Strategic insight into Bitcoin halving 2024: Comprehensive analysis

With the fourth Bitcoin halving close in sight, cryptocurrency traders anticipate positive shifts in market dynamics. The quadrennial event has many intricacies – and this cycle is unique in multiple ways.

While halving drastically reduces block rewards and Bitcoin’s supply, its price impact largely depends on the broader context. In this guide, we delve into the nuances of the 2024 halving for clues to Bitcoin's future behavior.

Institutional embrace of Bitcoin halving cycles

The periodic halving of rewards is a fundamental design mechanism. It curtails the number of newly created bitcoins. Satoshi Nakamoto, the enigmatic creator of Bitcoin, outlined this process back in 2009, setting the stage for a four-year price cycle.

"Total circulation will be 21,000,000 coins. It'll be distributed to network nodes when they make blocks, with the amount cut in half every four years. First four years: 10,500,000 coins. Next four years: 5,250,000 coins. Next four years: 2,625,000 coins. Next four years: 1,312,500 coins. Etc. . . ." — Satoshi Nakamoto, The Cryptography Mailing List, January 8, 2009

As the reward shrinks from 6.25 BTC to 3.125 BTC per block on April 19, 2024, miners of all sizes will face a notable challenge. The cost of mining a single block profitably, estimated to be at least $10,000-$15,000 in 2023, will surge post-halving. Smaller rigs using more expensive power may be shut down as a result.

Projections from industry experts, such as CoinDesk, suggest the costs could soar to $40,000 per coin, highlighting the complexities miners navigate. Large firms have long been preparing for the event by selling BTC holdings, upgrading equipment, and fundraising through public equity offerings.

Thus, the cost dynamics of mining and the supply of Bitcoin will radically shift. Institutional traders must be aware of the potential outcomes – and while past performance is not guaranteed to repeat, the previous cycles are worth looking into.

Beyond scarcity: Context considerations

While the scarcity narrative remains pivotal, Bitcoin is moved by factors beyond its tightening supply. Lower inflation resulting from slower coin minting theoretically boosts demand, but the correlation is far from straightforward.

- Bitcoin is susceptible to events affecting other risk assets, such as the Federal Reserve’s response to inflation, regulatory developments, geopolitical tensions, etc. Its price rises on news that underscores its potential as an alternative store of value – and indirectly benefits from influxes into other tokens.

- Security breaches and high-profile bankruptcies have brought the market down in the past.

There are no black swans this time; spot Bitcoin ETFs are outperforming gold funds, and the context looks overwhelmingly positive. That said, institutional investors must be mindful of the nuances within and outside the industry.

The efficient market theory suggests that as the halving is public knowledge, its effects should be priced in. Yet Warren Buffet's cautionary words ring true. The market is not always efficient – and if people think otherwise, investing is like playing bridge with someone unwilling to look at the cards.

Historical perspective and macro insights

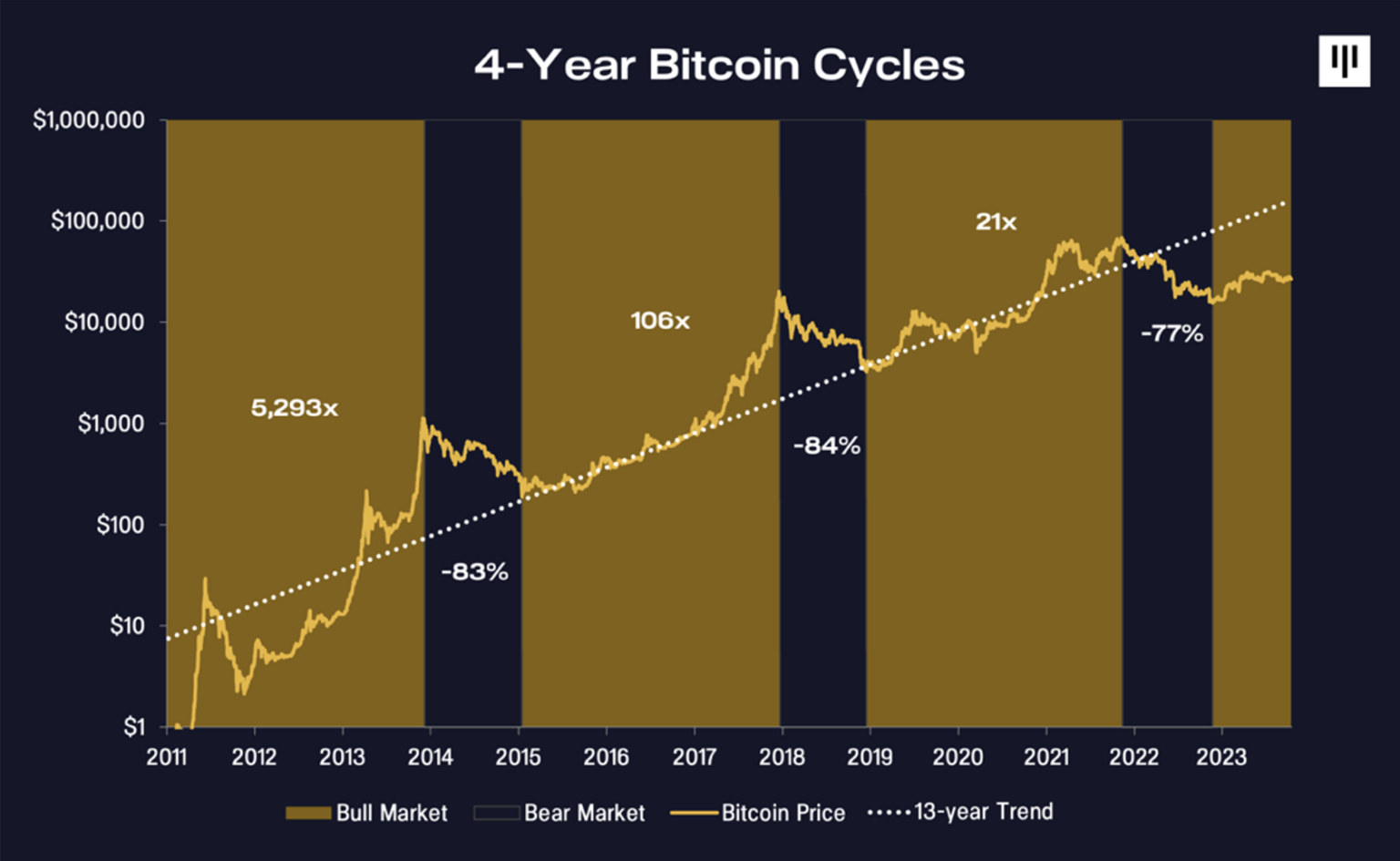

Adopting a historical lens, we must contextualize Bitcoin's halving cycles. All past events were accompanied by fundamental changes bringing direct or indirect benefits to the pioneering cryptocurrency.

Challenging economic conditions highlight Bitcoin's potential as an alternative to traditional assets, and general crypto enthusiasm is also conducive to growth.

- Following the 2012 halving, the EU debt crisis was in full swing. Bitcoin skyrocketed from $12 to $1,100 by November 2013.

- The 2016 halving coincided with the Initial Coin Offering (ICO) boom, leading to a rise from $650 to $20,000 by December 2017.

- In 2020, inflation fears triggered by the COVID-19 pandemic and lockdowns drove BTC to spectacular highs. From $8,600, it reached an all-time high of $69,044.77 in November 2021.

Retrospective analysis provides valuable insights into potential market reactions. By understanding how Bitcoin has behaved in the face of uncertainties, traders gain a strategic advantage in anticipating price trajectories.

Dissecting past performance: key takeaways

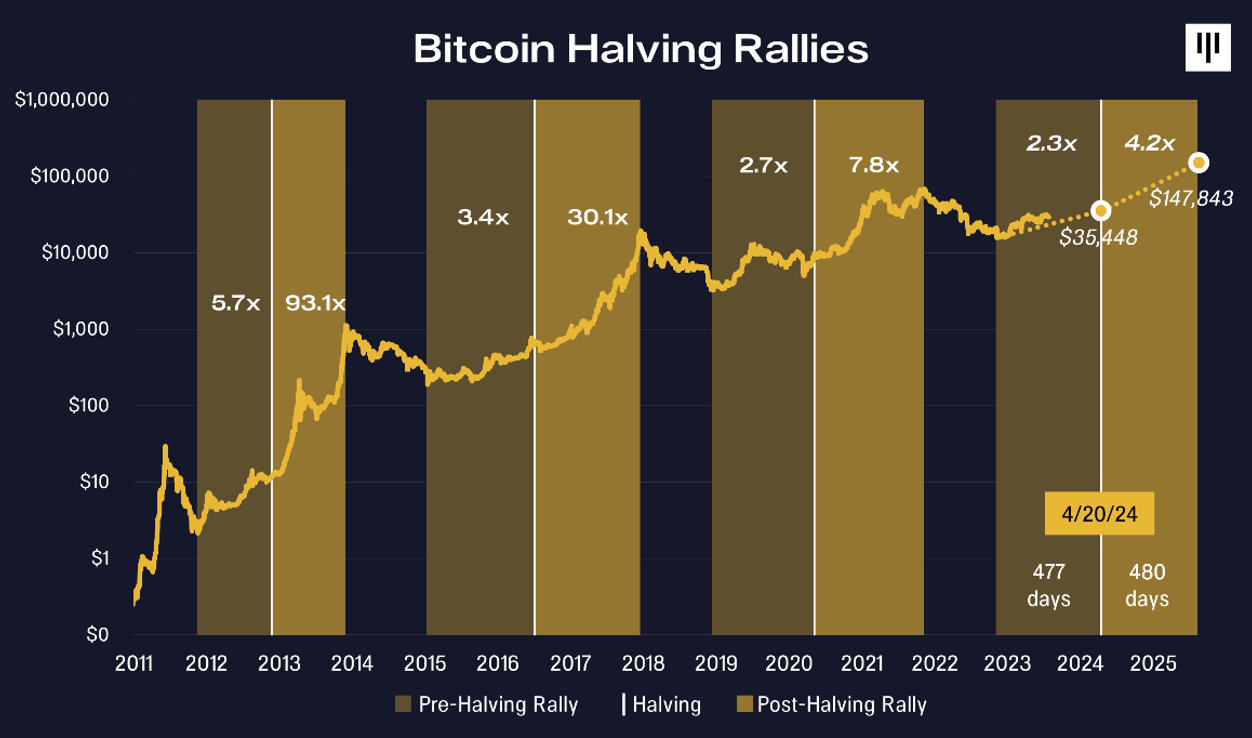

The timing of highs and lows around halvings suggests that BTC tends to rebound from its low long before the cuts. Typically, it rebounds 12–16 months ahead of each event.

According to Pantera analysts, the ensuing rally lasts an average of 480 days, ending at the peak of the subsequent bull cycle. If the pattern holds, this post-halving rally will last until November 2025.

One of the biggest questions is whether BTC will return to its all-time high of $69,000, observed in November 2021. Will it gain sufficient momentum?

The track record indicates that BTC gained over 30% in the eight weeks preceding the halving during previous cycles. Given the current price of $51,166.43, if this trend repeats, we may anticipate a potential rally toward the last all-time high before the 2024 halving.

This view is supported by 10xResearch. According to its founder, Markus Thielen, such probability increases as the big day approaches. On February 19, the research firm reported that Bitcoin's 14-day RSI (Relative Strength Index) had crossed above 80 — a pattern presaging 60-day gains of over 50% in the past.

The last time BTC's 14-day RSI went that high was in December 2023. As of February 22, it has descended to 67.60%, just below the threshold of solid upward momentum (70).

Supportive institutional context: Bitcoin ETFs

Goldman Sachs acknowledges the start of crypto's institutional era in 2023 with the spread of regulated derivatives venues like Coinbase Derivatives and Eurex. The trading of Bitcoin and ether futures on CME also reflects this growing institutional involvement. By Q4, it became the top exchange for BTC futures by open interest.

According to the CME report, "October price action brought along interest from institutional investors, who took the opportunity to position themselves for a potential spot BTC ETF approval and/or hedge exposure via derivatives."

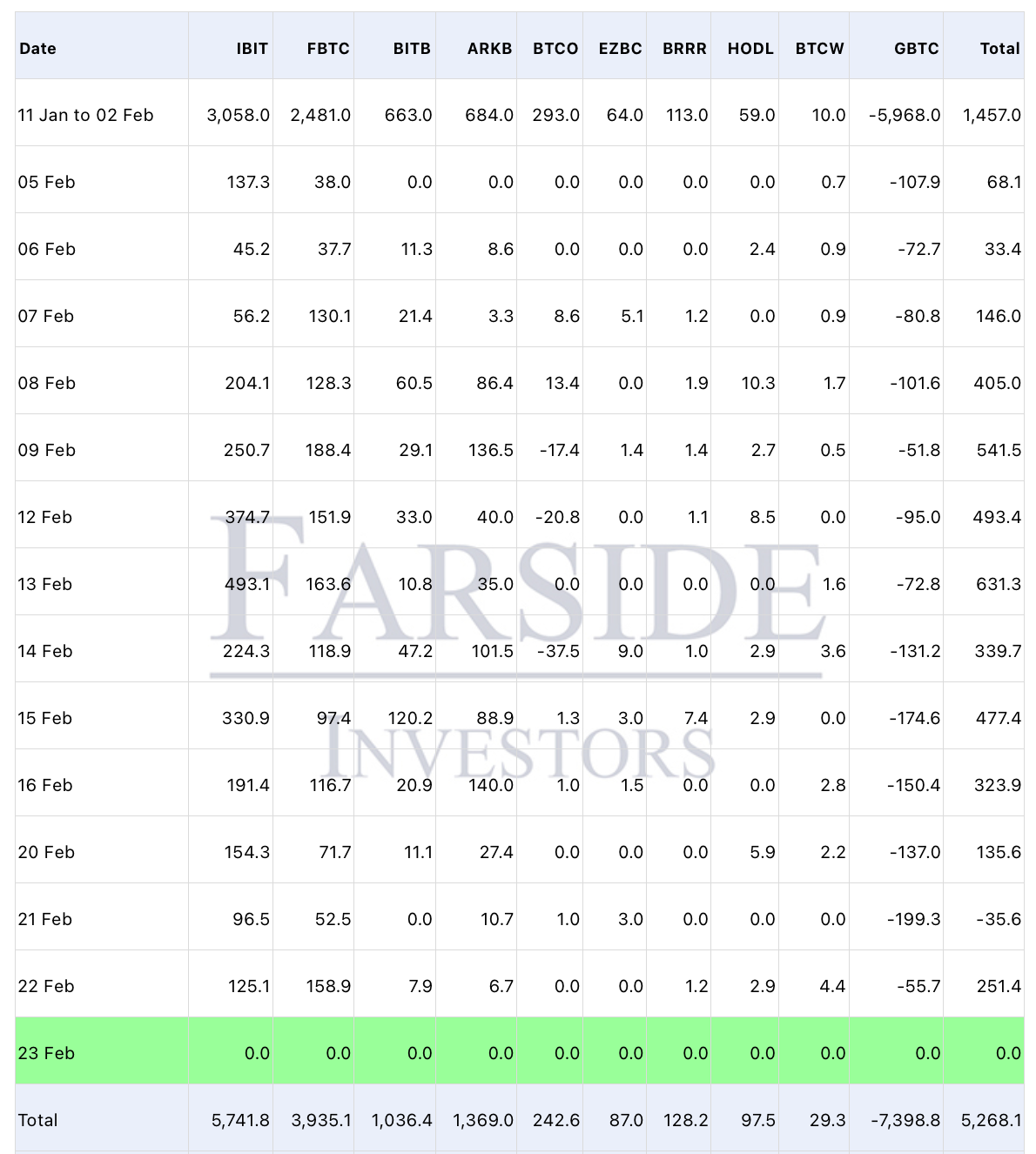

The adoption of spot Bitcoin Exchange-Traded Funds (ETFs) benefits the pioneering crypto in several ways, and their performance is worth tracking closely. On February 20, 2024 – just over a month after launch – the funds boasted over $5 billion in total net inflows.

Despite the massive outflows from Grayscale's GBTC, the ETFs are doing well, surpassing gold ETFs. As they provide exposure to Bitcoin without direct ownership, their importance for adoption cannot be understated.

Another, less salient aspect is the mitigation of sell pressure. Assuming all newly minted bitcoins are sold, the current block reward of 6.25 BTC amounts to an annual pressure of $14 billion (per Grayscale's calculations based on $43,000 per Bitcoin).

With the reward slashed in half, the pressure will be half as strong, so it will be easier to offset it. According to Grayscale's estimates, Bitcoin ETFs are poised to absorb it fast – the first 15 trading days offset roughly a third of that potential post-halving pressure.

Projections for 2025: Institutional insights

As institutional traders look further ahead, various projections are considered. Predictions by experts and research institutions generally suggest an optimistic range of $150,000-$200,000 by mid-2025.

Institutional perspectives emphasize order book liquidity, the highest since October 2023, thanks to the return of mom-and-pop traders and the ongoing rally in the buildup to the halving. Bernstein, a prominent institution, expects BTC “to touch a cycle high of $150,000 by mid-2025 and touch all-time highs in 2024.”

Anthony Scaramucci, founder of Skybridge Capital, projects a higher high of $170,000 or above by July 2025, multiplying the price at halving by four. “Wherever the price is on the day of the halving in April, multiply it by four, and it’ll reach that price in the next 18 months,” he explained.

Institutional traders take note of these projections, considering the potential market cap rise to half that of gold, as noted by Scaramucci. That would require the current market cap to grow more than sixfold to around $6.5 trillion.

Skepticism and short/medium-term factors

That optimism is not unchallenged. Rachel Lin, CEO of SynFutures, notes that the halving alone is unlikely to drive a full-blown bull run. Although the general context looks positive, more support is needed.

According to Lin, US regulators are unlikely to introduce adverse measures during the election year. Still, institutional caution is warranted, and factors such as crypto adoption, regulatory changes, and geopolitical events must be considered.

CCN has identified key factors affecting BTC in the short and medium term. Growing institutional adoption, positive technical indicators, and the rebounding price are perceived as positives. However, concerns ranging from regulatory shifts to competition from Central Bank Digital Currencies (CBDCs) and security breaches are recognized as potential negatives.

Signs of market maturation

Bitcoin's on-chain metrics, including the MVRV Z-score and Power Law Corridor, provide insights into its potential future. The MVRV Z-score, indicating market cycles and profitability, suggests a maturing market with gradual climbs becoming more likely than sharp surges.

As the crypto market evolves, price swings become milder while the potential for long-term growth strengthens.

Perspectives on miners and Bitcoin's future

Miners are crucial in securing the Bitcoin blockchain and verifying transactions, ensuring its truly decentralized operation. However, the BTC price must justify their costs to incentivize them.

Larger miners, well-prepared for the halving, are proactively building reserves. Smaller miners with higher operational costs and fewer efficiency avenues may struggle and eventually shut down their rigs – unless BTC surges high enough post-halving.

To stay competitive, miners acquire enhanced equipment, sell holdings on-chain, and explore equity offerings. Institutional traders observe the strategies of major mining companies like Hut8, Marathon Digital, and Core Scientific. They are adapting to the changing landscape, focusing on efficiency and sustainability.

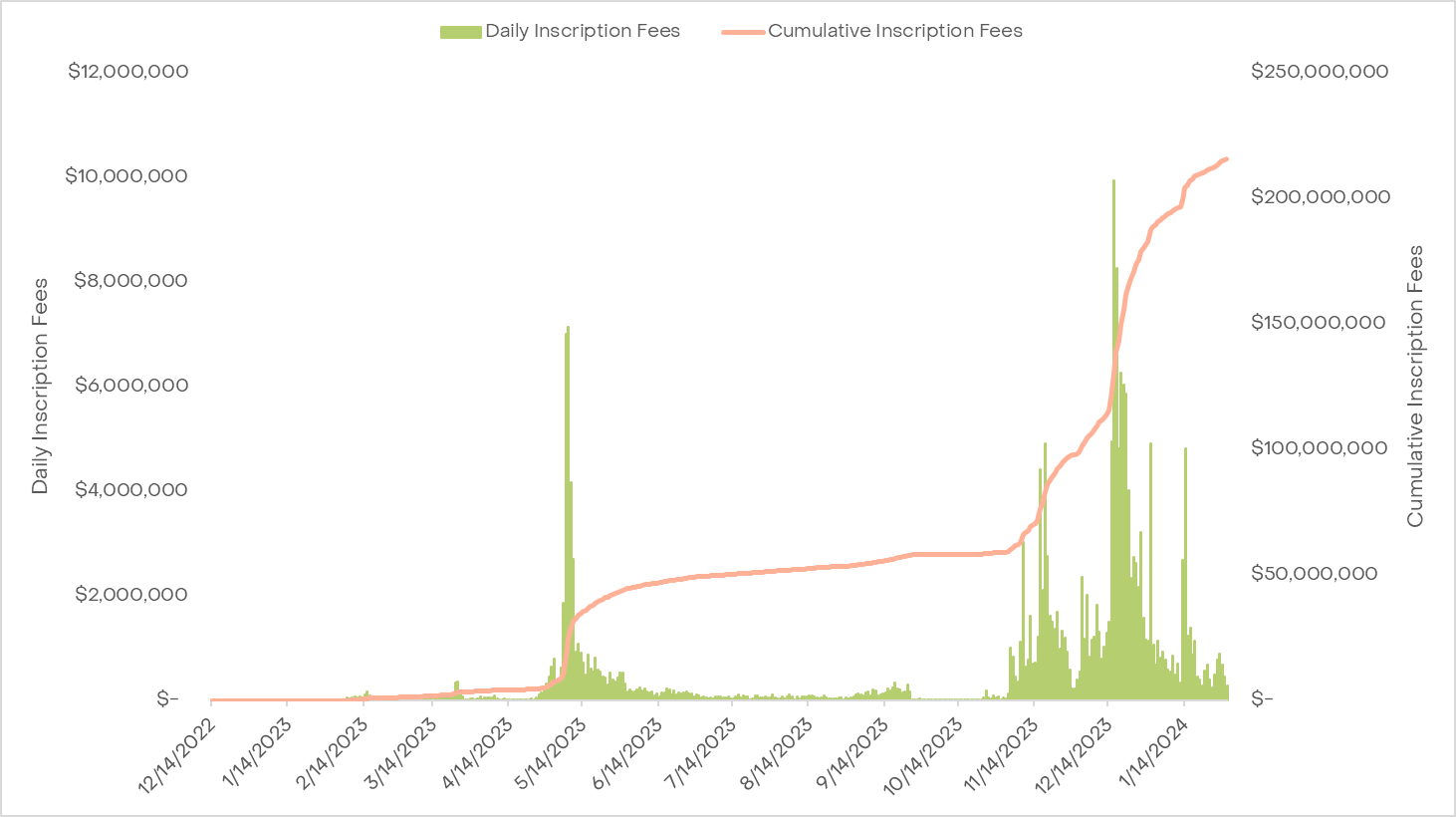

Bitcoin's own NFT protocol – Ordinals – plays a significant role in supporting their profitability.

How Bitcoin Ordinals & NFTs affect miner revenues

The substantial impact of Bitcoin NFTs provides additional reasons for institutional optimism regarding mining revenues. It has dramatically increased transaction fees and developer activity, with the former hitting a two-year high of $37 in November 2023.

That hike triggered a price surge for crypto mining stocks as the revenues nearly quadrupled. Transaction fees constitute a significant share of miners' revenues. As of this writing, the shares of Marathon Digital – the top miner by hash rate – are up 268.22% YoY, dramatically outpacing Bitcoin (+121.39% YoY).

Miners' carbon footprint in the crosshairs

In recent months, mining businesses in the US have faced sharp criticism from politicians and the media, including giants like The New York Times. Environmental concerns are emphasized by entities like the Energy Information Administration, which has made energy use reports mandatory.

Regulatory scrutiny is increasing with Bitcoin's energy consumption comparable to entire countries, including Australia. Yet, as stated above, the government is unlikely to introduce stringent restrictions in 2024 due to the US elections.

The Biden Administration is generally skeptical of crypto despite the SEC's approval of spot Bitcoin ETFs. Coupled with demand response programs in New York and Texas, its stance shapes institutional perspectives on the long-term sustainability of Bitcoin mining.

Institutional outlook on Bitcoin's future

The prospects remain optimistic as institutions navigate Bitcoin’s halving cycles, historical patterns, market dynamics, and macroeconomic context. The adoption of Bitcoin ETFs, miners' reserve-building strategies, and positive on-chain metrics contribute to the positive sentiment.

While recognizing skepticism and potential challenges, experts anticipate a post-halving rally, with projections ranging from $150,000 to $200,000 by mid-2025. As the institutional landscape evolves, Bitcoin's future trajectory is shaped by factors beyond scarcity, underscoring the importance of a holistic approach in institutional trading strategies.