Shadow ledger: Stealth trading with iceberg orders

Iceberg orders aim to minimize slippage and delays, removing the ramifications of institutional market impact. This order type is useful but imperfect, and some drawbacks defeat its very purpose. Discover its pros and cons and a superior alternative on Zent.pro.

What hinders institutional orders

Level-2 order books are real-time data collections. They publicly list all bids and asks on an exchange, including price, volume, and timestamp. Outstanding orders are visible to all users, who may tweak their positions based on these insights.

Large-volume orders increase the pressure of marketplace supply and demand. An institution placing a limit order for 50,000 BTC tips the market off, as it reveals a demand shift. Other traders jump in at a better price, buying or selling ahead of it. Thus, with large trading volumes in waiting, the results are twofold:

- The institutional limit order may not get executed.

- The current market price may change (sometimes dramatically).

Dividing large positions into pieces is the only way to prevent the impact. Instead of a gigantic limit order, just its fraction is visible in order books; the rest lies under the surface.

Definition of iceberg order

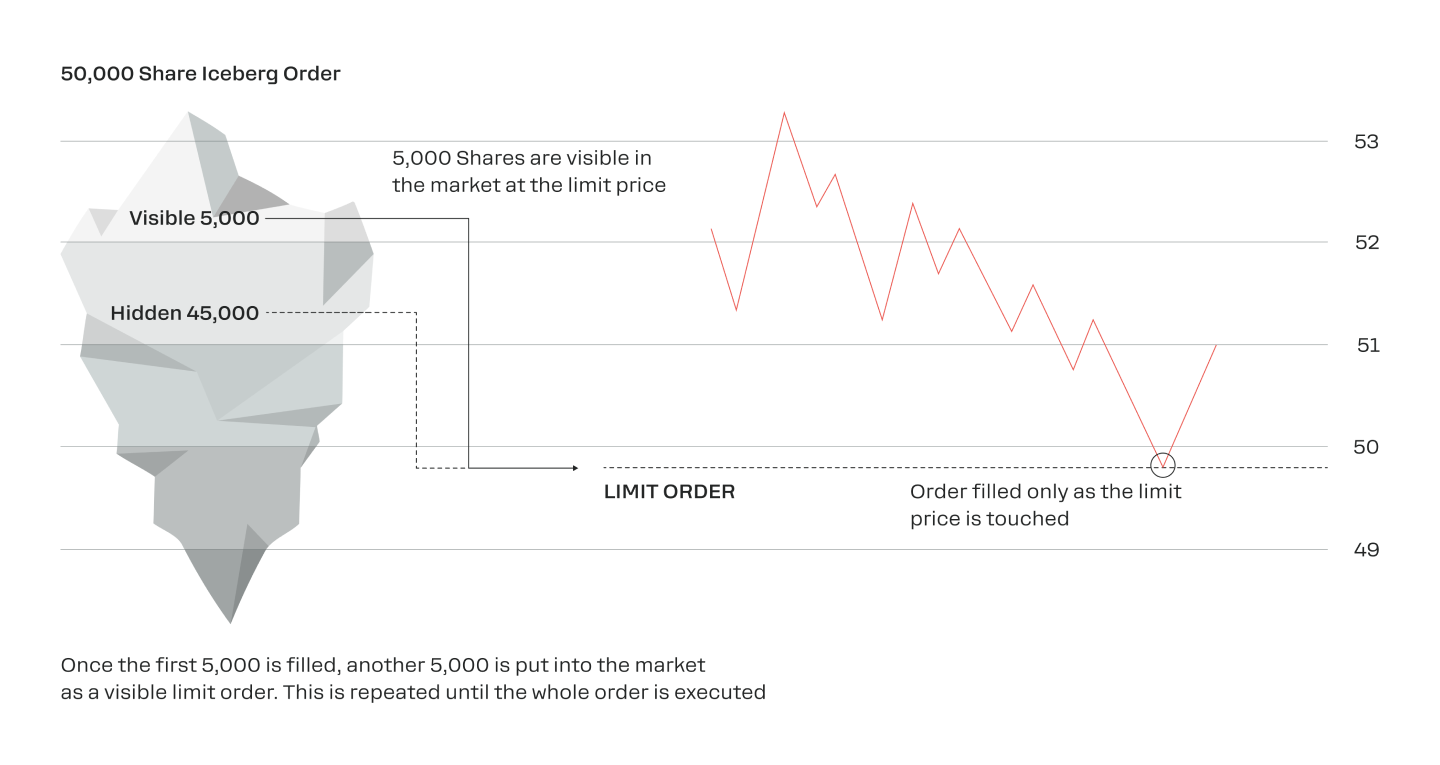

An iceberg order is an order to buy or sell a large quantity of an asset that is broken up into smaller orders. These chunks are executed as limit orders. The iceberg is the total order quality, while each small order is its visible tip.

Institutional traders use iceberg orders to conceal large-volume transactions and secure the best possible prices without delays. These orders may not be placed manually, and only some crypto exchanges offer the required tools as these are not standard options.

How to place iceberg orders

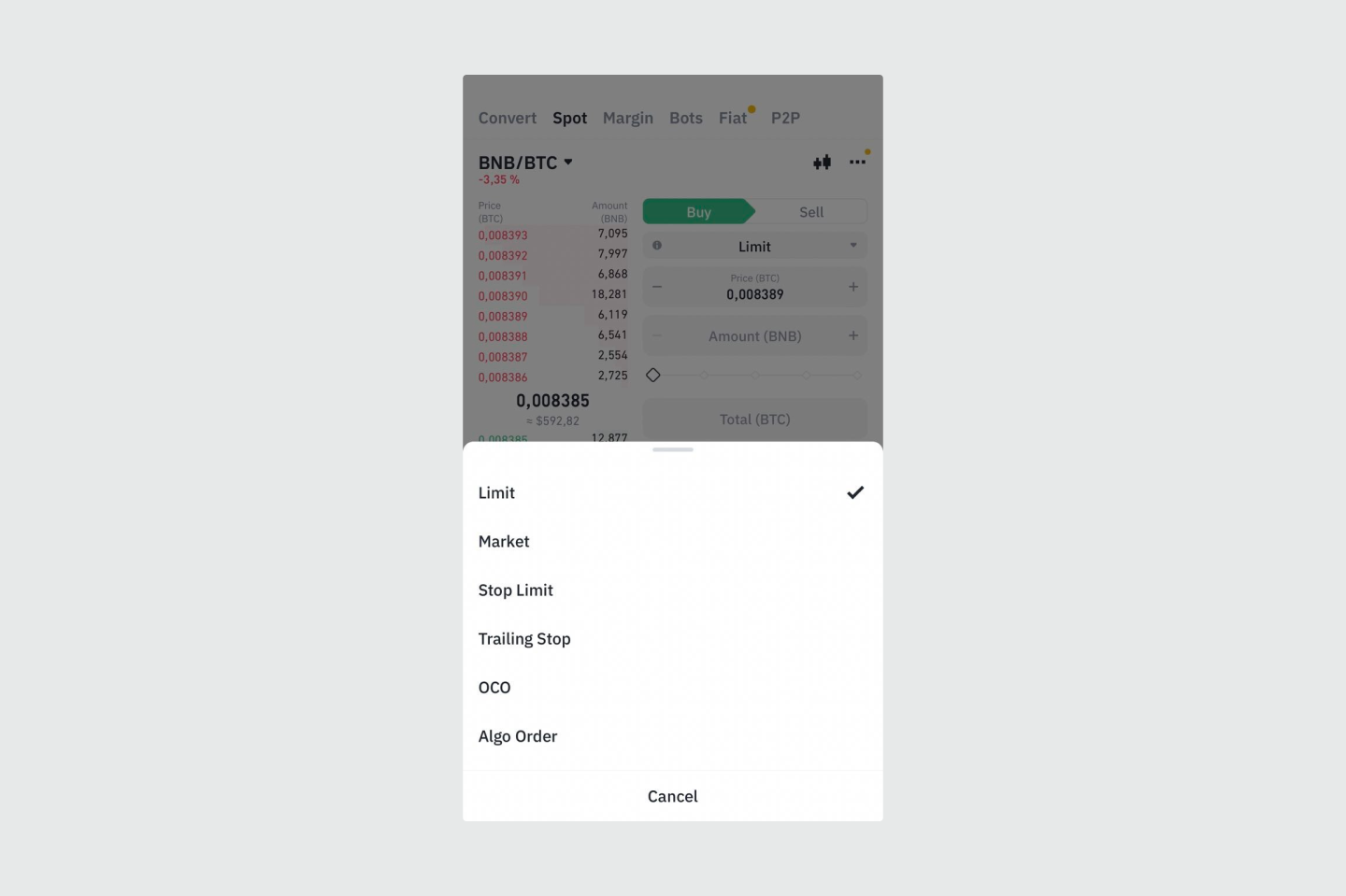

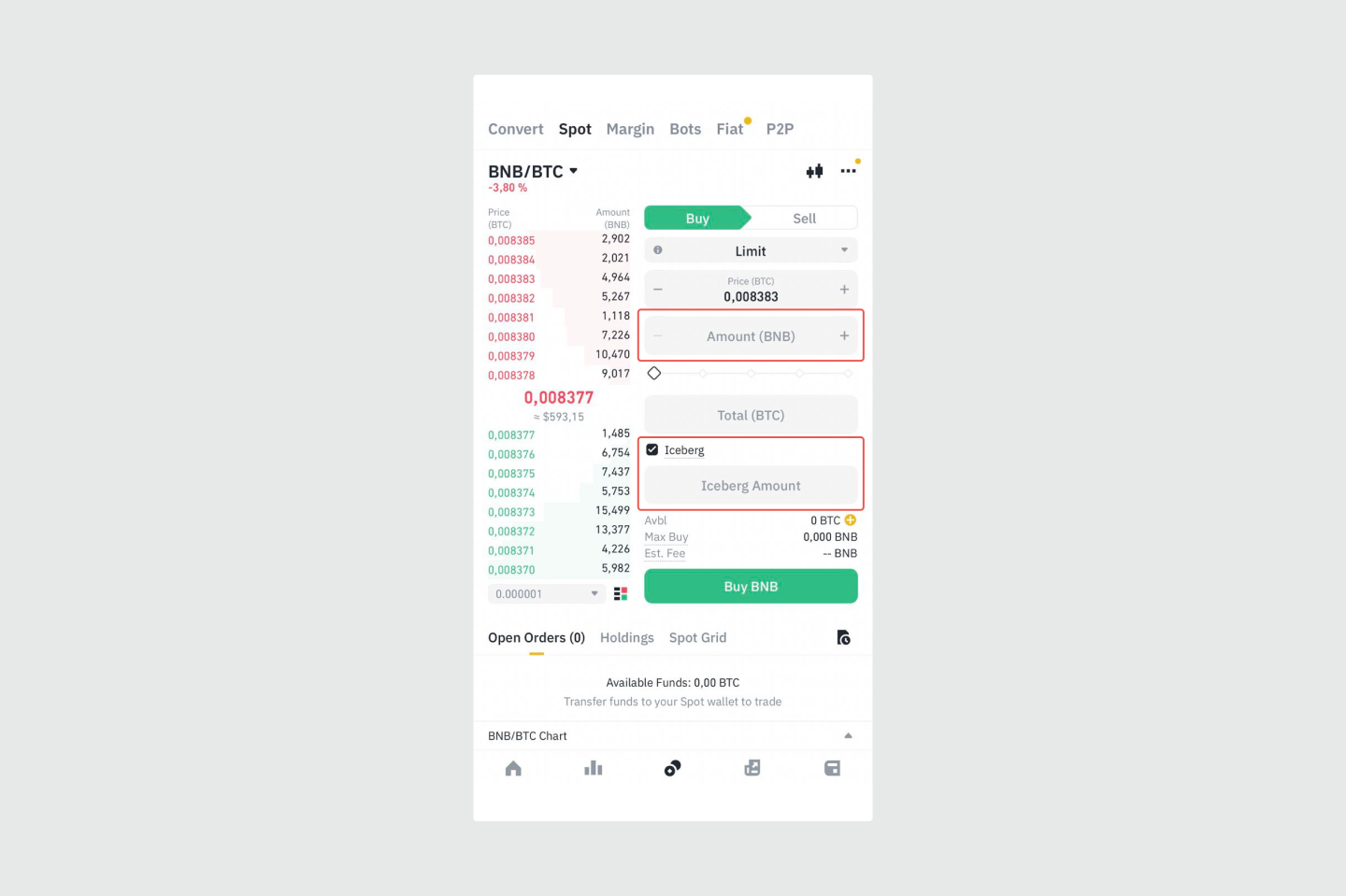

Iceberg orders are available on a relatively small number of crypto exchanges, including Kraken, Gate.io, and Binance. Placing them requires specifying two parameters:

- Order quantity — the entirety of the iceberg (the total amount).

- Display quantity — the portion of the iceberg that will be visible in the order book.

The display quantity may not be smaller than the order minimum for the trading pair. Additional limitations apply based on the exchange.

As the display quantity gets filled, more of the hidden portion is revealed incrementally, chunk by chunk. This process continues until the whole order is filled successfully.

How to identify iceberg orders

Accurate iceberg order detection is only feasible with technical tools. Hypothetically, traders may also deduce their existence when the order book is nearly empty, but orders are being executed in large numbers at a specific price level.

Volume is the most common indicator for dedicated software. It typically captures equal volumes from the same user at an identical or similar price. Detection may occur with a slight delay, but genuine real-time examples exist.

Advantages of iceberg orders

Iceberg orders ensure speed and better prices compared to undivided limit orders. They minimize slippage – as orders remain hidden (save for one piece), there is little to no market impact. Small increments do not cause the price to shift significantly against the trader, letting them execute all buys or sells at the desired price or close to it.

Example

A hedge fund places a single order to buy $1 million worth of crypto, whose average daily volume is around $300,000. Seeing this institutional action, other traders may assume it has some insider knowledge.

Attempting to front-run the hedge fund, they buy coins before its order is executed. Meanwhile, sellers may raise their asking price, seeing huge demand in the order book. These effects push the asset price higher.

With an iceberg order, depending on the settings, every chunk triggers the release of the next chunk.

For instance, the hedge fund may buy $5,000 worth of tokens per order, spreading the process throughout the day, several days, or even weeks. Eventually, the entire target of $1 million is bought, and the iceberg order is fully executed.

Disadvantages of iceberg orders

At first glance, an institutional iceberg order is an excellent solution as it ensures the best prices. However, the cons outweigh the pros, essentially defeating the purpose of this order type.

- Traceability. Iceberg orders are discoverable for software tools that alert other market participants, so execution may still be hindered.

- Limited choice of platforms. This order type is available on a handful of exchanges, including Binance, Kraken, and Gate.io.

- Visibility to the exchange. Iceberg order parameters are visible to crypto exchanges, which may exploit them via internal arbitrage and internal or third-party market-making.

- Locking the entire amount until execution is complete. The total amount is locked once an iceberg order is placed, with access to it halted immediately, regardless of the execution time.

- Exchange-specific limitations. Every crypto exchange imposes specific restrictions, such as the number of chunks: Binance allows ten limit orders at maximum.

Solution: Zent Order Rules

Order Rules, a feature found exclusively on Zent, streamlines trading for any institution—be it a hedge fund, a blockchain project, or a corporate trader. While it also divides large volumes into chunks, users circumvent the drawbacks of iceberg orders with additional benefits.

No detection

Like iceberg orders, Order Rules divide large volumes into chunks. However, as these are set up on Zent and transmitted via API, their parameters — and the intention to buy or sell a significant amount — are hidden from the exchanges.

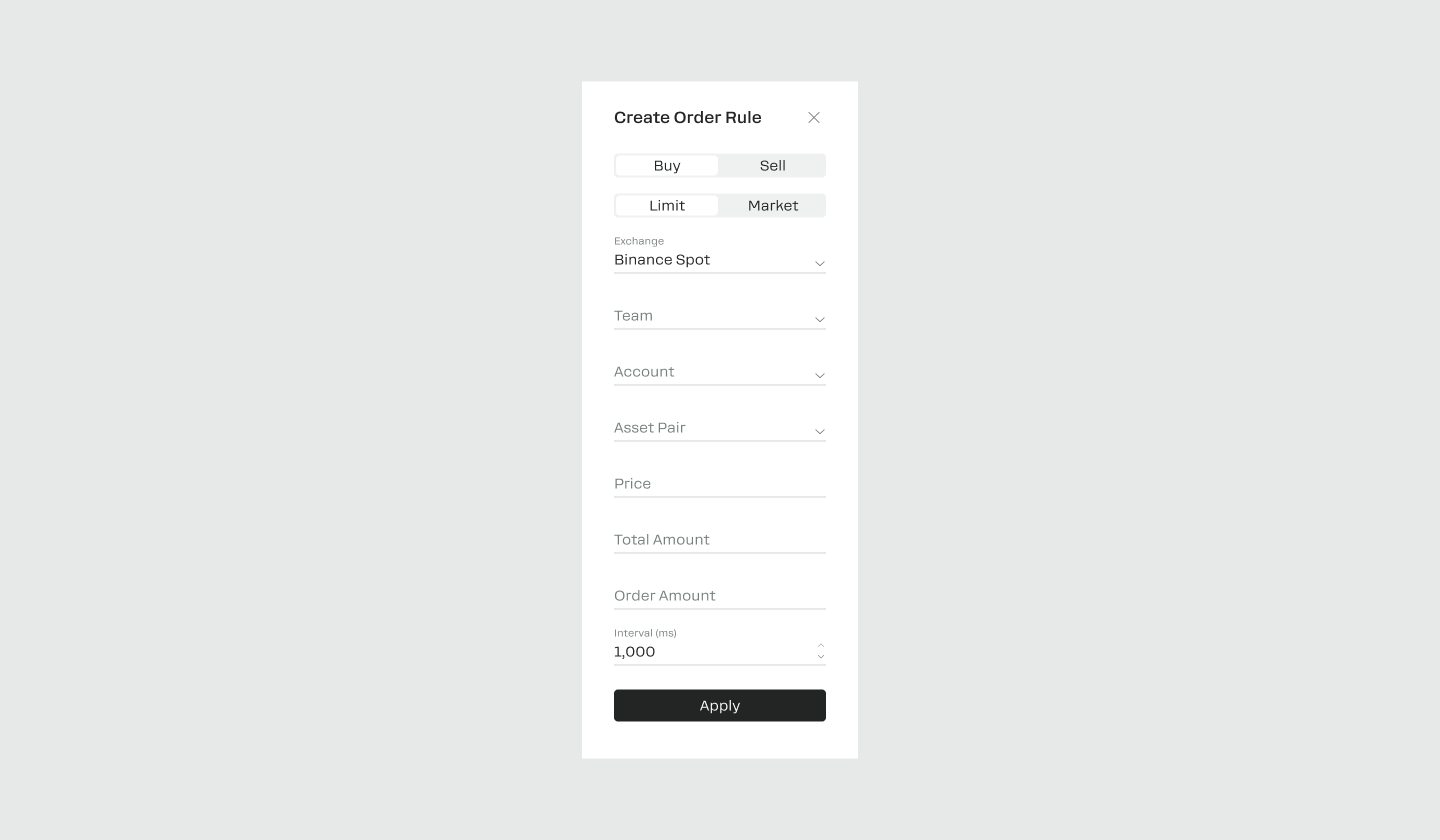

Zent's Order Rule settings include:

- Type (Limit/Market)

- Side (Buy/Sell)

- Exchange

- Account

- Team

- Asset Pair

- Price

- Total Amount

- Order Amount (chunk size)

- Interval (msec)

With regard to order-tracing software, volume randomization is the only way to conceal institutional positions. Randomized chunks are part of an upcoming Zent upgrade: once the total volume is set, execution will be performed through orders of different sizes, bypassing detection by dedicated tools.

No freezing of funds

Chunks are limited orders going live at a price match, with the balance used based on the sequence in which they are triggered. Zent does not freeze the total Order Rule amount — and institutions do not need to have it on their balance when submitting Order Rules.

Exchange orders are only generated once the trigger price is reached. At a price match, Zent sends out limit orders of the specified size, one by one, while the remaining funds may be used for other purposes.

Users may even withdraw their assets if execution is far enough in the future. As long as they deposit them back before the trigger price, execution goes as planned.

No limits on increment number

Notably, there are no strict limits on the number of chunks — Zent allows up to 300,000 orders per day, which is a significant benefit compared to iceberg orders.

Order Rules vs. iceberg orders: Summary

Order Rules have multiple advantages over iceberg orders.

- No blocking of funds so the assets may be used for any purpose before execution, as long as they're deposited back in time.

- Hiding the total volume from exchanges so they cannot react or arbitrage to exploit the institutional intent.

- Securing execution at the best price, including a favorable exchange rate difference. For example, if BTC drops to $59k, an Order Rule to buy BTC at $60k will be executed at that lower price.

- Virtually unlimited number of chunks. Currently, Zent allows 300,000 orders per day, while popular exchanges may restrict it to ten per iceberg order.

- Ready-made, efficient infrastructure for fast execution, strategically located in the data centers of the connected exchanges.

- API integration. Zent API is compatible with any corporate system: institutions may incorporate Order Rules into in-house platforms to access the full feature functionality.

- Circumventing the limit on API requests per exchange. Zent connects to exchanges throughout API, and one Order Rule can work with multiple API keys.

Maker fees vs. taker fees

Order Rule chucks are set as limit orders but executed as market orders, entailing a taker fee. These fees typically exceed maker fees, although the impact varies.

Furthermore, the difference is usually negligible considering the advantageous exchange rate. With Order Rules, traders secure the best possible prices with faster execution. Learn more in our Order Rules guide.

Key takeaways

- The impact of large positions is one of the biggest issues in institutional trading. Large limit orders in public order books affect the behavior of market participants, resulting in slippage and delays or non-execution.

- Iceberg orders divide large volumes into smaller limit orders executed and becoming public one by one. Thus, public order books display just the tip of the iceberg while the total volume is hidden.

- Iceberg orders eliminate or minimize market impact, ensuring faster execution at a favorable price. However, they have several downsides and are supported by few crypto exchanges.

- Iceberg orders are visible to exchanges, which may exploit them via arbitrage and market making. The number of iceberg order chunks is limited; the total volume is frozen immediately at order placement. Iceberg orders are also detectable via tools that trace identical volumes tied to the same users.

- Order Rules, a feature exclusive to Zent, solves these challenges, dividing significant volumes into manageable chunks without the typical limitations and visibility.

Explore Zent today

Zent traders minimize the market impact of institutional volumes, secure the best possible prices, and avoid delays while getting more freedom to use their balances without exchanges seeing their operations. Learn more on our Features page, contact us to explore a free Zent demo!