Spot crypto ETFs: What's next after Hong Kong debut?

Spot Bitcoin ETFs, launched in the US after a decade of rejections, increase crypto’s penetration into mainstream investment circles. Other jurisdictions have followed suit, with Hong Kong and Australia jumping on the bandwagon. Here's the lowdown on these new crypto ETFs.

Spot Bitcoin ETFs: 2024 Breakthrough

Exchange-traded funds that invest directly in crypto drove wild market rallies — and Bitcoin's new ATH — in Q1 2024, after being greenlit in January. Amassing over $53 billion to date, they enjoyed a winning streak until late April, when the inflows began drying up.

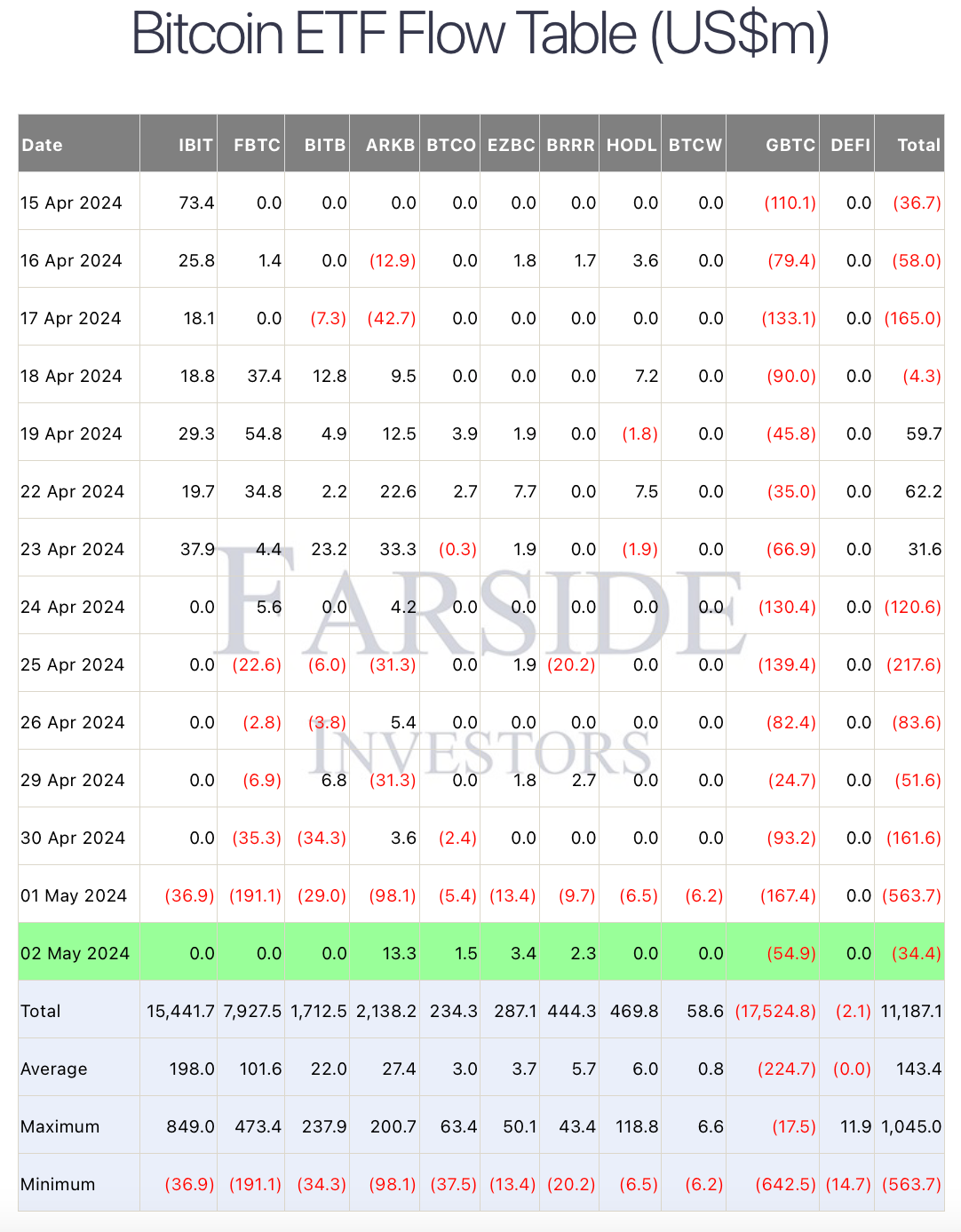

As indicated by Farside Investors, on May 1, the ten funds saw considerable outflows totaling $563.7M. This fading of euphoria is an expected return to normalcy.

Experts also note that the correlation between the BTC price and the ETF inflows has waned. Exits from Grayscale's GBTC triggered BTC's slumps in January, with the FTX bankruptcy estate accounting for nearly $1 billion of the total outflows.

Hong Kong's crypto ETFs: Misguided disappointment

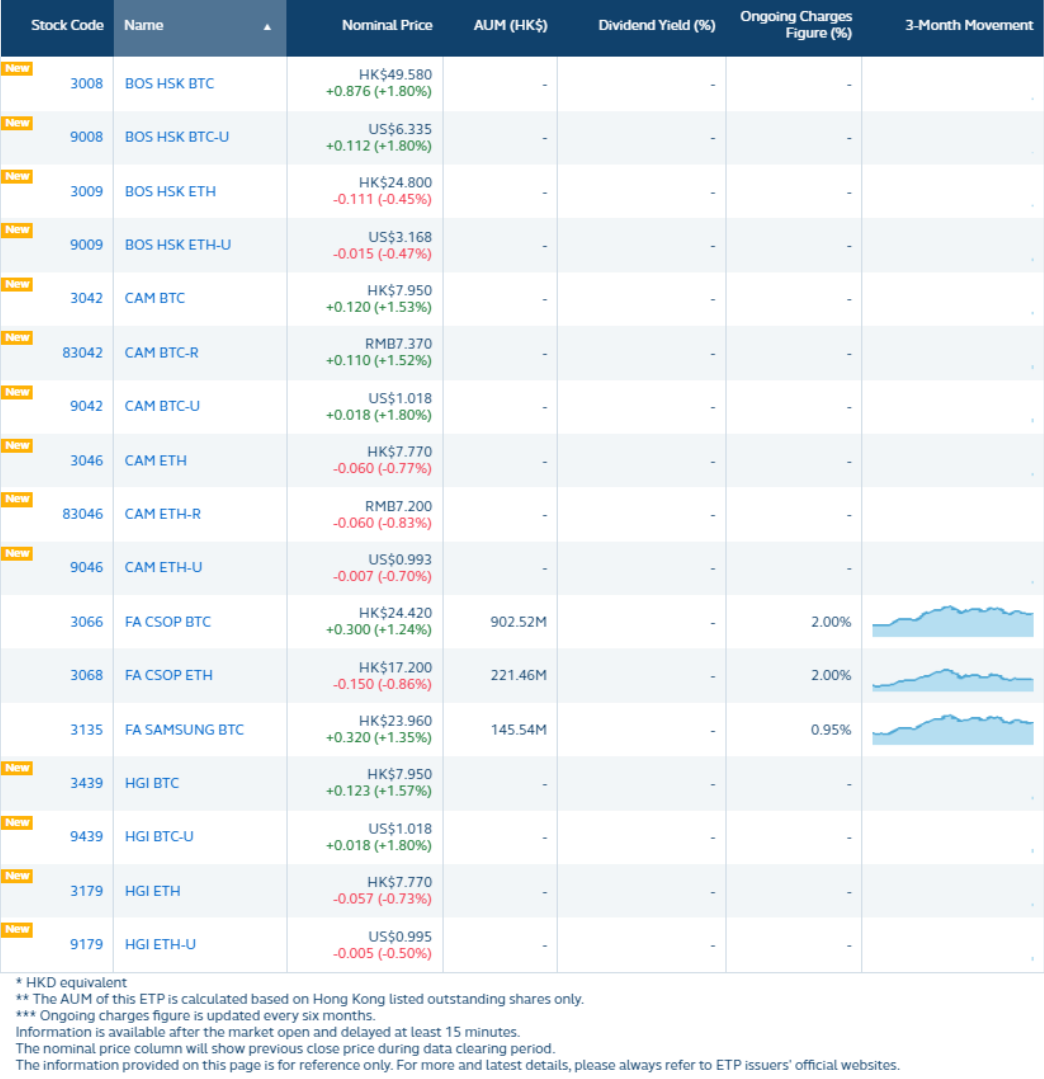

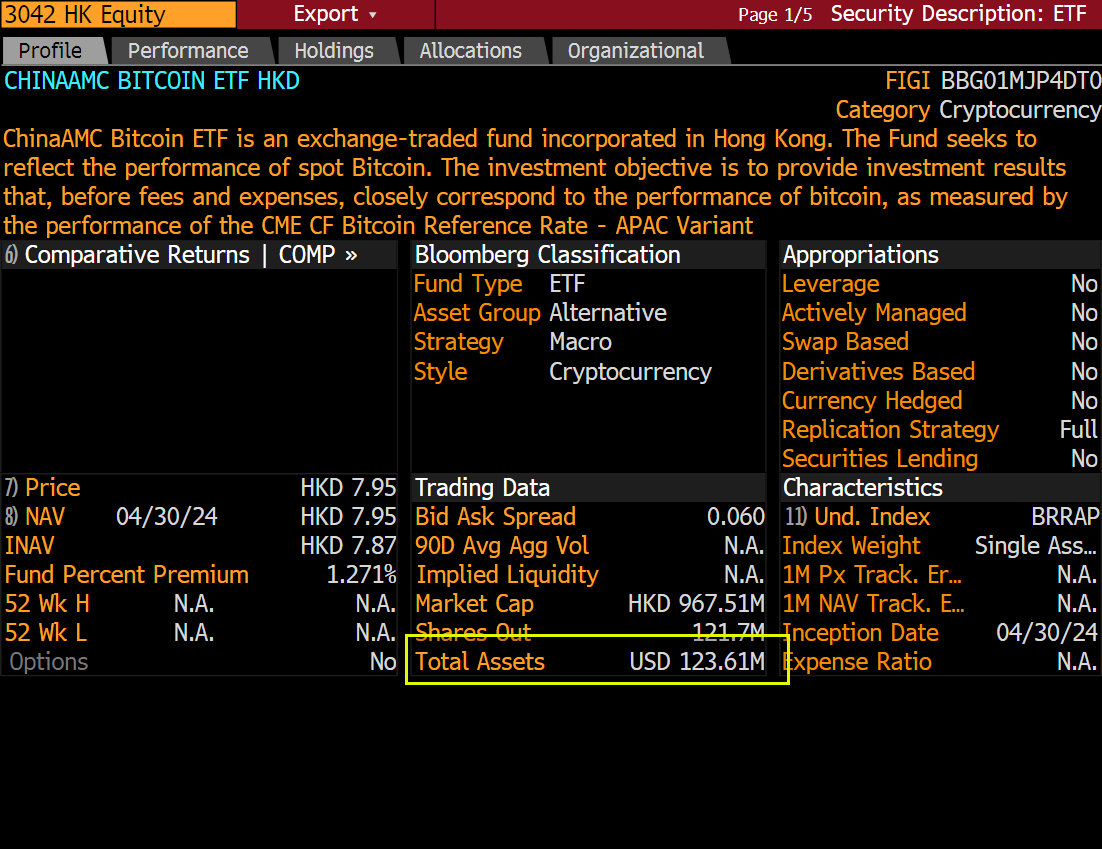

On April 30, Hong Kong launched its spot crypto ETFs — linked to Bitcoin and ether — in an effort to restore its reputation as a modern financial hub. Given the success of the US-based counterparts, that is a tough act to follow.

The six funds are the first batch of spot crypto ETFs in Asia. Earlier, the city allowed crypto futures ETFs, but their $175 million in total assets pale compared to the $2.5 billion in Proshares Bitcoin Strategy ETF, trading in the US. Three products have been listed so far: CSOP Bitcoin Futures, CSOP Ether Futures, and Samsung Bitcoin Futures.

Crypto trading is banned in mainland China. Hence, the Hong Kong ETFs need to be included in a program that would give Chinese investors access. China Asset Management CEO Yimei Li has expressed optimism about this happening.

The six funds were launched by some of the top wealth managers in China, including Harvest Global Investments Ltd., China Asset Management, and a partnership between HashKey Capital Ltd. and Bosera Asset Management (International) Co.

The local market is a fraction of its US counterpart. As a result, the city may hope to amass just $1 billion over two years, based on Bloomberg intelligence estimates. Other experts, including Harvest Global CEO Han Tongli, disagree, citing the international reach of the city's financial products and services.

According to different estimates, the collective trading volume for all six ETFs reached $11-$12 million on the first day. That is a fraction of the $4.6 billion for ten spot Bitcoin ETFs in the US. However, when adjusted for market size, the result is fairly impressive, as stated by Bloomberg’s Eric Balchunas.

Different redemption models

The Hong Kong products use in-kind subscriptions and redemption, unlike cash redemption in the US. Thus, local investors can swap the underlying assets for fund units and vice versa.

This approach can make ETFs more sought-after, and it justifies predictions of an eventual take-up three times bigger than that in the US. Furthermore, the products provide easy access, particularly during Asian trading hours.

The in-kind model “is particularly appealing to crypto natives, market makers and digital-asset exchanges” as it boosts efficiency and arbitrage opportunities, according to Wintermute Trading Ltd. co-founder Evgeny Gaevoy.

Australia: Next stop for spot ETF bandwagon?

Australia could launch its crypto ETFs by the end of 2024, with predicted inflows from self-managed pension assets. The Australian Securities Exchange (ASX), which accounts for 90% of the local equity market, is expected to give the green light.

According to Bloomberg, applications have been submitted by DigitalX Ltd., a local entity, and VanEck, which resubmitted in February. CEO and Managing Director Arian Neiron stated, "The demand for access to Bitcoin via a listed vehicle traded on ASX has been increasing, and many of our clients have told us that their clients are already positioned to have an allocation ready to invest."

ASX refuses to comment on any investment product applications. However, it acknowledged to CoinDesk that it "continues to engage with a number of issuers that are interested in admitting crypto-asset-based ETFs."

Earlier in April, Monochrome Asset Management applied for a spot Bitcoin ETF with Cboe Australia. This smaller competitor to ASX has a reputation for expertise across Asia and broader investor access.

Cryptocurrency ETFs debuted in Australia in 2022. The pioneers include BetaShares Crypto Innovators ETF (CRYP), which tracks an index linked to 30 stocks of crypto-related companies. According to etf.com, its assets under management (AUM) amount to roughly $43 million.

The runner-up, Global X 21Shares Bitcoin ETF (EBTC), tracks the BTC price in Australian dollars, providing shareholders an interest in BTC held in Coinbase's cold storage. The $5.78 million under its management is a fraction of EBTC's AUM.

There are more examples of products trading on ASX and Cboe. Both feeder funds have modest AUM estimates: just $100k for BT3Q and $190k for ET3Q:

- Global Ex 21Shares Ethereum ETF (EETH) tracks the ETH price in Australian dollars. Like EBTC, it provides interest on coins in Coinbase's custody but has less than $3 million AUM.

- 3iQ CoinShares Bitcoin Feeder ETF (BT3Q) is the feeder fund for an ETF trading in Canada. It tracks the daily changes of the BTC price in USD.

- 3iQ CoinShares Ether Feeder ETF (ET3Q) is another feeder fund for a Canada-based ETF. It tracks the daily changes of the ETH price in USD.

Revision of DTC's collateral valuation

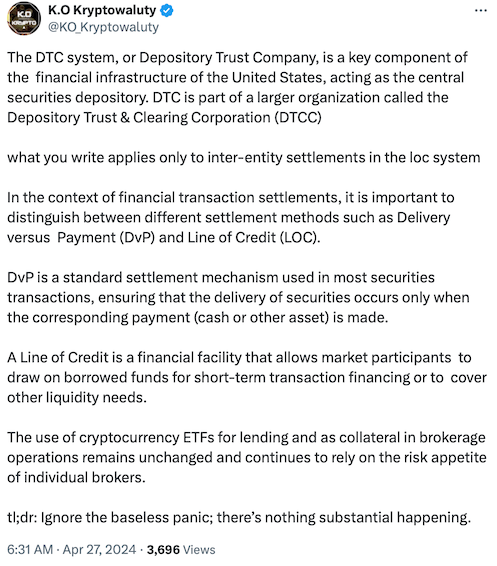

On April 30, the Depository Trust Company (DTC) effectively stopped accepting crypto as collateral for settlement purposes. According to the official update, a 100% haircut applies to any Bitcoin ETFs, crypto funds, and investment vehicles involving crypto.

As a clearinghouse for trades, the DTCC's subsidiary processed $446 trillion of conventional transactions in 2023. Crypto's inherent volatility and lack of ratings make the haircut consistent with its rules for other assets. For instance, mortgage-backed securities below Aa2/AA also get a 100% haircut even when issued by a US Government Sponsored Enterprise.

Furthermore, the Basel Committee does not consider cryptocurrencies (including stablecoins) as eligible collateral in its rules for bank exposure. Thus, DTCC will not extend loans against crypto or allocate any collateral to ETFs exposed to it.

As crypto enthusiast K.O. Kryptowaluty noted, the changes only apply to inter-entity settlement within the line of credit system. Depending on each broker's risk tolerance, the use of crypto ETFs for lending and as collateral in brokerage operations may be unaffected.

Anticipated Denial of Spot Ether ETFs in the US

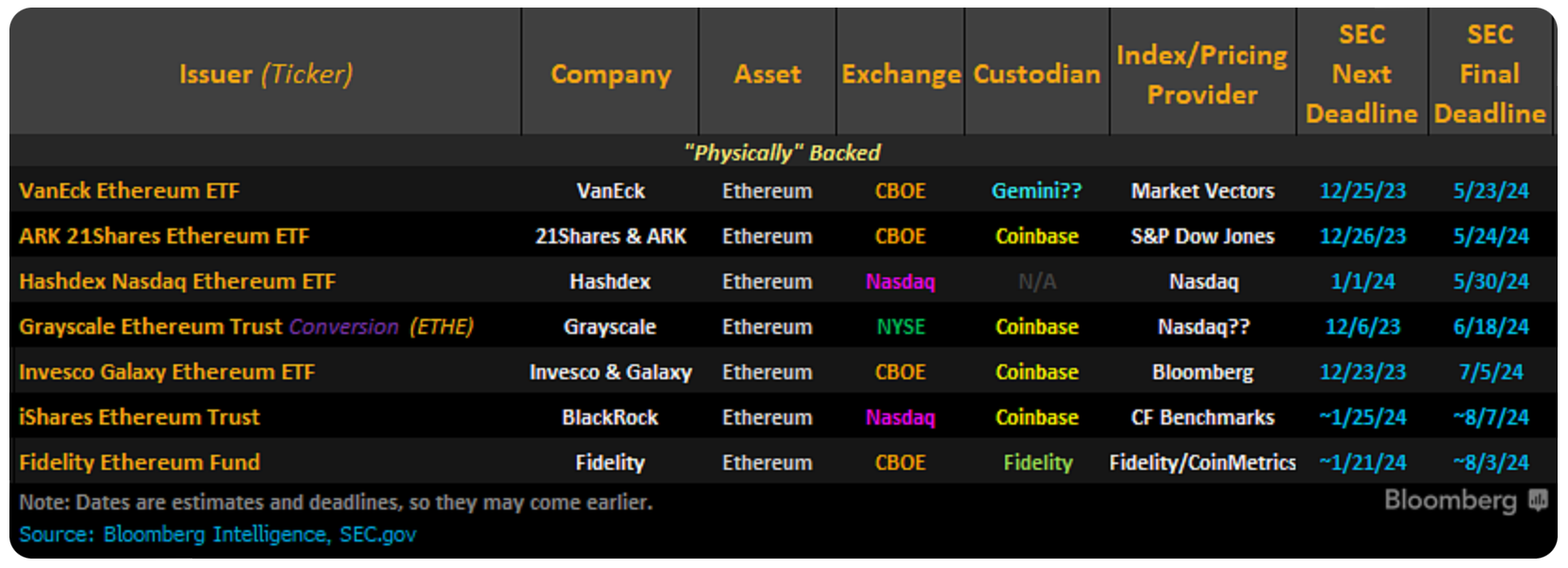

Nine US wealth managers, including VanEck and Ark Investment Management, have applied for spot ether ETFs. As the late May deadline approaches, the regulator appears halfhearted, and doubts mount.

Based on unconstructive, one-sided discussions with the applicants, the US Securities and Exchange Commission will likely reject them. The SEC took more than ten years to reconsider its stance on spot Bitcoin ETFs — only after Grayscale's historic court victory did the regulator, led by crypto skeptic Gary Gensler, grant approval.

While this decision could set a precedent for ether-related products, staking is the primary concern. In the eyes of industry regulators, locking up ETH as collateral to earn rewards is a questionable practice. The SEC's clampdown on staking last year resulted in a $30 million fine for Kraken and the shutdown of its staking-as-a-service business.

Moreover, unlike Bitcoin, ether may eventually be deemed a security. A rejection would hinder industry progress, as ETFs are vital in promoting mainstream crypto investment. The SEC has already extended the original deadline once, from March to May. According to a Standard Chartered Bank report, the market has factored in this news. On Polymarket, the likelihood of approval has plummeted to just 11%.

Final words

Spot ETFs are key to genuine institutional adoption of cryptocurrencies. Following the success of US-based funds, Hong Kong has launched its local alternatives, which could potentially be accessible to Chinese investors in the future.

While the outflows in the US reflect a return to normalcy, the Hong Kong market is more promising than it may seem, given its size. The launch of ETFs in Australia, expected this year, should further such products' institutional intake, reach, and impact.