to their stake, which also works as collateral.

If a validator misbehaves, their stake is partially or fully confiscated. The more crypto staked, the more secure the protocol. Over $100 billion worth of ETH staked on the Ethereum blockchain makes its protection supreme.

Restaking operates with similar principles. It secures upstart blockchain apps by leveraging significant staking numbers on incumbent protocols.

How crypto restaking works

Different chains employ different staking — and restaking — mechanics. EigenLayer works with Ethereum, offering Actively Validated Services. These AVSs, or modules, are protocols supporting Ethereum scaling solutions. Restaking is available on:

- Bitcoin via Babylon

- Solana via Picasso

- Near via Octopus 2.0

EigenLayer uses smart contracts, enabling Ethereum validators to restake crypto to secure other protocols. This opt-in service brings additional slashing conditions. Each module imposes its terms on top of the Ethereum mechanism to ensure validators pursue the network's best interests.

Restakers can pick the AVS modules they want to secure. EigenLayer provides an open marketplace connecting them with applications that need staked tokens.

Factors like resource requirements, size of rewards, perceived risk, and sector guide users’ decision-making. For instance, oracle-based AVSs attract believers in the power of oracle networks.

Restakers will receive newly created EIGEN tokens. These assets will become transferable — and therefore sellable — in September 2024. At press time, the protocol has launched an airdrop for Season 1, Phase 1 rewards.

This token claim process closes on September 7, and users who fail to claim by that date will not receive any EIGEN.

Delegated restaking

Like staking, restaking allows delegation for users lacking the time or equipment to meet the modules' system resource requirements. By entrusting registered operators to stake on their behalf, they participate in the network and earn rewards minus those validators’ fees.

Alternative: Liquid restaking

Services like Puffer, Renzo, and Ether.Fi offer a simpler way to reallocate assets without spinning up an operator and picking AVSs.

They work as intermediaries, depositing crypto into EigenLayer and its rivals. The users get liquid restaking tokens (LRTs), which accrue interest and are tradable in DeFi, unlocking even higher yields.

This system simplifies entry and exit, enabling participants to boost leverage through reinvesting into DeFi protocols.

Advantages of restaking

Restaking enthusiasts focus on security benefits for blockchain apps — those lacking the resources and community to support their own PoS systems. Restakers redeploy their tokens across multiple smaller protocols simultaneously, helping them remain sufficiently secure.

When the same amount is staked commonly rather than separately, it ensures a higher cost of attacking any member protocol. For instance, 100 protocols collectively secured by $100 billion are more secure than separate protocols with a $1 billion stake each. Kannan provided this example in a CoinDesk interview, noting that hackers would need $100 billion instead of $1 billion for an attack.

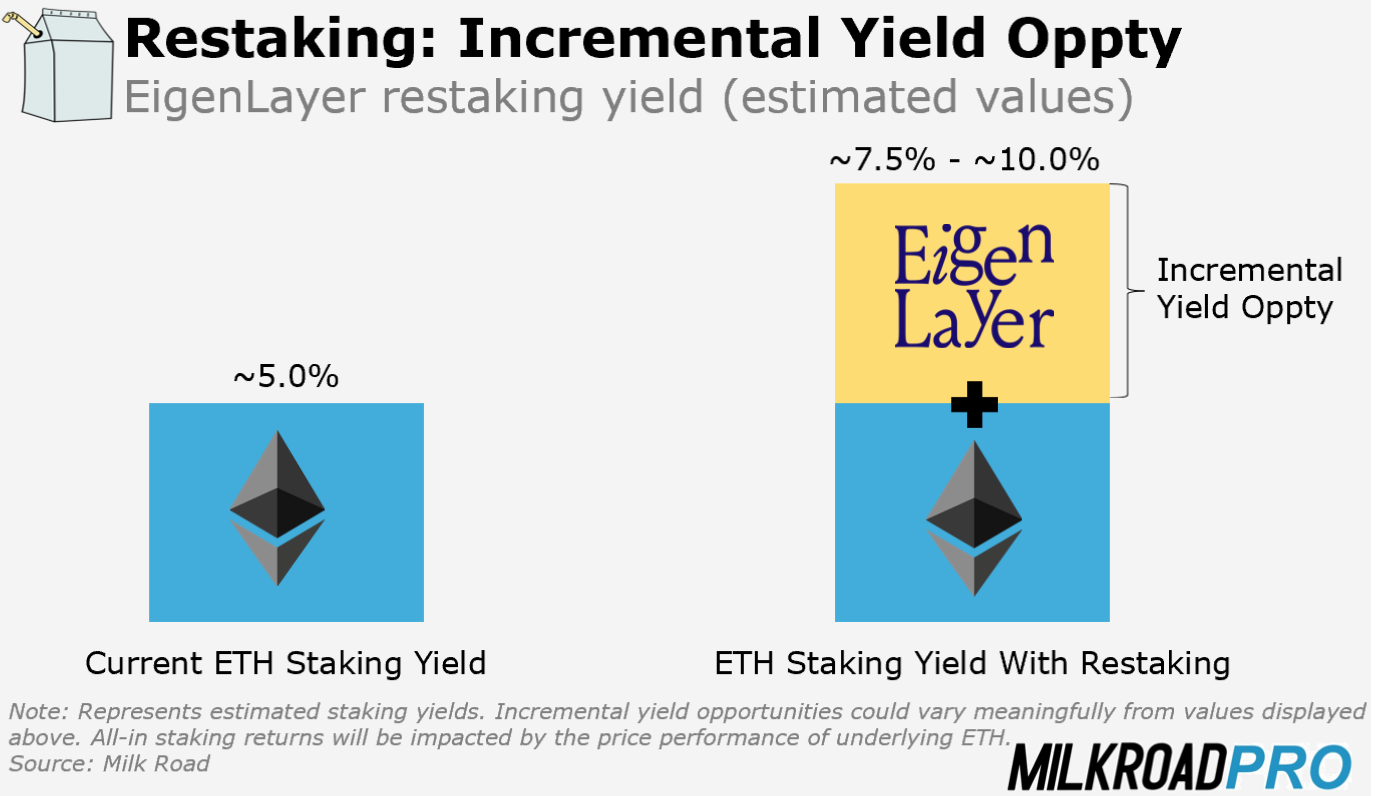

The key appeal for users is the yield. Currently, staking on Ethereum brings between 3% and 5%. Restaking lets them earn multiple yields simultaneously.

Safety of restaking: Concerns

Like any crypto technology, restaking platforms have inherent risks prescribing rigorous due diligence. This nascent field presents the following concerns:

- Smart contract vulnerabilities. Coding flaws, bugs, and backdoors may result in financial loss, exploitation by malevolent actors, and security breaches.

- Losses due to slashing. Every AVS imposes its slashing conditions on top of Ethereum terms. Validators may discover their stakes slashed without warning.

- Counterparty risk. Restakers who delegate to third parties entrust them with their locked assets. If those operators misbehave, resulting in the stakes being slashed, it is unclear if the restakers are eligible for compensation.

- Endless borrowing loops. Users may pledge the crypto representing their restaked assets as collateral in lending markets. This behavior may trigger endless borrowing cycles with a limited number of underlying assets. Massive liquidations and simultaneous exits may destabilize the broader crypto markets.

- Lack of payout mechanisms. EigenLayer is yet to develop a mechanism for paying out restaking rewards. Users are joining it as they anticipate future rewards and airdrops. However, the EIGEN token is not guaranteed to be worth anything in the future.

- No "paper trail." Restaking is an unlikely option for institutions as it is difficult to establish where specific assets go and how the rewards are distributed.

- Trust hypothecation. When protocols let users stake tokens, liquid staking tokens, and liquid restaking tokens, the scope of potential crises expands. Magnified by liquid restaking, the hypothecation of trust — offering it as collateral — could be a disaster waiting to happen.

Many experts are alarmed by the growth of restaking platforms. According to Kaiko's Morgan McCarthy, chasing after such airdrops is a "really, really speculative, this free money thing." Concerning trust hypothecation, CoinDesk’s Sam Kessler warns that “one slashing event or depegged asset could topple many.”

Kannan has commented on the borrowing risks, saying, “The risk isn’t in re-staking, but rather it’s in the lending protocols. The lending protocols are mispricing risk." To address the slashing risk, EigenLayer is integrating “attributable security,” but the details of this insurance program are yet to be clarified.

At the same time, some experts note that the amounts held in restaking protocols (over $18 billion) are tiny compared to the global crypto market cap, which is at $2.74 trillion as of June 7, 2024.

As a result, the losses are unlikely to spill over to traditional financial markets — for now.

Appeal and dangers of restaking

Despite its explosive growth, restaking is a controversial, albeit significant advancement in blockchain technology. It enables common security for smaller blockchain protocols, promising to unlock higher yields for users.

Restaking has been embraced by developers, investors, and even venture firms. Yet EigenLayer is still in limited beta, accepting deposits without finalized key features. With no payout mechanism in place, the main incentive is getting points tracked by EigenLayer and liquid restaking protocols.

These points, having no actual value at press time, are expected to be tied to future airdrops. Users are buying and selling them, fuelling a speculative frenzy. Thus, the specter of contagion risk is broad — and LRTs only amplify the risks.