Top 10 corporate Bitcoin holders in 2024

High-profile businesses hold significant amounts of Bitcoin, seeking to capitalize on the expanding market. The launch of spot ETFs and crypto accounting changes have bolstered corporate interest. More and more firms keep BTC on their balance sheets — discover the top ten owners in this guide.

Institutions hold the most BTC

As of May 2024, around 106 million people use Bitcoin. It has established itself as a revolutionary force with 460 million wallet addresses and roughly half a million transactions daily.

Corporate entities, including miners and institutions, hold most of the circulating Bitcoin. Crypto exchanges also store users' coins in cold storage for security purposes.

Crypto on balance sheets

Public companies started tapping into Bitcoin during the 2021 boom times. Some of them leveraged it as a hedge against inflation, while others sought additional profit.

Under the current FASB (Financial Accounting Standards Board) rules, firms must include a loss in earnings reports if their BTC holdings drop in value during a given time. Yet they cannot book a profit if the price rises.

From December 15, 2024, they will be able to record BTC at fair market value. This change should encourage the inclusion of crypto into more corporate treasuries.

Top 10 Bitcoin wallet addresses

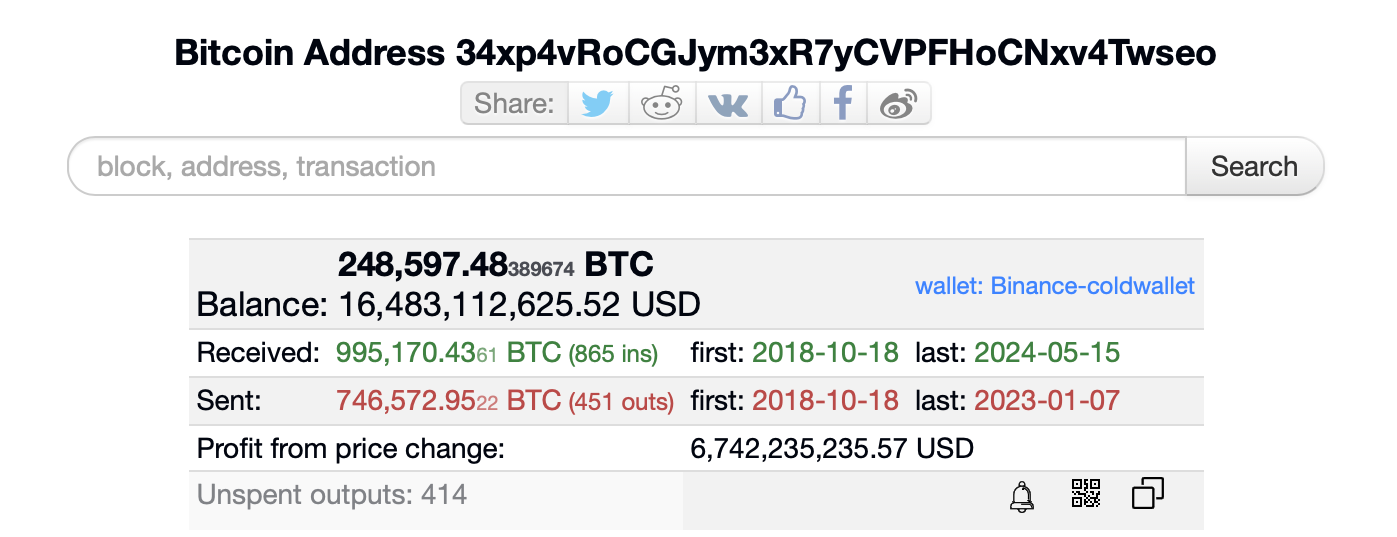

The distribution of Bitcoin among wallets is always in flux as coins move from one address to another. As of May 17, 2024, blockchain explorers show that the top ten Bitcoin addresses hold between 69,370 BTC and 248,597 BTC.

- Binance (cold wallet) — 248,597.48 BTC

- Bitfinex — 180,010.07 BTC

- Robinhood — 136,295.81 BTC

- FBI (funds stolen in the 2016 Bitfinex hack) — 94,643.30 BTC

- Binance (cold wallet) — 82,833.46 BTC

- Mt. Gox hacker (anonymous) — 79,957.26 BTC

- Unidentified holder — 78,317.03 BTC

- Tether (cold wallet) — 75,354.08 BTC

- Binance (cold wallet) — 75,177.38 BTC

- FBI (Silk Road funds) — 69,370.17 BTC

While Bitcoin transfers are semi-anonymous, they become traceable once the wallet address is shared. Blockchain analytics firms like Elliptic or Chainalysis link wallets to real-world identities, aiding investigators, regulators, and compliance teams in crime detection and prevention.

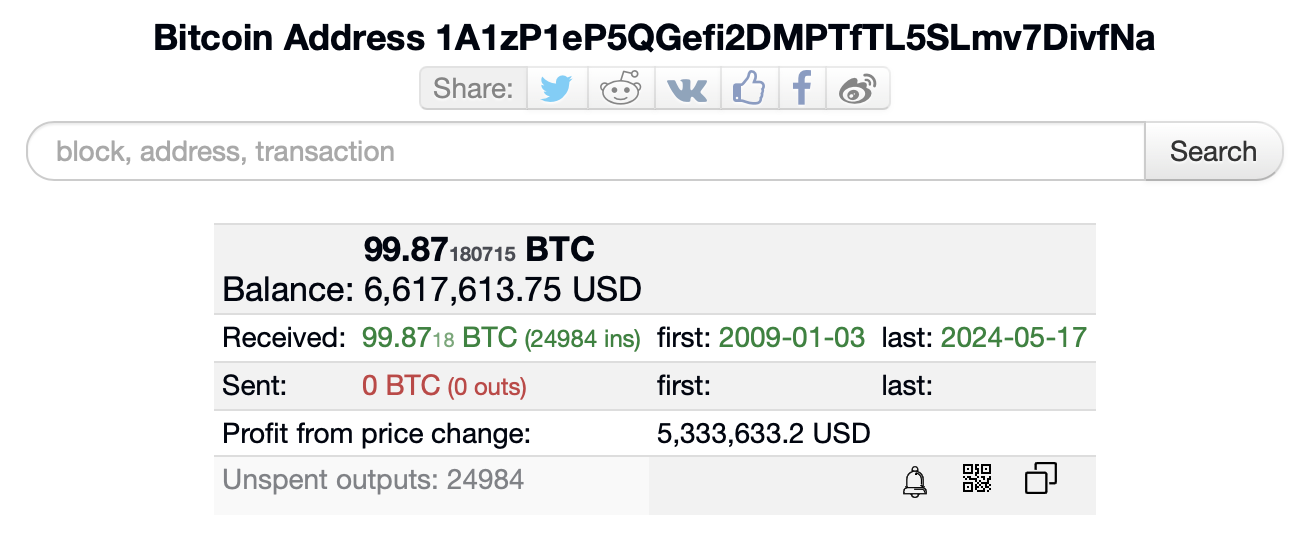

Satoshi Nakamoto's Bitcoin wallet

The true identity of Bitcoin's enigmatic creator, Satoshi Nakamoto, remains unknown, but he is speculated to own around 1 million BTC. Satoshi mined the first block — the Genesis Block — on January 3, 2009, and the linked address is 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.

This wallet holds approximately 99.84 BTC, with no outgoing transactions recorded. However, Satoshi likely controls hundreds or even thousands of other addresses.

Companies’ direct and indirect exposure to Bitcoin

The launch of spot Bitcoin ETFs in the US and Hong Kong has accelerated corporate adoption. ETFs offer a regulated, familiar, and convenient way to invest, further integrating Bitcoin into mainstream finance.

Investing goes far beyond storing BTC in crypto wallets. Aside from ETFs (spot and futures), firms may opt for shares of companies with significant BTC reserves and funds investing in blockchain technology.

Recent 13F SEC filings for US spot Bitcoin ETFs reveal 937 US firms with exposure in Q1 2024. In contrast, gold ETF attracted just 95 firms in their first quarter.

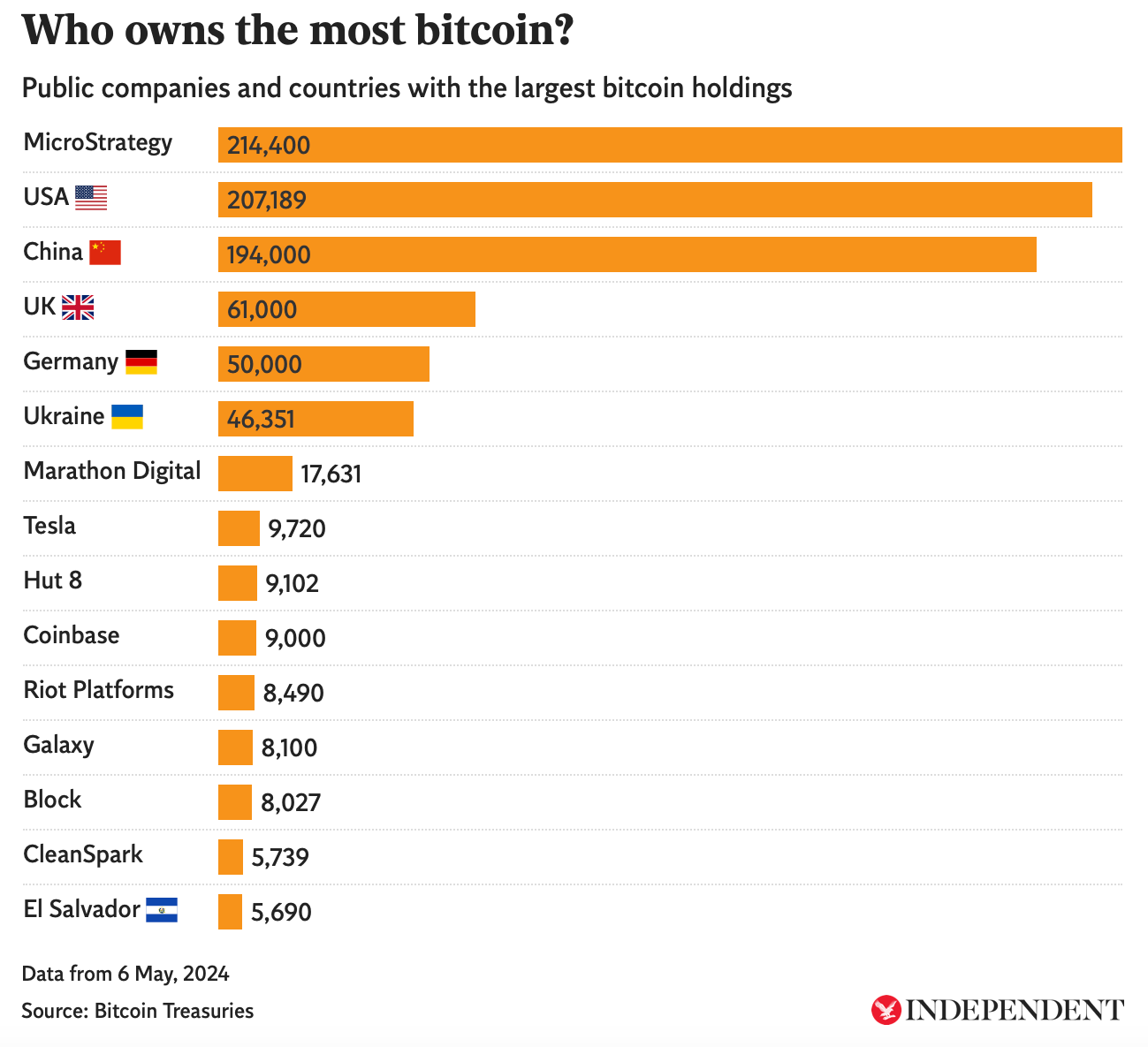

Top 10 publicly listed Bitcoin owners

BitcoinTreasuries.com keeps an up-to-date list of corporate BTC holdings. Here are the leading investors as of May 17, 2024.

- MicroStrategy Incorporated (MSTR)

MicroStrategy, a software giant led by cryptocurrency proponent Michael Saylor, is the largest Bitcoin holder. According to its Q1 2024 financial report, the company owns 214,400 BTC following its latest purchase in April.

At current prices, MicroStrategy's Bitcoin holdings are valued at approximately $13.5 billion, with an estimated paper profit of about $6 billion. Once a dot-com entrepreneur who lost $6 billion in a single day, Saylor has capitalized on Bitcoin rallies, driving his company's stock price to new heights.

With over 1% of all bitcoins in circulation, MicroStrategy holds more Bitcoin than any individual country, and its stock offers indirect Bitcoin exposure to traditional investors. The impressive 127.98% year-to-date rise has earned it a spot in the MSCI World Index, effective May 31.

2. Marathon Digital Holdings, Inc. (MARA)

Marathon Digital Holdings is a leading US-based Bitcoin mining firm. As of April 30, 2024, it owned over 17,631 BTC, valued at more than $1.5 billion, following the sale of approximately 600 BTC earlier in the month.

The company fell short of its Q1 2024 revenue targets, mining 34% less Bitcoin due to equipment failures, maintenance issues, and weather-related challenges. Its underperformance has driven a -16.35% dip in the stock price year-to-date.

The company intends to liquidate more of its Bitcoin holdings to "support monthly operations, manage its treasury, and for general corporate purposes."

3. Tesla, Inc. (TSLA)

In February 2021, Tesla, led by Elon Musk, invested $1.5 billion in Bitcoin to diversify and enhance cash returns. In the subsequent year, it sold 75% of its BTC holdings, citing liquidity concerns related to China’s coronavirus shutdowns.

According to Arkham's estimates, by April 2024, Tesla retained around 11,509 BTC. The Q1 balance sheet showed no change in net digital assets since Q4 2022, with Bitcoin making up most of these assets.

Despite accepting DOGE for merchandise payments, Tesla holds only a minimal amount of the memecoin. Its stock performance has declined in 2024, with 29.64% shed as of writing.

4. Hut 8 Corp. (HUT)

Hut 8, a Canadian Bitcoin mining company, is one of the two non-US entities on the list. It is the second publicly traded miner, with approximately 9,100 BTC in its possession.

A Benchmark report highlights that these holdings provide a "sizable liquidity cushion and the ability to capitalize on Bitcoin price rallies." The coins are worth around $592 million and represent about 82% of Hut 8's market capitalization.

This year, the company has faced financial headwinds, with its stock plummeting 33.13% at press time.

5. Coinbase Global, Inc. (COIN)

Coinbase is the largest publicly traded cryptocurrency exchange worldwide, holding over 9,000 BTC. The platform is a major industry player, catering to retail and institutional investors who keep hundreds of thousands of BTC in its custody.

Since early 2024, Coinbase's stock has climbed despite regulatory pressure from the SEC. The price has risen 14.52% year-to-date, buoyed by Bitcoin’s upswings.

6. Riot Platforms, Inc. (RIOT)

One of North America's biggest publicly traded miners boasts a stash of 8,872 BTC. Based in Colorado, it accumulates BTC through extensive activities, operating the continent's largest facility by mining capacity.

Although Riot Platforms's crypto holdings are limited to BTC, it also conducts electrical switchgear engineering and fabrication operations. After producing 41% fewer coins in April and with a -35.36% stock plunge this year, Riot Platforms may be compelled to sell some of its bitcoins.

7. Galaxy Digital Holdings Ltd. (BRPHF)

Founded by early Bitcoin adopter Michael Novogratz in 2018, Galaxy Digital has accumulated much of its holdings thanks to the CEO's involvement. In 2022, it acquired Helios, a vast 160-acre Bitcoin mining facility in Texas.

The asset manager ramped up its Bitcoin investment in 2023, bringing the total to approximately 8,100 BTC. Galaxy Digital pursues a diversified strategy, mitigating risk by investing in other cryptos through its DeFi and Web3-focused funds. As of May 17, 2024, its stock price is up 18.61% YTD.

8. Block, Inc. (SQ)

Block, Inc., formerly Square, Inc., is a fintech conglomerate led by Twitter co-founder Jack Dorsey. Its Block subsidiary first reported a Bitcoin balance in 2020 and has since amassed 8,027 BTC, or 0.038% of the total supply.

These holdings represent roughly 9% of the total cash, cash equivalents, and marketable securities. In Q4 2023, Block made $66 million in gross profit on BTC sales through its Cash App, a P2P money transfer app. It also provides Bitkey, a self-custody BTC hardware wallet. The stock price is at -7.21% YTD at press time.

9. CleanSpark Inc. (CLSK)

The self-branded America's Bitcoin Miner™ focuses on sustainable practices and low-carbon power to support the network. It closed 2023 with a 1,200% growth on the BTC treasury and now holds 5,739 BTC.

CleanSpark's operations grew significantly in April 2024. It mined 721 BTC in total, leveraging facility expansion, efficiency improvements, and the hike in transaction fees after the fourth Bitcoin halving. As a result, the stock price has risen 49.32% since the beginning of the year.

10. Bitcoin Group SE (BTGGF)

This venture capitalist firm is based in the German city of Herford. According to its website, it is the sole shareholder of Futurum Bank AG, which operates a crypto trading center, exchange, and broker, Bitcoin.de.

Bitcoin Group SE focuses on crypto and blockchain innovation, acquiring, selling, and managing investments. The 3,830 BTC on the balance sheet aligns with its mission to support the industry. This year, it has enjoyed a stock rally, gaining 73.49% by May 17.

Final words

Institutional adoption is changing Bitcoin’s user base and transaction dynamics. Mining and fintech businesses, exchanges, and ETF investors drive substantial engagement, leading to a broader and more complex ownership landscape.

Bitcoin's integration into institutional portfolios is evident and evolving. Its pace underscores its growing acceptance as a legitimate and valuable asset in the financial world.