Spot ether ETFs: SEC's pivot leaves questions

The SEC has taken a 180-degree turn on spot ether ETFs, approving the trading of the products. This surprising decision may have been politically motivated, but it is not the final green light for the US funds. Here are the key things to know.

SEC approves trading exchanges’ proposals

Nine issuers, including BlackRock, VanEck, and Ark Invest/21Shares, have filed applications for the ETPs. Their 19b-4 forms (proposed rule changes) were approved roughly four months after the launch of spot Bitcoin ETFs, a crucial event for the industry.

On May 23, the regulator greenlit trading proposals from three exchanges: the Nasdaq, the NYSE, and Cboe. Issuers must now secure the SEC's blessing of their individual ETF registration statements (S-1) with investor disclosures. According to industry insiders, the duration of that process is unclear: the SEC corporate finance division may request updates in the coming days and weeks.

Andrew Jacobson, vice president and head of legal at 21Shares, has described the news as an "exciting moment for the industry at large" and "a significant step" toward ether ETF trading. Cboe Global's head of ETP listings Rob Morocco said the exchange believes spot ether ETFs will provide safeguards for US investors similar to those for spot Bitcoin ETFs.

For months, Polymarket bets on ether ETF approvals lingered close to 10-15%. On May 20 — three days before the first SEC deadline, Bloomberg analysts jacked the odds up to 75%, citing rumors about a pivot.

Crypto as a political issue?

On May 20, SEC officials asked the exchanges to promptly adjust their filings, sending them scrambling to do weeks of work in days. This change of heart came days after Donald Trump told supporters the Democrats wanted to "end" crypto.

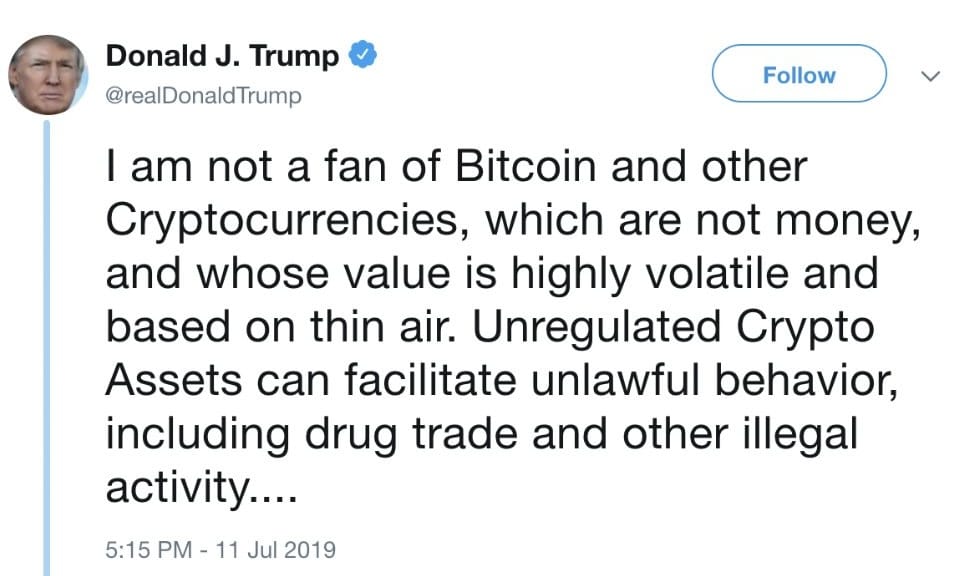

The former President was skeptical of crypto during his first term in office. Trump stated it was "based on thin air" and could "facilitate unlawful behavior" if unregulated. Later, he sold millions of dollars worth of NFTs.

Trump’s pro-crypto comments may have weaponized digital assets in the US presidential race. Although Joseph Biden nominated SEC Chair Gary Gensler, a strong crypto critic, the party is not unanimous on the issue. Earlier in May, Democrats in Congress joined Republicans in voting to overturn the SEC's SAB 121.

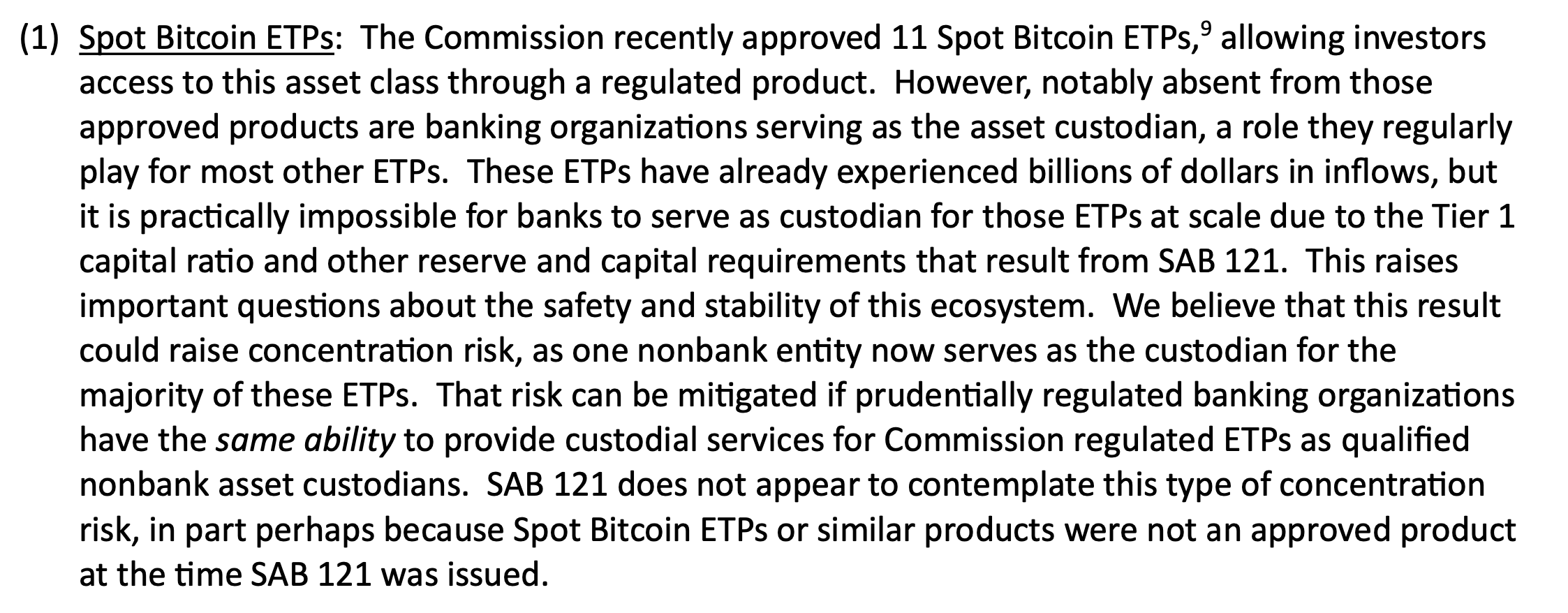

While officially non-binding, the Staff Accounting Bulletin is referenced by SEC employees. It limits institutions' opportunities to become crypto custodians, requiring them to report a liability and corresponding assets on the balance sheet for each custodied token.

The bipartisan support may have reflected the perception of the issue as an American rather than a partisan one. However, some of the Democrats may have voted 'aye' because Joseph Biden has vowed to veto the repeal resolution.

SAB 121, enacted in April 2022, was criticized by both bankers and blockchain industry players. In February 2024, the American Bankers Association, Bank Policy Institute, Financial Services Forum, and Securities Industry and Financial Markets Association signed an open letter to Gensler detailing the bulletin's adverse impact.

On May 22, 2024, the US House of Representatives passed The Financial Innovation And Technology for the 21st Century Act (FIT21). The regulation, which also secured bipartisan support with 71 votes from Democrats (from the 279 'ayes' total), should provide regulatory clarity for the industry and enhance user protection.

Perhaps most importantly, it may end the years-long clash over crypto control between the SEC and the CFTC. Gensler has criticized the bill for potential regulatory gaps and undermining "decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk."

SEC's criteria for approval

Concerning spot ether products, the SEC's main priorities are manipulation prevention, ensuring investor protection, and addressing risk concerns. The official document detailing its discussions highlights the following points.

Surveillance sharing with Chicago Mercantile Exchange (CME)

Section 6(b)(5) of the Exchange Act underscores the importance of surveillance-sharing agreements to detect and deter manipulation and fraud. All three exchanges maintain such contracts with the CME as members of the Intermarket Surveillance Group. However, although ETH futures contracts are traded on the CME, it does not conduct surveillance of spot ether markets, which raises concerns.

Market integrity and investor protection concerns

The SEC imposes requirements similar to those for spot Bitcoin ETPs based on Section 11A(a)(1)(C)(iii) of the Exchange Act.

Available pricing data

The pricing information available via the securities information processor must include quotation and last-sale data, with intraday indicative values (IIV) and net asset values specified on each product's website. IIV must be disseminated by major market vendors and updated every 15 seconds during regular trading hours.

Transparent portfolio holdings

Regular disclosures must include the amount of ETH and cash and cash equivalents, if any. They must be updated daily and shared via each ETP's website and financial information providers.

Surveillance procedures and sharing with other regulated markets

Counteracting manipulation and fraud goes beyond the CME. The exchanges must share surveillance data with other markets based on similar agreements, specifying trading halt and suspension conditions.

Volatility and risk

The Other Comments section of the analysis mentions the risks of merging crypto and TradFi. Citing potential threats to "retail investors and the broader financial system," one commenter notes that ether's price volatility may have far-reaching implications.

Like with the Bitcoin-linked counterparts, the potential divergence of the ETP prices from the coin prices may "cause stress for institutions heavily exposed to" or reliant on the ETPs.

The commission concluded that the exchanges' proposals met the requirements on fraud and manipulation, but did not address the volatility concern directly. Yet, as Forbes noted, its potential effects "remain largely unexamined and unaddressed," and disregarding them may trigger a "repeated 2007-2008 on a much larger scale."

Controversy of Ethereum staking

Another source of contention is the practice of locking up ETH in return for rewards. Last year, the SEC cracked down on staking, imposing a $30 million fine on the Kraken exchange. The CEX was forced to discontinue its staking-as-a-service program in the US.

US spot ETF issuers, including Ark Invest and Fidelity, no longer plan to stake the coins purchased for the funds. This concession makes their ETFs less appealing to buyers but more acceptable to the US regulators.

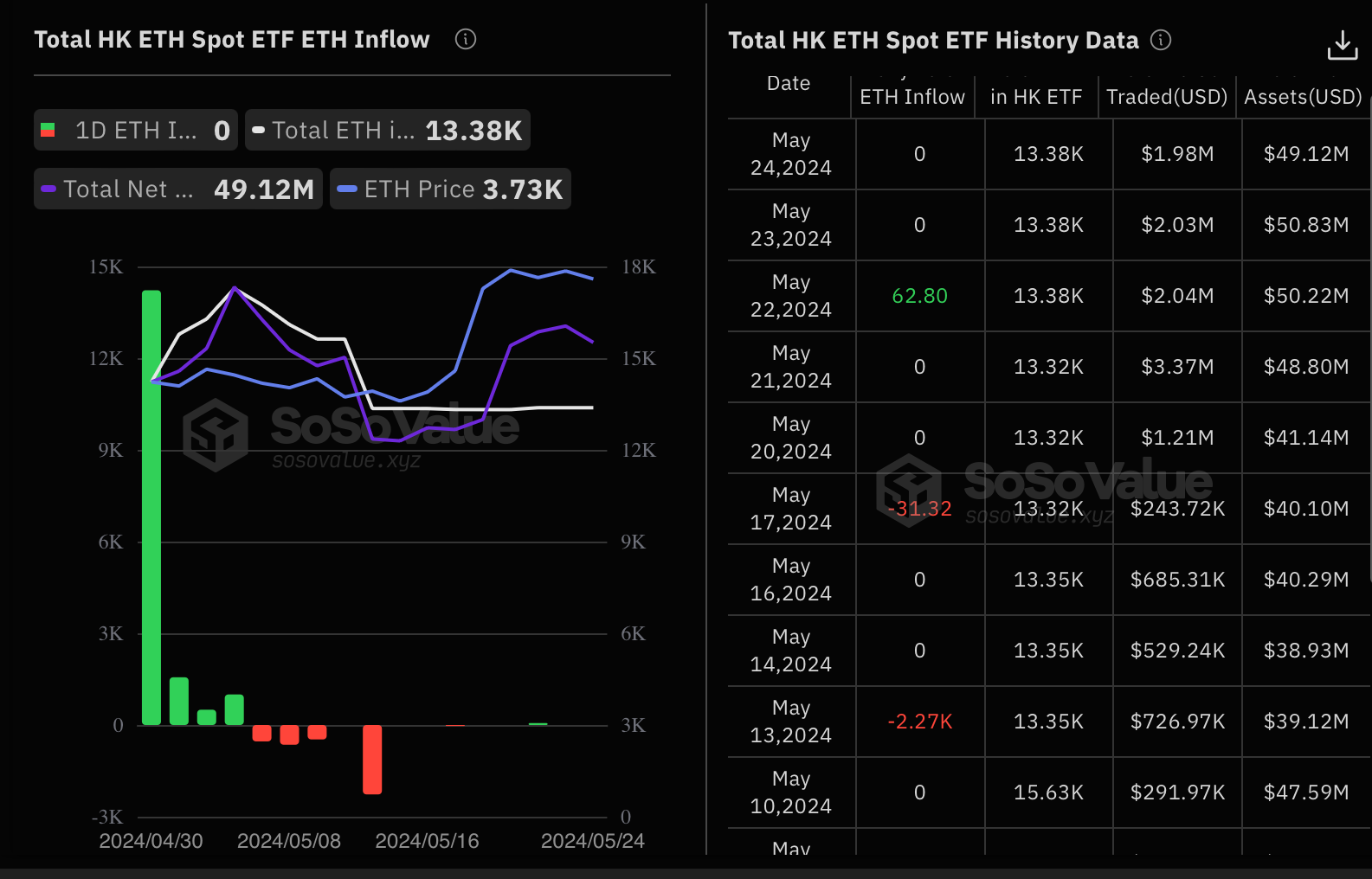

Meanwhile, Hong Kong's Securities and Futures Commission is in talks with local ETF issuers regarding the addition of ETH staking. Such services may be provided via licensed platforms, although it is unclear when a decision will be made.

Hong Kong has already launched sport ether ETFs, and staking would give it a head start over the US.

Is ether a commodity?

Legal experts note that the SEC’s approval does not make ether a commodity by default. On the contrary, it might still be classified as a security. Coinbase's Chief Legal Officer Paul Grewal has explained that using S-1 forms only guarantees that “these funds, by definition, do not include assets that have more than 40% of their portfolio in securities."

While ETH may or may not be labeled a commodity, staked ETH is another complex matter. The SEC’s lawsuits filed in recent years suggest it may treat staked ether separately, likely as an investment contract and security.

Thus, while ether's status as an investment asset is getting clearer, many questions remain. Some of them may be resolved after the passing of the FIT21 bill, which could end the "food fight for control" over crypto between the SEC and the CFTC, according to Republican Rep. Patrick McHenry.