Where to buy spot ether ETFs?

In a surprise move, the US Securities and Exchange Commission (SEC) greenlit nine spot exchange-traded funds linked to Ethereum's coin on July 23, 2024. Following the success of spot Bitcoin ETFs, these products offer another opportunity to diversify portfolios. Here is where and how to invest in them.

How spot ether ETFs work

Spot ether ETFs combine a familiar, convenient, and regulated investment vehicle with the advantages of the second-biggest cryptocurrency by market cap. Access does not require crypto wallets or accounts — it is as easy as buying stocks.

As opposed to futures ether ETFs, holding contracts linked to ether's value, spot ETFs enable direct investment. Like any financial product, these novel funds entail specific risks.

How to access spot ether ETFs

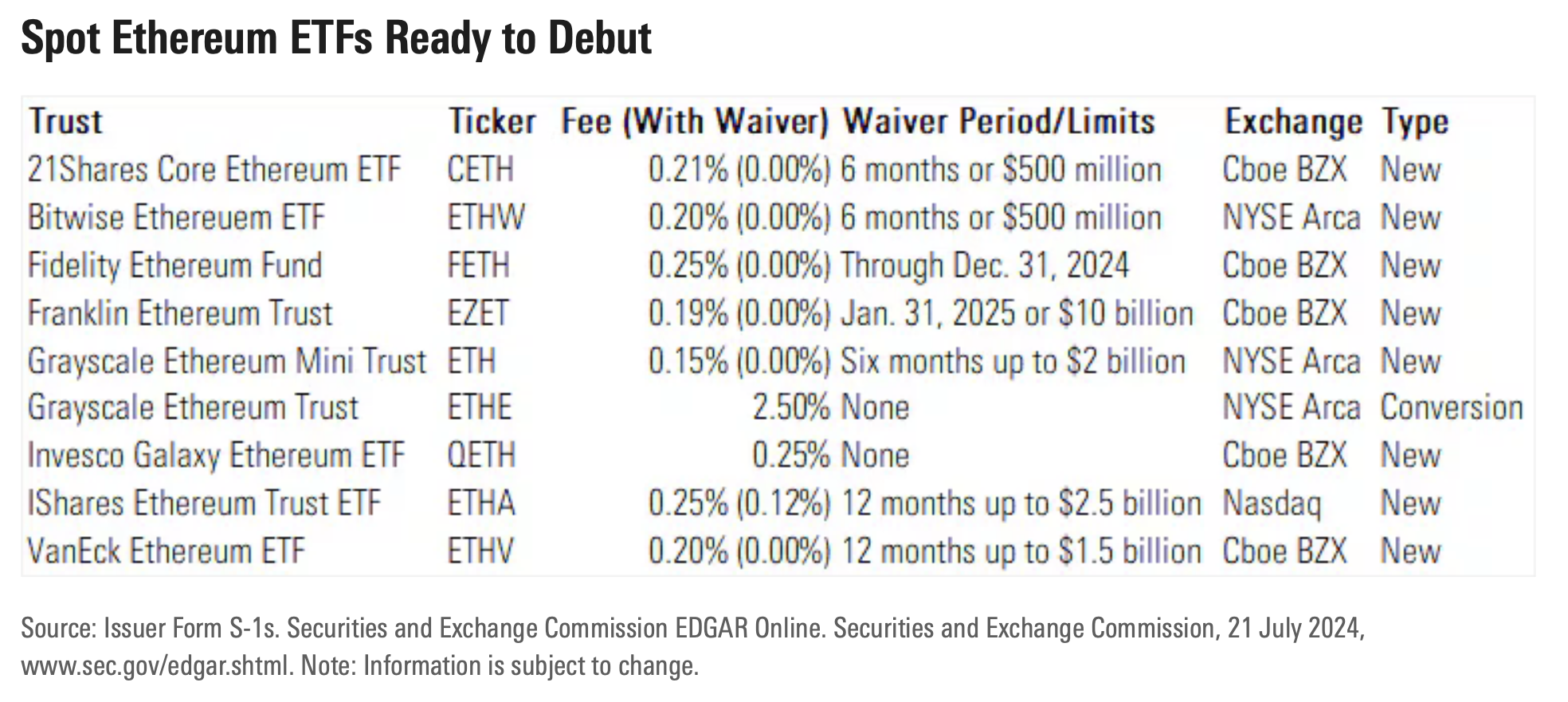

Spot Ethereum ETFs are available for trading on conventional exchanges, including Nasdaq, Cboe BZX, and NYSE Arca. They are also found in offerings from traditional online brokerage platforms and robo-advisors, with IRAs and 401(k)s potentially following, similar to Bitcoin-linked counterparts.

Five steps to investing in spot ether ETFs

Select a product within your budget, dissecting the costs carefully. Some issuers grant fee waivers for meeting specific criteria or buying their ETF early — like Fidelity, waivering all spot ether ETF fees until December 31, 2024. Here are the basics.

- Registering a brokerage account. Research the costs and platform features in advance to ensure they match your style and strategy. Opening an online account requires basic personal information.

- Funding your account. Check the minimum deposit requirement before making your first transfer. Make sure the amount is sufficient to cover any applicable fees.

- Choosing an ETF. At press time, only nine products have been approved by the SEC. When comparing your options, focus on higher trading volumes and assets under management (AUM), along with fees.

- Placing an order. As with stocks, place a buy order for your selected fund — an immediate market order or a limit order to secure a specific price.

- Tracking investments. Despite delegated management, investors should still keep an eye on ETF performance and ETH price charts, monitoring related news for factors that may trigger volatility.

Factors to consider before buying

Ether’s inherent volatility makes ETFs more suitable for those with higher-risk appetites. At the same time, they are generally more stable than the underlying asset. To make informed choices, consider your portfolio goals, issuers’ fees, and value structure:

Net asset value

Primarily, investors should focus on the net asset value (NAV), calculated as assets minus liabilities. The shares trade at the per-share NAV (NAV divided by the number of outstanding shares), which may change daily. Considering fees, those on a limited budget may opt for a lower value.

Management fees

Applicable fees vary. For instance, BlackRock's spot product — the iShares Ethereum Trust ETF — imposes a sponsor fee of 0.25%, which Fidelity and Invesco's ETFs do not have.

However, the latter issuer charges a separate 0.25% management fee on its Galaxy Ethereum ETF. The gross and net expense ratios may also apply to some products.

Benefits of spot ether ETF investment

Investors can leverage Ethereum's growth and appeal through a familiar instrument without holding the underlying coin. Here are five top advantages:

Simplified and secure access. Investors can benefit from Ethereum's native currency without setting up exchange accounts or wallets, in a familiar environment with TradFi's safeguards.

Portfolio diversification. Crypto ETFs offer an easy way to diversify portfolios with digital assets, helping to harness crypto volatility for higher potential returns.

Early investment opportunity. As a recently launched product, ether ETFs offer an early way to tap into Ethereum’s potential as its mainstream adoption grows.

Regulatory oversight. The landscape of crypto regulation is still forming compared to traditional asset classes. Investing through ETFs provides more regulatory oversight than any crypto exchange.

Tax implications. In the US, tax gains on spot ether ETFs are lighter than on crypto, similar to those on conventional instruments like shares. With crypto, the IRS imposes taxes whether one owns, sells, or transfers it between wallets.

Drawbacks of spot ether ETFs

Regulatory controversy. Despite its spot ETF approvals, the SEC is yet to explicitly determine if ETH is a security or a commodity. The regulator dropped a case insisting on the former in June 2024, but it may eventually revisit it.

A security status or new lawsuit would impact the price of ETH as it happened with XRP — Ripple Lab's legal battle with the SEC has continued for nearly four years.

Demand changes. Bitcoin is primarily regarded as a store of value, digital gold, and inflation hedge. Ethereum's utility-focused use cases differ, as the coin and network power a plethora of decentralized applications.

Demand for spot ETFs changes alongside that for the underlying asset. Solana, Toncoin, and other cryptos offer utilities that could eclipse those of ether in the long term. With the recent launch of spot Solana ETFs in Brazil, experts wonder how soon the USA could follow suit.

Expense ratios and fees. Buying and holding spot ether ETFs entails expenses. The costs may be prohibitively high for smaller investments, eroding any gains made.

Custody risks. The issuers must use the services of reputable custodians to hold the underlying ETH coins. The ETFs may collapse if those coins are stolen due to hacks or other attacks. Safeguarding ether requires multi-layered measures, as cyber criminals' strategies evolve, and self-custody may be preferable due to counterparty risk.

Alternatives to spot ether ETFs

Spot ether ETFs provide an accessible entry point into the crypto market with familiar products and brokerage platforms. They also mitigate exposure. Yet some investors may opt for alternatives:

- Direct buying. When bought directly, ether provides additional profit avenues, such as staking and airdrops. Furthermore, unlike traditional markets, crypto is traded around the clock. On the downside, geographic restrictions may apply, and managing a crypto exchange account is far riskier than using an established ETF brokerage.

- Futures ether ETFs. These ETFs hold ETH futures contracts instead of direct holding. The management costs and price discrepancies are generally higher, but so is safety, as no custody risks are involved.

- Crypto stocks. Shares of blockchain businesses, such as Coinbase, are another indirect investing method. Their stocks positively correlate with ether's price.

- Ethereum trusts and funds. The Grayscale Ethereum Trust is one of such alternative indirect investment vehicles. They issue a fixed number of shares, often with lower liquidity.

Final words

Nine US spot ether ETFs, recently greenlit by the SEC, offer a convenient and regulated avenue for exposure without the complexities of digital asset management. Accessible through established brokerages, they appeal to those looking to diversify portfolios and capitalize on ETH's price swings, albeit without additional opportunities like staking.

Past performance is not indicative of future returns, and potential investors must also weigh up factors like net asset value, management fees, custody, and the inherent volatility of ether before diving in. As the crypto landscape evolves, some regulatory uncertainties also remain, despite the SEC's approval.