Will pension funds embrace Bitcoin ETFs?

As spot Bitcoin ETFs go global, more entities explore the perks of indirect cryptocurrency exposure. Pension funds have cast their eyes on these products, and their entry could mark a watershed moment for institutional adoption.

Re-initiated discussions around Bitcoin

Major wealth managers, including BlackRock, have been educating institutions on ETF investment for years. A recent report by Fidelity Digital Assets — the issuer of The Fidelity Wise Origin Bitcoin Fund (FBTC) — underscores growing interest from pension funds. Conventionally known for cautiousness and conservatism, they are exploring this new terrain.

Pension funds' interest could spur an unprecedented tidal wave — and rallies — in the Bitcoin market. The US entities alone have over $6 trillion AUM. Allocations of a mere few percent would translate into billions of dollars in market inflows.

Fidelity Vice President Manuel Nordeste has said, "Now, we're starting to have conversations with the larger, real money institutional investor types, and we're getting some of those clients, as well as corporates and so on."

According to BlackRock, such conversations revolve around ways of allocating to Bitcoin and other opportunities from a portfolio construction perspective. Robert Mitchnick, its head of digital assets, said the company is “playing a role from an education perspective” during “ongoing diligence and research conversations.”

Pension funds vs. high-net-worth individuals

Admittedly, the discussions with pension funds are still in their early stages. Unlike family offices and individuals, they approach crypto with caution, taking their time to fully understand the risks and benefits.

Launched in 2018, Fidelity Digital Assets initially saw demand from these smaller players, hedge funds, and "the big blue chip hedge funds," as Nordeste explained. The tides are turning, with larger types and corporates joining in.

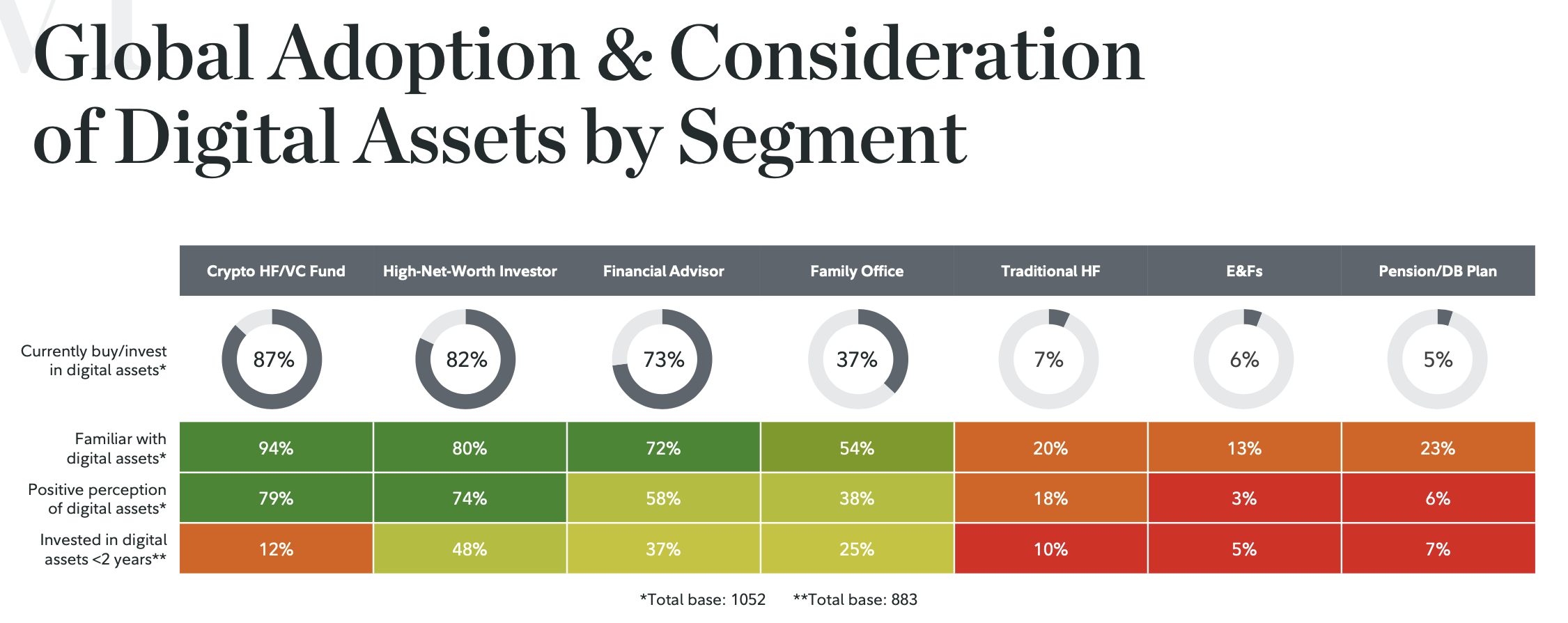

Surveys confirm that private investors are more open to crypto than pension funds. Fidelity's 2022 survey of the broader market showed a dramatic mismatch between the categories. High-net individuals had an overwhelmingly positive attitude to crypto — 80% vs. 23% for pension plans. Only 7% of pension plans were invested in digital assets.

That was hardly surprising: the smaller the institution, the more agile it is and the more risks it accepts. Smaller firms have absent or easy-to-navigate investment mandates, so they can more readily adopt new opportunities. Pension plans need a longer time to enter a market, and the conditions for entry must be specific.

Pension funds warm up to digital assets

More encouraging data came from a financial trust survey in 15 markets worldwide conducted by the CFA Institute, the global association of investment professionals, in April 2022. Among the two-thirds of institutions invested in crypto, government-sponsored pension plans were “the most likely holders” (94% of those surveyed).

Furthermore, 62% of corporate-defined benefit plans were allocating capital into crypto, and 84% of all institutions trusted cryptocurrencies to hold their value, unlike 42% for retail.

Today, pension funds are holding diligence and research conversations, as BlackRock confirmed. This interest is familiar, and the demand for spot Bitcoin ETFs, which have accumulated over $76 billion since launch, is a catalyst.

Pension funds' forays into crypto

In 2022, the Ontario Teachers' Pension Plan and CDPQ, two Canada-based funds, incurred losses due to investments with FTX and Celsius, which went bankrupt. However, that negative experience did not deter all of their counterparts.

The following year, crypto broker Hidden Road revealed it had financial allies in pension funds. Retirement plans of the US aerospace and defense firm Lockheed Martin supported the brokerage, as per the Financial Times sources.

Meanwhile, the investment arm of M&G plc invested $20 million into Global Futures & Options Holdings (GFO-X) on behalf of the Prudential With-Profits Fund. M&G plc is a London-based firm serving around five million investment, insurance policyholders, and pension customers.

At the time, the company managed €332 billion ($357 billion) in assets. GFO-X is the UK's first centrally cleared crypto derivatives trading platform regulated by the Financial Conduct Authority (FCA).

As shown by its 13F filing, Global Retirement Partners (GRP) has started allocating to Bitcoin ETFs. This retirement consulting firm has over $119 billion in AUM and serves over 1.6 million clients.

Julian Fahrer, co-founder and CEO of Apollo Stats, has specified that GRP holds shares in seven different Bitcoin ETFs and one Bitcoin mining ETF.

Regulatory changes spur institutional intake

The green-lighting of spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) in January 2024 was a crucial regulatory change. It opened the door for increased institutional exposure, with pension funds showing a keen interest in these newly approved products.

Banking institutions are already investing in these newly approved products, getting ahead of many US wealth and pension funds. According to a filing with the SEC, BNP Paribas, Europe's second-largest bank, has recently acquired $40k worth of BlackRock's iShares Bitcoin Trust (IBIT).

Despite the small allocation scale compared to the bank's $600 billion AUM, this move highlights a turning point in the financial sector. As the embrace of crypto widens, a major conventional entity — a European bank —— has allocated to Bitcoin via an ETF.

Across the pond, US Bank, the fifth largest bank in the USA with $405 billion AUM, holds $14 million worth of Bitcoin ETF shares. In addition, the launch of spot Bitcoin and ether ETFs in Hong Kong on April 30, 2024, has spurred allocations by local institutions.

While the $13 million debut may seem underwhelming, it was impressive when adjusted for market size. Harvest Global Investments CEO Han Tongli believes “the potential of Hong Kong’s ETFs is more than double that of the US” for two reasons: in-kind transaction and the regulatory uncertainty around crypto in the US.

Asset managers like BlackRock respond to this growing demand. Their products make market entry more accessible and encourage participation through enhanced transparency and liquidity. Furthermore, ETFs offer a familiar investment structure that could ease entities’ hesitations.

Additional exposure: Indirect avenues

Aside from investing directly, pension funds may also engage in crypto-related infrastructure plays. Last year, when the fate of spot Bitcoin ETFs was undecided, the COO of Castle Funds, Dan Hoover, outlined several avenues for conservative institutions:

- Derivatives markets

- Clearing organizations

- Other "capital-intensive parts of the trading value chain"

Hoover said, "Regarding direct investment into tokens, I think that pension funds are still trying to classify the exposure. It's not a traditional asset class, so it doesn't fit well into their asset allocation models and policies."

To sum up

Adoption by conventional institutional investors is the crypto Holy Grail. If pension funds open to spot Bitcoin ETFs, the market may shift into a new dimension, helping crypto mature as an asset class. Yet extensive deliberation slows down the adoption of novel investments. It remains to be seen if pension funds will emulate more adaptable players, such as smaller firms and high-net individuals.